Probably totally wrong here, but a fundamental question. Why did you build your own screener instead using the “thousends” of already existing on the web?

Don’t get it wrong, I think it’s awesome what you did but was this more for fun or for a serious reason (e.g. information missing etc)? I never really used (or seldom) stockscreeners so I just want to make sure that I don’t miss anything if I start using them/yours.

For both!

Being myself a software developer, I thought this was a cool project, and that afterward I could add other criterias that you cannot find on other screeners (Piotrowski Score, Return on Invested Capital, and so on…)

1 Like

Understood

Did you take it offline or just moved somewhere else? Do you still expand the market universe or is it more difficult to extract relevant data as provided by SEC? l’m thinking of HK, Singapore, Korea, Japan, NZ and Australia. These markets are not covered like the US market and thus much more opportunities arise.

For the moment it is still offline, but I still use it

However, it proved quite difficult to find free data and APIs for other markets. Canada seems doable, but I did not find anything practical for Asia/Pacific for instance… But if you know some resources they are welcome!

1 Like

Can`t promise anything, but let me check with a colleague form our HK office. Maybe he knows something.

1 Like

Global fundamentals data is fairly hard to find for free, it’s true. In US there’s public SEC EDGAR of all US companies filings, from which you easily source everything you need in bulk, but there’s few comparable international equivalents. Most of the time you’d rely on intermediate data vendors to source and clean up data from multiple sources and the access usually costs a fortune. One vendor with a free (but not bulk) access to at least a few recent quarters’ data is morningstar.

2 Likes

Thanks for the tip!

I knew Morningstar by name and I was aware they offered research on mutual funds, but I did not know they offered ways to download companies financials.

By digging a little bit more, I found this page that even explains how to access their API for free!

As you said, you cannot download bulk financials, but hey, it is already much better than nothing.

Plus they have a lot of markets; for instance, I managed to download fundamentals of:

This is exciting! I will have to check Morningstar’s API limitations, but it opens a lot of new possibilities

1 Like

Another API with global fundsamentals you can use for free if you’re an IB client is IB’s reqFundamentalData with data coming apparently from Reuters, they allow 0.1 QPS (=60 queries/10 min). There’s probably something in T&Cs that you shouldn’t redistribute the data further to third parties however

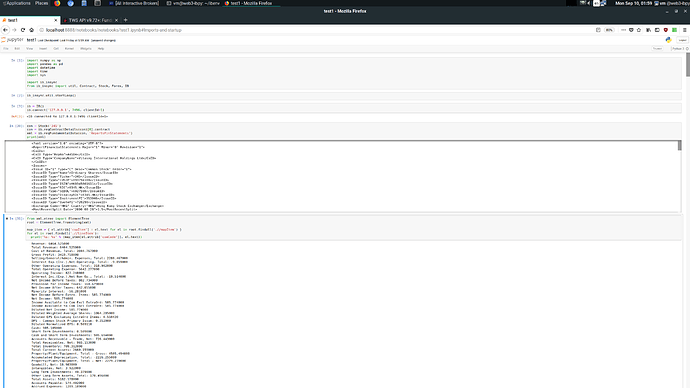

Here’s for example what I’m getting for one asian stock (I get 8 quarters woth of data beginning with 2018-03-31 according to xml)

3 Likes

Sorry for my late feedback, was a crazy week.

Finally I was able to speak to my colleague and it is a bit disappointing. He told me that they mainly use Reuters for Asia markets but as we all know, it costs a bunch of money. Thus not really suitable for (small) individual investors like us.

There is indeed morningstar`s free data which @hedgehog already mentioned. Besides that he suggested the Financial Times data as well. According to a website he suggested FT is even more comprehensive than Morningstar.

Check out this website: https://the-international-investor.com/investment-faq/international-fundamental-data-price-data-foreign-stocks and scroll down to the fundamentals section. A very good market overview of good data providers (unfortunately not all for free, but also cheap solutions among them). But maybe then it is cheaper to pay for an screener which already covers these special markets.

1 Like