@weirded My son is approaching his 3 y.o.and I am still looking for a dental and orthodontist insurance.

How much did you have to pay over the years on orthodontist for your kids ? What was the maximum pay by year by chiild ? I am considering subscribing to the 6k chf max by year or the 10k chf max.

Here is my actual comparison (in French sorry).

-

Admission sans contrôle dentaire pour les enfants de moins de cinq ans.

-

Prise en charge de 75% de tous les frais de traitement orthodontique, y compris les frais de laboratoire et de radiographie (max. CHF 10’000 par année, selon le niveau de couverture).

-

Trois niveaux de couverture possibles: CHF 2’000, CHF 6’000 ou même CHF 10’000, pour vous permettre de choisir le plus adapté aux frais orthodontiques que vous prévoyez.

-

* Prise en charge des prestations dans les pays limitrophes de la Suisse (Allemagne, Autriche, Italie, Liechtenstein et France) au maximum du tarif qu’elles auraient coûté en Suisse.

Denta Ortho : 75% par an max 6000 chf sans franchise; Total = 27,50 chf / mois, 330 chf / an, 4950 chf / 15 ans

Denta Ortho : 75% par an max 10,000 chf sans franchise; Total = 35,50 chf / mois, 426 chf / an, 6390 chf / 15 ans

Pas de déclaration dentaire, tranche d’âge.

Délais de carence de 12 mois, avant les 5 ans.

Exemple d’ortho : commence à 13-14 ans, 2e enfant 8-9 ans.

+ Denta Sana : Détartrage, caries = 4 chf / mois, 48 chf / an, 720 chf / 15 ans

Délais de carence de 6 mois.

Détails «Classe de prestations 4» Cp 4 a partir de 5 ans

-

Participation de 75% aux coûts jusqu’à un max. de CHF 2’000.- par année civile à partir de 21 ans

-

Participation de 75% aux coûts jusqu’à un max. d’orthodontie CHF 10’000.- par année civile à partir de 21 ans

-

Participation aux traitements dentaires, à l’ajustement et à la correction de positionnement des dents

-

Participation de 75% aux coûts de correction de positionnement des dents sans limite de montant qu’à l’âge de 20 ans révolus

Le montant de la prime de votre assurance complémentaire est tarifé en fonction de l’âge. De façon générale, le passage à une classe d’âge supérieure s’accompagne d’une augmentation de la prime. Celui-ci a lieu le 1er janvier de l’année où vous atteignez l’âge déterminant pour le changement de classe.

Pour les CP 0–4, les classes d’âge sont les suivantes: 0–5 ans; 6–10; 11–18; 19–25; 26–30; 31–35; 36–40; 41–45; 46–50; 51–55; 56–60; 61–65; à partir de 66 ans.

0-5 : 9,40 chf ; 6 ans + 28 chf / mois, 11 ans 47 chf, 20 ans+ : 30chf

Total = 7433 chf = 113 chf + 1680 (336*5) + 5640 (564*10)

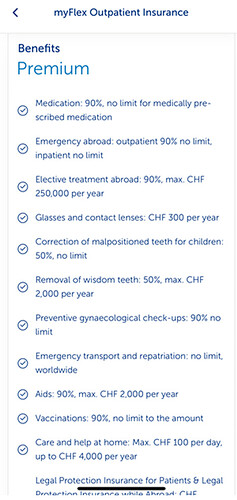

Assurance pour soins dentaires

Participation aux coûts pour des interventions dentaires. Pas de questionnaire de santé pendant les 3 ans.

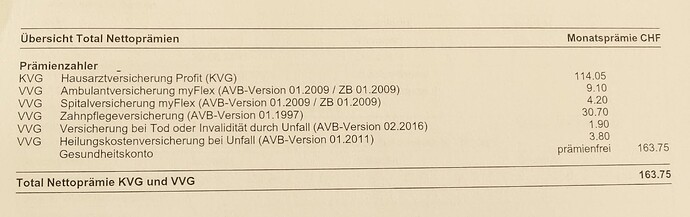

30.70 chf

L’assurance pour soins dentaires prend en charge les coûts qui ne sont pas couverts par l’assurance de base et protège des conséquences financières des interventions dentaires.

-

Traitements tels que hygiène dentaire, radiographies, obturations

-

Traitements orthodontiques et examens de contrôle

-

Prothèses dentaires telles que couronnes ou dents à pivot

Prise en charge des coûts / année

75% par an max 6000 et franchise de 500 chf = 30.70/mois, 368 chf / an, 6256 chf / 17 ans

75%. max pour 3000 chf max et sans franchise = 51.70/mois, 621 chf / an, 9936 chf / 16 ans

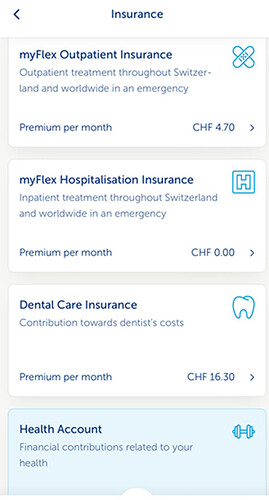

+ Assu oblig ambulatoire myFlex jusqu’à 15 ans= 11,50/mois, 138 chf / an, 2208 chf / 16 ans

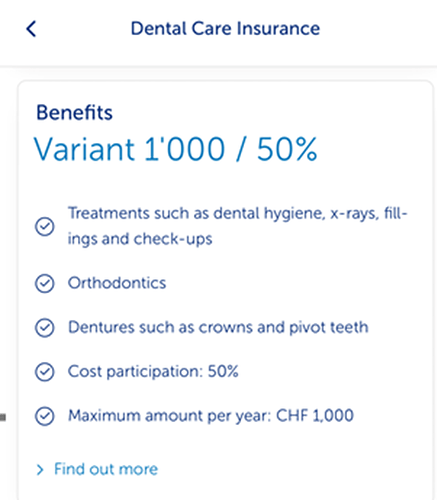

Balance Traitements dentaires pour 50%, max. CHF 1’000 / année

Correction de la position des dents 50%, max. CHF 12’000 / année

Total = 12144 chf / 16 ans