First of all, I take this opportunity to wish you happy holidays. On the advice of many other Mustachians I was researching the third pillar and was convinced to do so once I saw the benefits, until I stumbled upon something. Before I wanted to ask you a question, I read that to start the third pillar, for example in 2022, I have to pay the first installment at the latest on the last day of the year 2021, is this correct or can I wait a while and continue to get informed? In any case, the biggest problem arose after reading this thing of the UBS, as I am an employee with permit B and current income below 120k chf, starting from the year 2021 I will no longer be able to make a corrective declaration on the set the source … here is the link to the article: Changes to the withholding tax in 2021 | UBS Switzerland

You have to pay in by the end of the year for that same calendar year.

E.g. you can start your pillar 3a by paying in CHF 6883 for 2021 tomorrow - and then pay in another CHF 6883 for 2022 on the second of January.

Do check if you have to make an ordinary declaration anyway.

There’s been a myth that no one whose (<120k) salary was taxed with withholding at source has to file - while in fact they had to declare (due to) their wealth or capital income anyway. Even though tax administrations used to be very lax in enforcing it.

The supplementary tax declaration for people taxed at source no longer exists. However, you can still file a complete ordinary tax declaration and fully deduct 3a, as is also explained on the linked UBS webpage. You need to request an ordinary tax assessment by end of March of the following year.

In some cases you’re better off without an ordinary tax assessment (and not paying into 3a) instead of an ordinary tax assessment with 3a deduction because there are differences in the tax rates. You have to calculate the taxes for the two cases yourself to compare. However, also note that you are required to complete an ordinary tax declaration if you have taxable assets or income that is not taxed at source (e.g. dividends). The exact details depend on the canton.

Ok thanks! So I still have time to lose “only” 1 year of third pillar having entered switzerland 2 years ago, now the question remains whether for people like me it can still be done.

Why not? You can open finpension other VIAC online and pay in, can’t you?

frankly sent me a “only five days remaining” reminder just a few hours ago (though I’ve already opened the account)

I have already completed a tax correction document in March of this year (never received a reply), will it be the same document? Rereading, I understand that I can make a final statement that will not be rectified until I go above 120k chf (in 2 years), could I take advantage of this in March 2022 which will also be automatically used in March 2023? Also as a fintech I have seen that there are mostly 2 that are the best, but in particular finpension has taken over lately, correct?

VIAC or finpension wich one di you recommend? I have 29 years and I’d like to invest in stock for the most

No, for the tax year 2021 you have to file a full ordinary tax declaration (same as permanent residents) until March 2022, not just a correction, if you want to deduct 3a payments or have taxable assets or additional income such as dividends.

I’m not sure I understand your sentence correctly. If/when your income is above CHF 120k, you are required to file a full ordinary tax declaration. Below 120k (and without additional assets/income) it’s your choice whether you want to switch to ordinary tax assessment or not. If you switch to ordinary tax assessment by March 2022, it will apply to tax year 2021 and all future tax years.

For 100% stock, finpension is the best choice right now, as I see it. If you want less than 100% stock/real estate/gold, VIAC may be better at the moment as VIAC allows holding a portion of your account in cash with a (small) positive interest while finpension only provides bonds as alternative (with worse expected returns than cash as long as the SNB prime rate is negative).

I slightly prefer finpension due to the availability of quality funds, though I like VIAC’s handling and app a bit more.

As I have a substantial amount in pillar 3a (about twice my pension fund savings), I’ve split between both. And thrown in a couple hundreds at frankly, for curiosity’s sake.

I think I understand this now. I will earn less than 120k chf only for 2022 and 2023. From 2024 I will rise above 120k chf. At the moment I live alone in the Canton of Ticino and have no other income beyond my salary, with a tax rate at source of about 11.75%. If I start the third pillar these days (6883 chf in 1 payments) and make the change with ordinary tax declaration for March 2022, would that be a bad idea? Could a ordinary tax declaration also have a higher rate than mine with withholding tax? Who can I ask for this information?

Hi and happy holidays!

The Federal Tax Administration has a pretty simple calculator: https://swisstaxcalculator.estv.admin.ch

It’s accurate in my situation. In order to estimate your deductions, you can start with the explanatory notes linked at the top of the calculator page.

Yes, it could.

