Is that really what hip economists say nowadays? What I came across is the efficient frontier concept, and there value stocks are rated as the least risky type of equity:

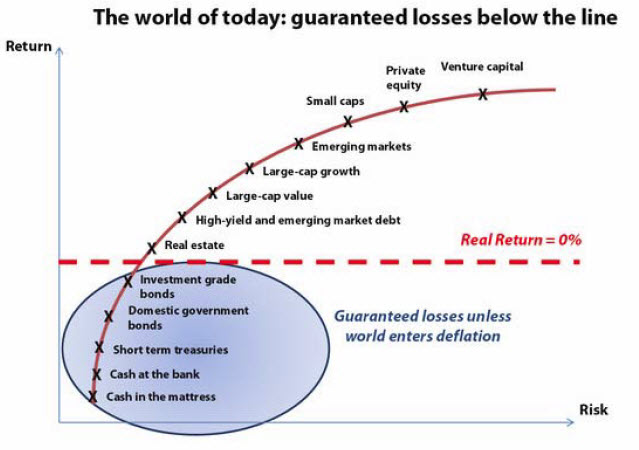

I really like this chart as it puts a lot of information together. The Risk axis is sometimes described as Volatility, and sometimes as Standard Deviation. It’s for you to answer where will you sit comfortably on this chart.

Btw, the source for this chart is an interesting read on its own: