Suddenly appearing short-term obligations on long-term portfolios are very suboptimal. It’s 25%, but if the market crashed earlier, it could have been 50%. And it still can be.

If you can not delay this in case the market turns sour, you might take a long-term hit. The underlying reason is that we are affected by geometric instead of arithmetic returns. Let me explain:

Model and Example

Let’s assume our portfolio can increase by 2x or shrink by its inverse (0.5x) with a 50-50 chance (we call this a) It could be other numbers, but the point is that this portfolio has an expected return of 1 (geometric return, instead of 1.25 like arithmetic returns would suggest), because we are forced to run those coin flips in series, all-in.

A long-term portfolio should also have return (maybe 1.05, and we call it c) above the risk free rate (which we will assume to be 0% and matching inflation for simplicity’s sake).

Now, we know we will have a fixed expense at a point in the future. It is some percentage (25%) of our portfolio at present (called b). We can choose to convert to the risk free asset now or later.

General formulas:

|

now |

later |

up

|

(1-b)*a*c |

a*c-b |

down

|

(1-b)*\frac{1}{a}*c |

\frac{1}{a}*c-b |

Geometric

Expectation |

(1-b)*c |

((a*c-b)*(\frac{1}{a}*c-b))^{0.5} |

Numbers

|

now |

later |

up

|

1.575 |

1.850 |

down

|

0.394 |

0.275 |

Geometric

Expectation |

0.788 |

0.713 |

We see that the return of converting later is much reduced. The additional return from our portfolio couldn’t overcome this.

All coin flips

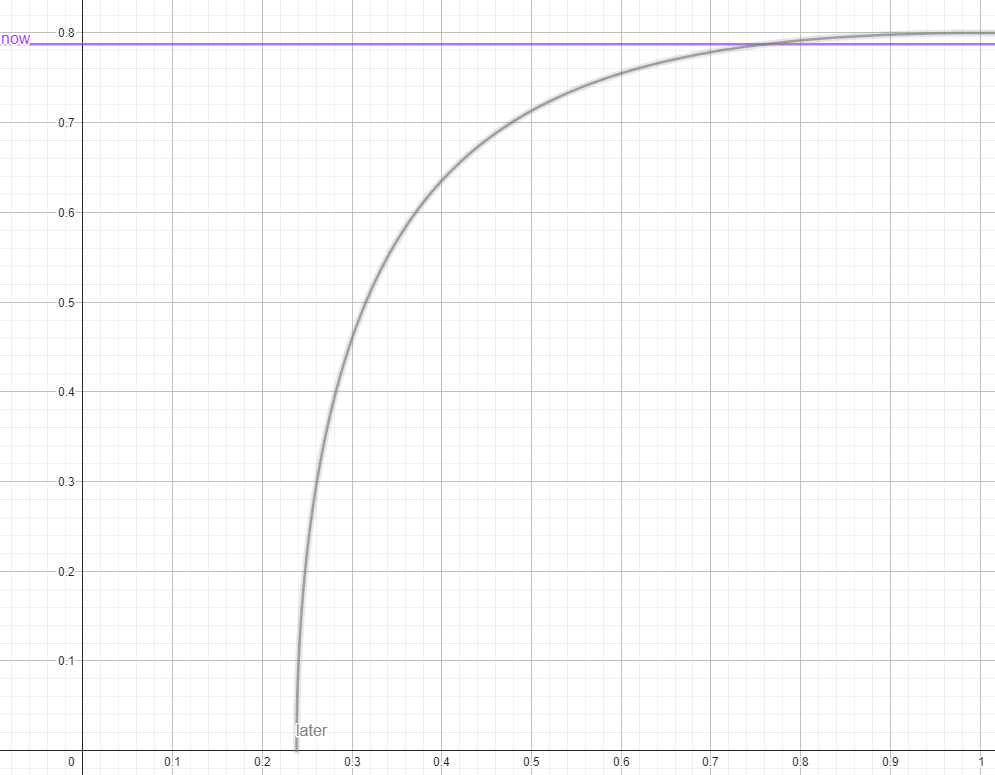

But maybe an a of 2x/0.5x movement is a bit extreme. Lets draw a curve over all a:

The advantage at low volatilities is small, and reaches 0.788 vs. 0.800 in favor of “later” at no volatility (= 1). And of course, at 4x/0.25x the 4x means nothing, because you risk getting wiped out.

