Thank you. I had not realized I was using the Hungary based entity and didn’t properly think it over after the discovery. I am also not happy with being Hungary based. That is not the most stable country and thus a poor choice to trust your life’s assets with. I might also take my investing elsewhere (Degiro I guess) since I haven’t started yet.

I am with degiro.ch and degiro.fr (started in CH and then opened in FR as well as I’m thinking it may make life easier when it comes to tax returns). I only started investing last year, so this year will be my first time submitting a French tax return and needing to extract the required docs from Degiro…we’ll see.

But I was interested in IB as there are certains stocks and funds not available in Degiro that are available on IB…but for me the Hungary thing is more or less a dealbreaker…

Are you happy with Degiro? You have both? Should it not correspond to your current (tax) residency? What are the benefits of either? French one provides the correct documents for the french taxes? Also for the matters discussed in this thread how are they funded? Can I fund using CHF? Also can I transfer CH IBAN to CH IBAN?

I think currency conversion is much worse in Degiro right? That was why I initially preferred IB.

With the crash last year I thought it would be a good time to start investing a stash of cash that had been sitting in savings in the bank; I went to degiro.ch and degiro.fr and only degiro.ch was available in English…so that was what influenced my initial choice

My strategy is mostly just buy-and-hold-ETFs, so I’ve only made relatively few trades, but around the end of the 2020 I started thinking about tax returns and decided it would be best to use degiro.fr moving forward. Degiro themselves didn’t seem to care that I have accounts on both platforms, as long as my tax residence is properly declared at both (which it is). Generally speaking, I’ve been happy with the usage of Degiro so far; I’m no expert in these things, but the platform is simple enough and I haven’t had too many issues…just that now I’d like to buy a non-ETF stock which is not available with Degiro (despite my asking their support to make it available, nothing exotic…freely-traded stock on the LSE). I know people who have bought this stock on IB, and since for many it’s usually a toss-up btw Degiro and IB, I started leaning towards a move to IB…until the Hungary thing came up.

The IB FX exchange is also very interesting to me as being frontaliers we are exchanging a few 1000s every month, and so was another lever for a move to IB, but I am not sure if it’s worth it to use IB “just” for that (again due to the Hungary factor).

Would the 10USD a month charge for having less than 100k at IB and the IBAN issues you have discovered (+ any resulting transfer fees) be compensated by better FX…?

Needs deeper investigating that I haven’t got around to yet!

Thanks for the information. Could you expand on the CHF issue or are you not using CHF to fund the account? I think avoiding a bank rate currency conversion when buying stocks is really important. Can you fund the degiro account using CHF (and then use something close to market rates to convert if necessary for stock purchases)?

As I think I may have hijacked the original topic of CHF to IB, will reply to you personally…

Do they even have one, if they aren’t supporting CHF deposits (as it seems, see my link provided above).

What’s wrong with Hungary?

The IB Central Europe entity may lack some functionality - but is there anything wrong about the country itself? I mean it’s not as if Luxembourg or Ireland with their outsized financial sectors seem less risky to me.

In political terms, it doesn’t seem less stable or democratic than the U.S. (where IB is headquartered) either, and there’s few people having qualms about investing more than half their life savings there.

Nothing wrong with Hungary in itself; we have loved visiting there and apologies if my comment offended anyone, but in the past few years the government has nationalized private pensions and undermined the independence of the judiciary. Perhaps I’m being paranoid and everything will be fine and stable, but when it comes to our life savings I’m double/triple-thinking everything…

Could it be they were not rated in that research because they don’t offer services to individuals, just businesses?

Their WIR Franc system is a bit WIR-d though.

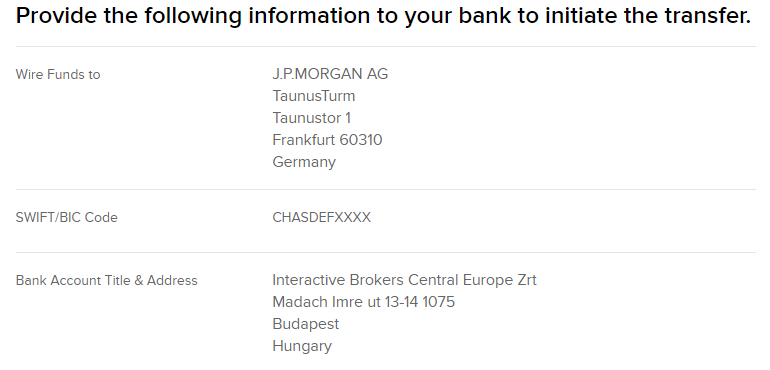

@nabalzbhf and @San_Francisco : I was curious about using IB purely for FX (deposit CHF, change to EUR, withdraw to EUR account in France), so I completed my saved application. I can confirm that it is possible to deposit CHF directly into IBCE (despite what their documentation says). The IBAN is for an account held at JPMorgan in Germany. So for ex, to send CHF from my UBS account to the IB one would cost 5chf.

