Do you reduce the VIAC portion by the expected withdrawing tax of 4-6%?

No I’m not doing that, but might be a good idea for future net worth assumptions, thanks!

That’s very nice! How can you evaluate a company with this strategy, what metrics are you looking At?

Here is my not so mustachian portfolio. I do a lot of stock picking, rebalancing, and I try to time the market. I deserve to be beaten to death by the community.

DeGiro: 15% Weight

-World Equity ETF

VIAC Portfolio : 20% Weight

-100% Cash

Managed 2nd Pillar : 20% Weight

-60% Diversified Fixed Income

-40% Diversified Equity

IB Portfolio 55% Weight

-50% Nasdaq ETF

-50% Tech stock picking

What’s your returns like compared to index?

Die you backtest your Strategy?

Why do we even bother to invest in EM when they are constantly lagging behind?

FTSE EM Benchmark annualised returns in 10 years: 3.93%

FTSE All World annualised returns in 10 years: 9.14%

The MSCI Emerging Markets has an annualised performance of 5.47% since Nov. 2005.

The MSCI World has an annualised performance of 6.35% since Oct. 2005.

I cannot see a reason to invest in EM? Is investing in EM some kind of old braid that no one dared to question?

Sources:

vanguard.ch/privateinvestors/individual/investments/en/product.html#/productType=etf

https://www.ishares.com/ch/privatkunden/de/produkte/251881/ishares-msci-world-ucits-etf-inc-fund

Checkout performance since 1987 or 80/90s in general.

Why not investing only in Nasdaq 100?

Are you suggesting we should make investment decision based on recent-past performance? Allright.

I believe the world moves more or less in sync and I think EM will catch up (or Developed Markets catch down).

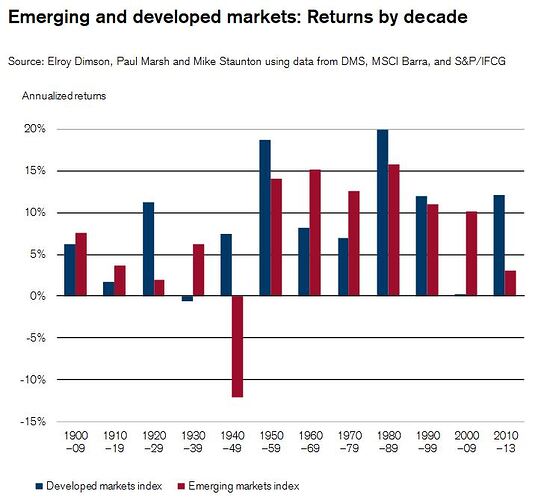

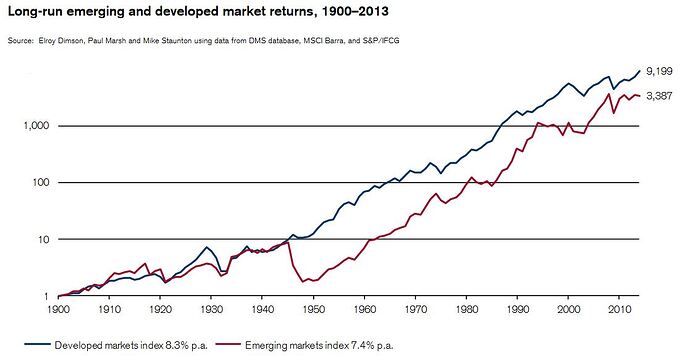

It is true that EM markets have had decades where they beat developed markets, but overall performance is just below developed markets:

Source: http://doc.xueqiu.com/14cdbae48e74653fe7546fe0.pdf

Wat only Nasdaq100? I am trying to make a serius discussion…

“I think EM will catch up” Are you suggesting we should make investment decision based on out guts? What makes you think EM will catch up? We hear these phrases for a long time now. And even if they catch up, what makes us sure that EM markets rise because of that and not companies listed in developed markets operating in EM?

What makes you think that the expected future gains from EM aren’t already priced in in the current price? If you go that way, you could ditch the whole exUS world. Europe is even worse than EM, but I still have some part of my portfolio in Europe.

Your chart is fancy, but how would it be for an investor starting in 1950 or 1985?

Maybe they are, but how is that an argument for buying EM stocks? I’m not saying I won’t invest in EM stocks, to be clear. Starting to invest in 1950 or 1985 in EM is just irrelevant according to your suggestion that historical data doesn’t matter for today and how had someone could have foreseen that?

So you think it’s a good idea to look at past performance? How does it matter for today? And how should it affect your asset allocation?

Past performance is no indicator, but it is better than ignoring it in my opinion. What I wanted to say in the first place is that the term of diversification has probably changed over time. Nowadays we are told to have stocks from all over the world (including EM), wheras Benjamin Graham wrote in The Intelligent Investor (Chapter 5):

There should be adequate though not excessive diversification. This might mean a minimum of ten different issues and a maximum of about thirty.

as well as

The defensive investor who follows our suggestions will purchase only high-grade bonds plus a diversified list of leading common stocks.

Buying hundreds or even thousands of stocks via ETF is way more diversified (and probably safer) than Graham’s suggestion, but there is nothing about EM (in the suggestion for the defensive investor).

Hello, I want to do my Mustachian portfolio with the next distribution:

ETF VWRL IE00B3RBWM25 50% Degiro

Vanguard S&P 500 UCITS ETF IE00B3XXRP09 15% Degiro

Viac Global 80 & Suisse 100 (50%/50%) 10% Viac

Mirabaud Eqs Swiss LU0636969866 10%

European Small , MID Caps FR0010288308/ES0159202011 10%

Pictet China Index P (EUR) 5%

Allright. What exactly led you to this choice of funds? Some of them look pretty expensive (TER) and are not very liquid judging by their size.

Yes…You’re right.There are some funds I bought a year ago…but maybe I’ll reduce my portfolio to 2 or 3 choices…I am in the study phase

It was a legitimate question. Maybe you have good reasons. The Mirabaud fund is actively managed and charges a very high TER (1.8%). Does it indeed outperform the index after fees? If so, good for you.

The Pictet China though is fully passive and still expensive. There are better alternatives available.

For the Mirabaud…any alternative? SMI/SPI index? with lower TER?

For Pictet because it’s expensive I know but I think will have a good performance in the future.

But I’m here for learn…so…another better alternative?

Thanks

SPI Extra on VIAC is easily the best option. Do you really want to double that?

Pictet China is passive and follows MSCI China. There’s plenty of cheaper stuff following the same index also passively.