Hi all,

Newbie here. Early 30s, current nw in the low six figures. No current assets invested.

Main goal is FI in the next 10-12 years (assuming current employment and savings rate stay stable, which is a big IF). Saving rate is currently around 65-70%. Target number is between high six figures and 1M. Feels a bit arrogant to even think I can plan so far in advance, but I guess it’s good to have a goal, for starters.

A few aspects I couldn’t figure out at this point, and for which I would really appreciate any inputs/critiques:

-

Lump sum vs DCA: I would tend more towards DCA, but have read contrasting opinions about it; do I assume correctly that DCA would put me in a better position to gain from any dips or corrections coming?

-

% of total nw to invest : how much, as % of NW, should I ideally have invested one year from now (not planning any big purchases in the short term)?

-

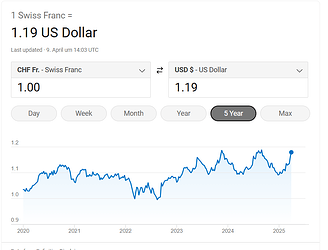

Currency : investable assets are in USD: assuming inflation rises in the coming decade, and putting aside the unforeseeable nature of the currency market, it seems the dollar is in for a long-term depreciation; what’s the strategy here? convert now to stronger currencies? (too early for me to figure this out now, but I probably won’t be retiring in CH);

-

Broker : IBKR would be my first choice, but I have to admit that what happened during the GME saga left me kind of worried; not sure how to assess and incorporate broker risk it into the overall strategy; no CH-based alternative looks interesting though;

-

Asset allocation : will try to keep it simple while also diversifying in terms of asset classes and geographical distribution; starting from Ray Dalio’s all-weather portfolio I would expand to include non-US equities and non-US bonds and rebalance to 50% stocks (moderate risk tolerance), 25% fixed income and 25% commodities (including GLD);

-

US ETFs and PRIIPS : if this is actually applied starting from 2022, would I still be able to increase any positions held at Jan 1st 2022? or would I need to reach a full position with, e.g., e.g., VTI and VWRL, within the next 10 months?

-

Market timing : while I understand market timing is close to impossible, I can’t deny the past few months in the markets have made me anxious, even if just watching from the outside: just wondering whether keeping a full cash position and wait until Q1 to end (as if Q1 could bring some clarity) would make any sense…

Is there any other aspect I am not considering at this stage? Just want to make sure I do my due diligence before making any moves. Any inputs/critiques truly welcome.

Thanks!