20 chars

I used this link to calculate my taxation and it seems quite overlapping with my current withholding tax, so I assume I shouldn’t have any particular changes. I also phoned my canton and they confirmed that I can make this switch and therefore deduct the third pillar. I have already opened a finpension account. My doubt now is which percentages in shares to invest, because the reality is that at the moment I have 4-5 years, sure in which I will stay in Switzerland, after who knows … But I think it is a little bit for everyone and we go forward by 3 years in 3 years. Would it be wrong with this prospect to put everyone in 99% shares on finpension? Or should I do something more conservative about VIAC? Furthermore, finpension gives the opportunity to do 99% global or to invest in a personalized way, the global version seemed to me to be quite valid, apart from the very high component (about 39%) of swiss stock. What do you think about it?

You can leave your finpension account open and invested after you leave Switzerland.

At least in Switzerland these are pension benefits and tax-deferred. This could also be the case on your new country of residence (though it will surely depend on its tax legislation and maybe applicable DTA).

I don’t think it matters that much how long you stay in Switzerland or how long you keep it at finpension. More important is how long you can keep that money invested (i.e. don’t need it e.g. for a house). If you leave Switzerland and take the money out of 3a, you can still invest it in ETFs with a regular broker. And you can keep a similar investment strategy if you want. Except for the time it takes for the transfer, you’ll stay invested.

He or she may have to pay taxes on it upon withdrawal - and these could be higher than in CH. Though of course you‘d have to compare them with the income tax savings in CH - for most people the taxes on the „uppermost“ CHF 6883 of their salary each year.

It also depends on wealth, seems like the cutoff in Ticino is 200k. (But depends a lot from cantons to cantons)

Assuming that this is the right calculator (?) and that you have no children, does this translate to a gross income of about CHF 86‘000 CHF, for a tax amount 10’148?

Deducting CHF 6883 from that income, you‘d earn approximately CHF 79’117 and pay 8’702.85 tax at source.

So you basically pay 21% income tax on these CHF 6883 - or save them by paying that amount into a 3a account.

As long as you‘re staying in Switzerland and do not withdraw, any capital income/dividends earned in your 3a account will also be tax-free. You do pay fees to the 3a provider though and they may be higher than on free brokerage accounts.

The funds that you invest in, however, may have lower TER and/or be tax-privileged for interest or dividends (especially US and Japanese dividends).

At the time of withdrawal, you will however, implicitly, be taxed on capital gains in 3a funds, since the amount of tax and tax rate will be calculated on the basis of the amount withdrawn - yet at much lower rates than standard income tax (at least in CH).

After leaving Switzerland, the question becomes if and how your Swiss pillar 3a account will be considered and treated by your new country of residence‘s tax administration. I suppose it‘s likely one of these cases:

- as part of your wealth and capital income, just like any other brokerage account

will it be taxed the same as any domestic account you’re holding, more favourably (e.g. remittance based, as a non-taxable foreign account, or less favourably (e.g. non-reporting or intransparent investment fund or account)?

will it be taxed the same as any domestic account you’re holding, more favourably (e.g. remittance based, as a non-taxable foreign account, or less favourably (e.g. non-reporting or intransparent investment fund or account)? - as tax-deferred or pension benefits, to be taxed only at the time of withdrawal

will they be taxed at withdrawal, and if so, at which rate? At full income tax rate or is there a preferable rate/taxation for pension benefits?

will they be taxed at withdrawal, and if so, at which rate? At full income tax rate or is there a preferable rate/taxation for pension benefits?

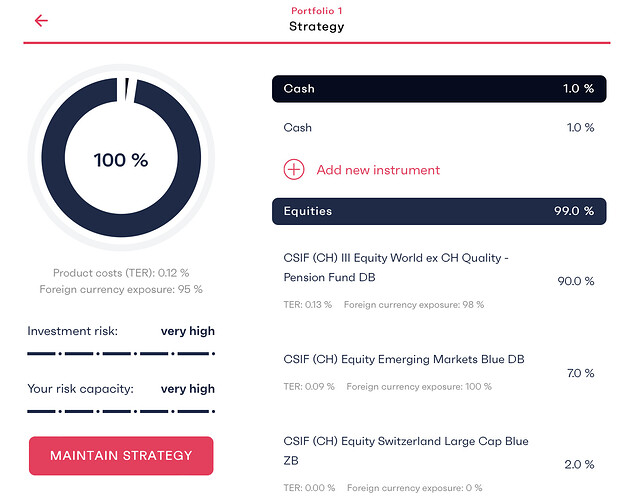

Wow. Thanks for your very comprehensive explanation. I will try to inform myself of these things over time, especially in Italy, a place where I will probably return to live if I ever have to leave Switzerland. Now I will deposit the 6883 chf in the next few days to re-enter in 2021. I was thinking of a personalized distribution like this, what do you think? Maybe the TER a little too high …