Analytical solution

I tried to calculate this with a over a log-normal probability distribution. But since that includes the chance of falling to 0.25 and below the geometric expectation is 0. This is where this model reaches its explanatory limits.

But this does mean that for example using leverage without protections will at some point bankrupt you. Though, depending on the likeliness, that could take much longer than you have time to live (or the whole of humanity for that matter). If your capital has more than one heir, the new capitals will be insulated from each other. At that point this turns into arithmetic returns, where some total failures can still have a positive expected return over all portfolios.

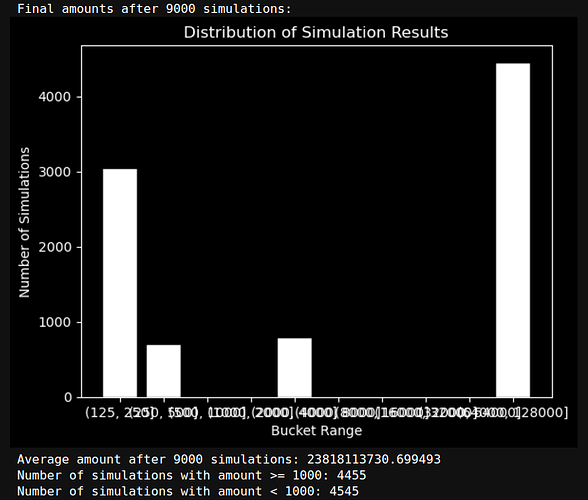

Monte Carlo

So, I ran a Monte Carlo simulation (n=100’000) over 4 quarters with log-normal distributions with μ=0, σ=0.096 (quarterly standard deviation of S&P 500 Price since around 1928), and applying the functions from before,

now(x_1,x_2,x_3,x_4)=(1-b)*x_1*x_2*x_3*x_4*c

later(x_1,x_2,x_3,x_4)=x_1*x_2*x_3*x_4*c-b

and also their combinations, e.g.:

semi(x_1,x_2,x_3,x_4)=(x_1*x_2*c^{2/4}-b)*x_3*x_4*c^{2/4}

Additionally there is a roll strategy, which makes five equal sized buckets and allocates them to one strategy each, over the same 4 quarters.

This gave me the following metrics:

|

now |

quarter |

semi |

3-quarter |

year |

roll |

| MIN |

0.375 |

0.330 |

0.294 |

0.281 |

0.251 |

0.309 |

| MAX |

1.701 |

1.822 |

1.903 |

1.947 |

2.017 |

1.872 |

| AVERAGE |

0.802 |

0.807 |

0.811 |

0.815 |

0.819 |

0.811 |

| GEOMEAN |

0.789 |

0.790 |

0.792 |

0.794 |

0.796 |

0.793 |

| STDEV |

0.149 |

0.163 |

0.176 |

0.188 |

0.198 |

0.174 |

Discussion

Based on these numbers, the additional return of could rationally be worth the additional volatility. This seems to be in line with normal leverage (with which it has much in common). We also see that “roll” slightly improves over “semi” in both GEOMEAN and STDEV.

The most extreme yearly drawdown I found in the SPYTR data of testol.io was -68.50% on 1932-06-28. Subtracting an additional 25%, would have left the portfolio at 6.5%. The stock market isn’t a log-normal Monte Carlo simulation. But you aren’t a robot either, and wouldn’t liquidate for renovations on that day.

To be honest, I didn’t expect that liquidating later would have the better expected geometric return. And for portfolios of higher volatility, or with less return, or if the expense is bigger, it doesn’t. But for those reasonably chosen values it works.

tl;dr: Selling later or rolling seem to be superior in return to selling now. This was calculated on a model with assumptions and not historical data.