I try to make back-of-the-envelope calculations for an early retirement. My dream is to sail the world for a few years and then settle somewhere. Because of discovered health issues, I’m bound to a place that has a proper health system and insurance. Let’s take Switzerland. I wish I could stay here long-term.

Let’s take the following suppositions:

- less than 60, single, no real estate, capital 1.5 Mio,

- small AHV: missing 18 years of AHV if contributing till 65, so assume 10k/year AHV at best.

- living off capital till 65.

- 1.5 Mio including 2nd and 3rd pillars. (Need a strategy to withdraw them before 60)

With less than 60, I’ll have to pay AHV contributions based on capital and virtual income.

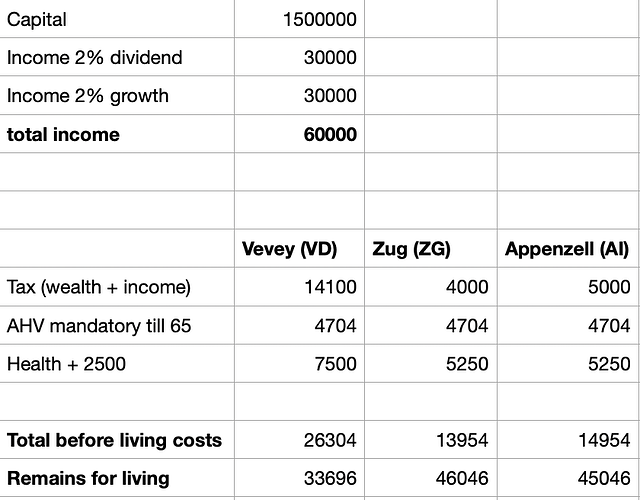

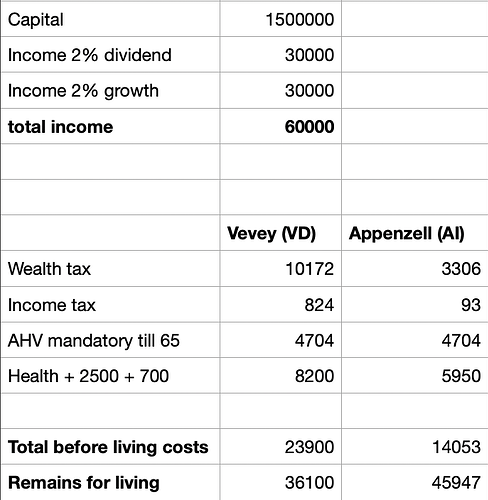

With this back-of-the-envelope calculation, I get the following incomes, taxes and available:

While it is possible to live with 45k in Appenzell, it’s not what I envision for retirement living with 33k in Vaud.

My take on this is that you need quite a bit more than 1.5 M capital and avoid the Romandie because of taxes.

So what are the possibilities?

-

Live very frugally in CH

-

ETFs with minimal dividends and avoid fixed income. Only growth ETF with low dividends (risky but reduces taxable income) and move out of romandie.

-

Have a tax residency somewhere in Europe or the world where the tax and health system are okay and come back to CH regularly (would be nice to have a small flat to stay in and keep stuff in CH. But this costs).

-

Sail the world 4-5 years (my goal) without tax residency (I guess it’s possible but difficult or impossible to keep a bank account and broker). 60k/year without tax is already a tight budget for this (plus a boat is expensive).

How would you go about it with 1.5M, low AHV, below 60, unfortunately two chronic health issues, and still goals to explore the world while I can.

(I put this in the taxes topic, but it’s not the only parameter)