Now that that the yields in the US are above 3% I would love to move some cash into a short term money fund to preserve value (I am ignoring CHF currency risks here). However I am not quite sure which product to use with IB. I dont want the volatility of bond fund that would lose value in when interest rates rise more. Which USD or EUR fund product would give me market rate returns without price volatitility? I know the concept of a money market fund but I have not been able to really find tradeable product there.

That’s 10y+ yields not short term, you’re gonna have to settle for about 2% at the moment if you want short term bonds. Don’t forget you’ll be fully on the hook for swiss taxes on these things so mentally subtract 40% or whatever marginal tax rate you’re paying

As a non-US customer they won’t let you buy US mutual funds.

But you can buy same shit in ETF form, no problemo, tons of eligible bachelors on the market Government Bonds ETFs - look for “short term”, “bills”, 0…3 months/years, in the name, etc.

Since you mentioned money market, I found this on justetf:

It has practically zero volatility in USD (go to the chart and switch to USD, you’ll get a super smooth curve). It had a 2% return in 2016 and in 2017. However, if you switch to CHF, then it had a negative return. Or if you take USD inflation into account, then you’ll be also close to 0%.

Thanks a lot! Any other tips for parking cash right now, in EUR or USD? With “parking” I basically mean no volatility and a safe (low) return close to market rates, available on IB.

So what’s wrong with bond ETFs, why aren’t they sufficient for your case? Esp. with the “available on IB” constraint bond ETFs is pretty much all you have to choose from.

My issue is that exchange traded bonds are volatile (interest rates go up, their value drop).

I know that they have different maturities but I still have not been able to understand which one I can buy to be sure I am not losing money because of the price fluctuations.

But maybe I am misunderstanding something?

It’s a basic property of any such financial instrument. The fact that they are tradeable is only a plus - you can cash out on the free market any time before maturity. As opposed to e.g. banks’ CD/term deposits where you might not have such a right at all or be forced to waive a significant part of the profit if you cash out prematurely

Probably. You’re not losing money from fluctuating interest rates as long as you hold a bond to maturity. Modulo bankrupcies/taxes/costs you get exactly the yield you locked as implied by the price you bought at. Only if you’d have to liquidate before maturity, then market interest rates come into play as they determine what anyone else will pay for it. So choose a maturity appropriately. If you expect you might need to sell within a year, don’t buy 10+ year bonds.

At the lowest end of the spectrum for USD you have treasury T-Bills, available in ETF form for example as BIL, 1-3 months maturity and yielding 1.6-1.8% right now. For EUR short term government bonds are negative yielding and not particularly interesting. But if you’d go outside of IB you might find some maybe 0.5-1% yielding savings accounts or term deposits with some degree of protection in e.g italian banks

It’s not IB, but you can check coop anyway:

http://www.coop.ch/de/services/depositenkasse/dienstleistungen.html#kassenobligationen

from 0.25 to 0.8%

I’ll use this thread to continue the conversation for the question “Where do you park your cash?”

I had a look to:

Interactive Brokers

I have been accumulating some cash so far, part of it is in IB which offers some interests on IDLE cash in your account, you can calculate it here depending on your current balance. In general for Account’s NAV > 100k they’ll pay > 1.5% interest on your cash. (again make your own calc).

As far as I remember IDLE cash is not insured, right?

UBS Savings’ account

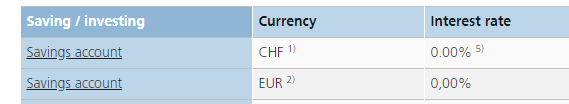

I had a look to UBS offering which made me laugh,

So, if you park cash in a savings account you receive 0% interests.

Ok, here I come with the question.

Where are you parking your cash so that it’s ready to be used in short time (from instantly to 48h)?

IB charges negative rates on CHF deposits, as the LIBOR is negative.

You only get interest on USD balances, and I’m not entirely sure if it’s above 100k NAV, or 100k in deposited cash

I park cash on my current account. If I want to trade something instantly on IB, I will trade on margin and transfer cash afterwards.

On IB they currently pay 1.62% above 10k idle cash in USD and I don’t think that it would be taxed in Switzerland.

Why wouldn’t it be taxed? Regular interests are taxed as income.

No Swiss anticipatory tax, but of course interest income is taxable.

Right, my bad, it is taxed

Threadsurrection…

This USD cash interest rate on IB is now 0%, if I read (the calculator) correctly?

https://www.interactivebrokers.com/en/index.php?f=1595&p=schedule

Apparently yes.

I wish they wouldn’t use 0 as the benchmark for margin loan when the benchmark is negative. Borrowing at a negative rate should be fun ![]()

I was reading a letter from a fund manager to its investors and the following text draw my attention:

As I never heard about such instruments before, I went on and asked good old Google and it come up with this explanation. Pretty good, thanks G!

Then I asked again Google if there are any ETF covering inflation-linked bonds, and it come up with this list. As you can see, there’s plenty to choose from.

Now, my question to you guys is whether you have some experience with these instruments and what would you recommend to use for investment. The scope is to protect against USD hyperinflation (with all the money printing and debt skyrocketing in the US of A these days, who knows what’s going to happen).

I would park my cash in CHF at ~1.25% or whatever best rate you can get instead of USD.

And where would that be?

Reviving the thread. What about parking cash at 4.08 % in USD ?