One other note: if you choose to keep CHF on hand at IBCE, you will pay them interest. Apparently this is a change from IBUK, but at IBCE account holders pay interest on cash balances for any currency that has a negative interest from that currency’s central bank…

Can you share the transfer instructions (without your account info)?

It still contradicts the link from @San_Francisco tho ![]()

Foreign exchange spot trades at IBCE must be connected to an investment service transaction and its resulting cash flows.

IBCE will support a limited number of deposit currencies. The following six cash deposit currencies, the “Allowed Deposit Currencies” are:

EUR, USD, GBP, HUF, CZK, PLN

They might have changed it recently, in their docs (valid from march 8th) CHF is included in the list

https://www.google.com/url?sa=t&source=web&rct=j&url=https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView%3Fformdb%3D4518&ved=2ahUKEwiskpmJ3MvvAhUCqaQKHSpGDXgQFjABegQIBRAC&usg=AOvVaw04cBDo_Rln87Wvdp38s37K

At the point during account creation where you have to accept the 2386237 different terms and conditions docs ![]() I had a read of the “Fees” doc and another doc about “Multi-currency accounts”. In one doc they said allowed deposit currencies are EUR, USD, GBP, HUF, CZK, PLN and in the other it said there are 10 deposit currencies (one of which is CHF).

I had a read of the “Fees” doc and another doc about “Multi-currency accounts”. In one doc they said allowed deposit currencies are EUR, USD, GBP, HUF, CZK, PLN and in the other it said there are 10 deposit currencies (one of which is CHF).

@nabalzbhf is the below what you’re looking for? I’ve left off the actual IBAN as I’m not sure if I’m allowed to post that kind of info in a public forum…

The only things I’ve left off the screenshot are the actual IBAN itself and the Payment reference of my account.

One question from my side: I would like to send UBS CHF to IB, then FX to EUR, withdraw EUR to my EUR account in France. If I’ve understood the fees correctly, that should cost 2USD currency conversion fee with one free withdrawal per month. Does anyone know please if that 2USD would be subtracted from the 10USD inactivity fee? Or is it only actual trades that count towards the 10USD inactivity fee?

Thanks!

Yes, the monthly fee covers all commissions, including FX (at least for IBUK)

Great thx! That helps with my calculations…

So today I finally tried it and it turns out that the intermediary banks will completely ruin it.

I transferred 10000 CHF from my Liechtenstein CHF account, to their German CHF account (which is the same as in the screenshot above, even for IBKR Ireland.)

My bank charged me 3CHF for that… Ok, I guess. But then at some point along the way someone took a 25CHF free from it. IBKR confirmed that it wasn’t their receiving bank.

Interestingly in my test were I only transferred 100 CHF there were no intermediary fees. Now I don’t know if it’s random, or if higher sums trigger through a more expensive route?

This is why I hate that they are allowed to just have these hidden intermediate banking fees. They might as well take the whole 10000 CHF and you have no recourse. Hrr… How can it be legal that the banks don’t have to guarantee any capped fee at all up front.

With a OUR wire, it’s usually known up front (but the downside is that it is often more expensive than SHA).

Yes that was it. So unlike Citi, looks like JPMorgan only has their local branch connected (there’s only the CHASCH[…] SWIFT codes, no CHASDE[…]

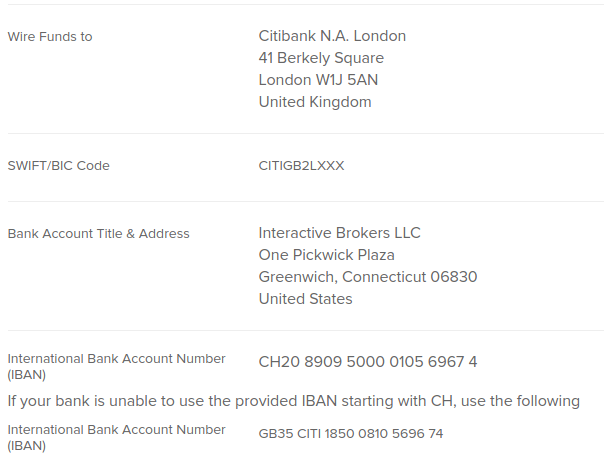

Swiss resident with account in IBUK here, I’ve never been charged when transferring CHF from UBS. Here’s the info I get for the transfer:

I wonder if they’d still credit your funds if you wired them there with your usual payment reference. Care to do a 10CHF experiment? ![]()

Since a while I also use the IBUK IBAN for transfers. I have to admit, I am not even sure if it makes a difference which IB acount you send your cash, as long as you include your account number. Last time, when announcing the deposit, I got instructions for sending it to a US account. I send it to their CH20 8909 etc. IBAN without problems and a hassle.

(I even declared the amount in $, and paid in CHF, without a compaint for far).