I’d need a convincing factor, like a webpage that compare companies

I’m not convinced that we’ll get that much return from our pension funds in the future.

- Minimum is 1%, so you’ll get it in bear markets too. They need to compensate for it in bull markets.

- Asset allocation is very bond/RE heavy, most pension funds only have 30-40% in shares.

Well, color me eating a crow: I’m very cynical and keep running on the principle that our pension fund is the worst and would only distribute the absolute minimum it has to but they’re crediting 2+1% this year (the 1% is because they’re reducing the 5.5% (mandatory and extra-mandatory combined)).

Can’t they settle for a powerpoint?

(Please, tell me if you want me to remove that in case you’d want to show them this thread as evidence that better funds exist.)

I’d ask for their agreement for you to contact providers on their behalf and ask for offers. They’re not loosing anything and it would give you freedom to fish for a better plan. If you have an official representative for the employees (as you should), I’d get through them first.

30-40% is good as the maximum is 50% for equities. They are bound by the BVV2 regulation, there’s not so much ground for playing around. The problem imo is that lots of pension funds have a home bias when it comes to equities.

It seems that everybody receives information about the interest in these days… but do you guys get these info straight from the PF or you check by yourself on their web page or whatever ?

Me having changed 3 employers (and 3 PFs) so far have never received any kind of information beside the yearly statement… my wife neither.

Just curious…

Checked on their webpage.

The only informations I get directly from them come printed in color on A3 high quality paper and tells me that they want to save trees and, as such, they won’t provide me my yearly 2A4 pages form in paper anymore but I have to download their amazing app which allows me to see in real time how much my pension assets don’t fluctuate. xD

On the webpage of my PF the last available Jahresbericht is still 2020.

According to that, last year they had following situation:

- Performance Gesamtvermögen: 4.39%

- Verzinsung Vorsorgegelder: 1.0%

- Technischer Zins (don’t know what this represents exactly…): 1.5%

Deckungsgrad was 113.9%

Any comments ?

Surprised to see so many generous funds. My employer until recently is with Baloise and all we got this year is 1% for the obligatory portion and 0.25% for the over-obligatory portion!

Mine (CIEPP) did not published the interest rate yet. It is usually available early February.

I hope it will be better than 2020 (serve 1,5% for 3,81% perf).

If I retired at 65 y.o. the conversion rate will be 6%.

Coverage rate: 120% (+ 10% increase).

Profile of members:

- Affiliates: 45 500 (+ 10 %)

- Retired/survivor/invalid: 6500 (= 14 %)

- Retired evolution rate : +8% by year

Portfolio allocation:

- Cash: 6.53%

- Bonds: 29.70% (Vanguard, Blackrock, Credit Suisse, HSBC)

- Real Estate funds: 12.12%

- Shares: 37.80% (index funds 2 Vanguard, 7 UBS, 6 Credit Suisse, 1 HSBC)

- Others : 6.43% (Private Equity ,Senior Secured Loans, Private loans,Microfinance )

- Buildings owned: 6.50% (they list all the buildings they own)

Management fee : 0,23%.

Risk part : 12,28%.

Saving part : 87,62%

I will be able to redo my calculations based on that.

The things I do not like is the fact that they never mention the interest rate of the over-obligatory part and do not communicate it after request.

When I connect to their portal, I can see the vested benefit but there is no history detail and you can’t follow the annual evolution or the interest payment, the overall performance …

At least the plan insured 82% my salary for risk, 40% for invalidity, 25% for survivor.

Can you see more detail in yours such as Viac or FP ?

I am with PTV.

For 2020 they declare following allocation (from the Jahresbericht):

- Stocks world: 28.7%

- Stocks CH: 6.7%

- Bonds World: 11.5%

- Bonds CH: 25.3%

- Real Estate: 24%

- Others: 3.8%

Management fees: 0.24%

The planned conversion rate at 65 is 5.4% (not relevant if we RE - the lower, the better probably).

They currently (2020) have 14’600 active insured and 2’700 beneficiary.

Same numbers (3%/5%) for our pension fund (incl. coverage ratio).

Not banking level pension returns, but that’s still a nice year

My company‘s pension fund is within Gemini Sammelstiftung. Does anybody have an idea how to find out concrete numbers for it? Gemini seems to be some kind of umbrella organization and pension funds within are separated from each other…

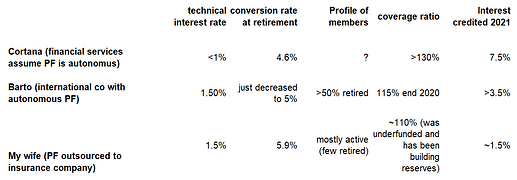

I made a back of an envelope comparison between 3 plans. Not at all scientific but sharing as I think it helps illustrate @teacup 's point about conversion rate, technical interest rate (=discount rate) and interest rate credited to members

I did an evaluation for my company’s 2nd pillar this year. This may be interesting for small companies looking for a 2nd pillar fund:

If you want to go for high share portfolios in second pillar, get quotes from Axa or Profond.

Profond is quite picky about who they allow as customers. I did not even get an offer because we were below 5 persons IIRC.

The other day, I computed the history of the mandatory contributions (both employersand employees) to my LPP2 and noticed it does not add up.

Even without including the interest rate served, I have less available displayed in the annual report than the cumulation of both contributions added to the amount of the previous year.

Is it the payement of the invalidity/death insurance ? It could be their management fees but it seemed inconsistent.

From 2020 to 2014:

-1,63%

0,94%

-1,18%

-8,23%

-5,66%

-5,17%

-6,67%

Did you do the math on yours or their report is clear enough ?

Yes.

In my report it is clearly stated how much each of us (employer and myself) contributes to savings and how much to insurance. In my case 12.5% savings (4.75% me / 7.75% employer) and 3% insurance (1% me / 2% employer).

You don’t get negative returns with pension funds, they are obliged to pay your minimum interest of currently 1% per year.

Maybe you forget to include the risk part. Around 2% each year and the fees to manage your pension account.

If you have doubt, you can always ask for a detailed report from your pension.

It’s also possible that your employer contributes less than you paid, which is illegal

I only have savings deductions. Insurance is completely covered by the pension fund (I don’t even see it in the statement).

You need to check how much is paid each month/year. You will have the details of how much is going to the insurance part.

They’d basically need to underreport his/her salary to the pension scheme then.

The pension fund will have his/her salary on record. And the insured salary (after coordination deduction) should appear on the statements. The pension fund will then bill his employer accordingly.

As long as the salary has been reported correctly, everything should be OK.

It’s very unlikely that a reputable pension fund (anything other than tiny shoebox-and-a couple-Excel-sheets operations) would operate an illegal plan in something as basic as that.