I know I’m bumping an old thread, but I was trying to use the forum search to find the “closest” existing discussion about the state pension portion that I can count towards my retirement.

I’d like to share my own situation, and ask for confirmation that I’m understanding correctly how state pension payments will work. I often see very general statements about pension harmonization treaties, but I rarely see concrete info on the mechanics of how it’s calculated and who pays out.

Background: I moved from Canada to the US in 1997 for my first job, then later worked in Canada for a couple of years, then immigrated to the UK (at the time an EU country) in 2002, then immigrated to Switzerland in 2017.

I first read the EU rules on “Pensions” Pensions - European Commission which stated:

Even if you have worked in several countries, you should apply for your pension in the country where you live, unless you never worked there. In the latter case, you should apply in the country where you last worked.

and which appeared to claim in its FAQ ( FAQ Social security - Pensions - European Commission ) that the country where you live will supply you with a P1 summary:

You should apply for your pension in the country where you live, unless you never worked there. A “contact institution”, normally an institution of the country where you live, will take charge of the management of your pension claim.

The contact institution facilitates the exchange of information between the countries involved in your pension claim.

Once the contact institution has been notified of all the decisions from the different countries, it will send you a summary note of these decisions (a P1 document).

I assumed that because of Freedom of Movement agreements, Switzerland would adhere to this situation, so I sent into the Swiss AHV office a “318.282 - Antrag für eine Rentenvorausberechnung” (request for AVS entitlement) https://www.ahv-iv.ch/en/Leaflets-forms/Forms/Electronic-forms/318282-Pension-forecast-application-form .

I got back the Swiss 318.282 response and it doesn’t not appear to be a P1 summary of all EU contributions in EU countries. However it did seem to take into account some EU time in its calculations: based on time spent earning in the UK since 2002 and in Switzerland since 2017 it was determined that I had 18 years of “Anwendbare Rentenskala”. The amount of Swiss state Pillar I pension it determined I would be eligible for at retirement age was “CHF 727.00 (plafonierte Rente)”. Time working in Canada and the US did not appear to count towards my Anwendbare Rentenskala.

I believe this suggests that despite Switzerland’s accords with the EU it nevertheless does not take part in the State Pension Harmonization efforts of the EU including the P1 summary and the “final state of residence” management of all state pensions.

[QUESTION 1:] Can I confirm Switzerland does not take part in this P1 summary mechanism of coordinated EU pension pay-outs?

[QUESTION 2:] Can I confirm the “CHF 727.00 (plafonierte Rente)” the Swiss AHV said it will pay out is just the Swiss portion, and not somehow a combination of Swiss and UK state pensions?

[QUESTION 3:] Can I confirm I must myself manage following up with the UK state pension authorities to pay out directly its share of my pension, the Swiss its share, the Canadians their share, etc. each independently? i.e. I should not be expecting the last EEA country I live in to coordinate and provide a single payment, correct?

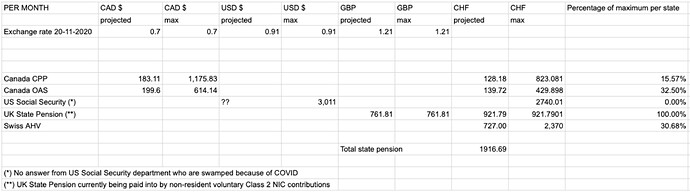

When I try to sum up all the state pensions I would be entitled to having worked in Canada, US, UK and CH, I get:

Horrible text-only version:

| PER MONTH | projected CAD | max CAD | projected USD | max USD | projected GBP | max GBP | projected CHF | max CHF | Percentage of maximum per state

| Exchange rate 20-11-2020 | 0.7 | 0.7 | 0.91 | 0.91 | 1.21 | 1.21

| Canada CPP | 183.11 | 1,175.83| | | | | 128.18 | 823.081 | 15.57%

| Canada OAS | 199.6 | 614.14 | | | | | 139.72 | 429.898 | 32.50%

| US Social Security ()| | ?? | 3,011| | 2740.01 0.00%

| UK State Pension (**)| | | | | 761.81 | 761.81 | 921.79 | 921.7901 | 100.00%

| Swiss AHV | | | | | | | 727.00 | 2,370 | 30.68%

Total state pension CHF 1916.69 / month

() No answer yet from US Social Security department who are swamped because of COVID

(**) UK State Pension currently being paid into by non-resident voluntary Class 2 NIC contributions

As you can see in each country a percentage of an individual’s maximum state pension, except for the UK where I am continuing to make https://www.gov.uk/voluntary-national-insurance-contributions/who-can-pay-voluntary-contributions .

So I see I’d be entitled to a total state pension amounts of CHF 1916/month at retirement age. This is less than the maximum one could expect e.g. had one spent all one’s working life in Switzerland, but more than the maximum one could expect in Canada or the UK, so from the seat of the pants it makes sense to me given the share of time I’ve spent contributing in each system.

[QUESTION 4:] Does this combined state pension amount of CHF 1916/month sound about right?

Relevant Info:

https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-international/eligibility.html

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/benefit-amount.html

https://www.tax.service.gov.uk/check-your-state-pension/account/nirecord