Anyone did the transfer from one to the other?

I was thinking that SQ is probably the best solution (between the two) for the accumulating phase, especially if you buy ETF with the flat fee. Then it’s cheaper to have everything on PF.

I wonder how much it will cost to move everything (ETF and Stocks), since selling and buying will be just dumb.

Not me, but I think it is a reasonable thing to ask SQ support about. However, my 3.14 Rappen:

- Unless you are going to do it next couple of years, I don’t think it makes sense to consider it now. In 5 years the landscape of brokers and fees will change.

1a. I suspect Postfinance is going to change their E-trading fees structure during the next couple of years.

-

I would rather try to profit from an offer of a broker covering securities transfer fees. TradeDirect has such offers from time to time.

-

What about Yuh, which is also using SQ platform? You can transfer money for free between SQ and Yuh. Anyone tried to ask to transfer securities between them?

-

Do you assume to only receive dividends and not sell anything after you made a transfer?

I haven’t done exactly that transfer, but various others, incl. to Postfinance, and never an issue.

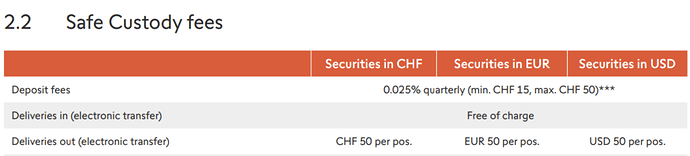

Swissquote outgoing transfer “moderately” priced for Swiss standards.

At incoming end never any fees, on the contrary, some even take over the fees to get your business. But Postfinance probably not so generous.

Screenshot from Sq fee summary:

Well if I have 100k in 1 or 2 etf, 50/100chf isn’t much. It’s surely less than buying them again on PF.

I didn’t check YUH.

The idea is to slowly buy more than 20k/year of ETFs (PF free 90chf should be enough for 20k trades) and once I stop buying, move everything out.

SQ costs max 200chf year, while PF 90chf. If you buy more than 20k chf on PF you can easily reach 200chf.

Moving swag stocks would be expensive though

Yes.

If you want to have a Swiss broker/s and you are buying at PF until you use up trading credits coming from the yearly fee and then continue buying at SQ, it sounds reasonable to me.

You can also generate some SQ trading credits by using SQ digital “credit” card, even with TWINT or Revolut. A drawback is that you have to keep enough cash as a margin for this credit card. Or maybe not, but their interest rates are higher than that of IB ![]()

Well, you should look at the total cost including actual custody fee at SQ. Might actually make sense to regularly transfer chunks of 50-100 kCHF worth of one ETF to save on SQ custody fees.

And since we are at this topic - a fee to transfer out securities from degiro or IB is even less, and the acquisition cost an order of magnitude lower

I’d love to see how much does it cost a transfer from IB to PF.

I saw 40 USD/CHF mentioned on this forum. And yes, I also would be interested to hear about a first hand experience.

BTW for any securities transfer all accounts should be in the same name, no individual to joint account or vice versa transfers are allowed.

I’m currently in the process of transfering a couple of simple securities from Swissquote to IBKR. I have instructed both parties on Nov 6 and have so far not seen any result.

The forms can be found at Swissquote (securities transfer debit securities account) and at IBKR (Transfer Positions).

- Swissquote first refused my digitally signed transfer order. Even though I used their secure message channel while being logged in, they wanted me to print the document, sign it, scan it and resubmit to them. They will never want to see the original. I don’t own a printer, so it takes me a bit to get it on paper and resubmit.

- Because of the delay, IBKR threatened 6 days later to reject the transfer, if they don’t hear from Swissquote.

- When contacting Swissquote on day 8, they tell me that they tried to reach me by phone (I didn’t find any record of this) to ask me to verify the transfer order that I submitted over a secure channel with my signature and without change of beneficial owner.

- Now I’m flying blindly, not knowing if Swissquote instructed and IBKR rejected or any other sequence of non-events. On day 20, I get a reminder from IBKR that if they don’t hear from SQ, the will reject the transfer.

- I forward the mail to SQ and get the answer that they have contacted their transfer team urgently. On day 22, nothing has moved yet.

I understand that outgoing transfers are not SQ’s core business and probably quite rare. I am nevertheless amazed by their slow, sloppy, complicated and opaque process. Along with their past bad performance in the area of Corporate Actions, I begin to wonder if I should take my business elsewhere.

Transferring from UBS to PF (SQ in fact but accessed through PF account) took a visit in person in UBS to submit the printed and wet signed form, along with taking a copy of my residence permit and passport (the kid at the front desk was inexperienced and had to call a more senior colleague), a phonecall from UBS 2 weeks later to confirm I want this, and a phonecall from PF 1 week after that to tell me that one of the positions is in USD rather than CHF, and will show as USD on my account (which didn’t make sense to me because all my IE ETFs’ currencies are USD already, and showed in CHF in my UBS account). Total time to see the positions on PF was nearly 1 month ![]()

For some reason I read “a visit in prison” lol.

I also did a ubs2pf transfer and also had to go to prison like you did. ![]()

Surprisingly, Swissquote is more digital than UBS! BTW: I always wondered why a service like PDF to Scan Online 100% Free | i2PDF exists. Now I know.

i submitted a transfer IBKR —> SQ. Still showing under review on IB.

Since i only entered this on 27th evening, I guess i should give it a couple of days because we are in holiday period