But at the end of the day, the performance can be fairly similar to other relatively close products - there is no need to stick to that one in particular.

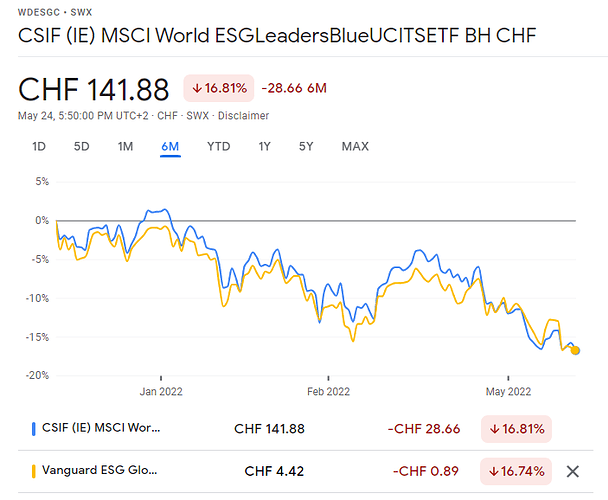

Below is a comparison with WDESGC.SW, hedged in Swiss francs, TER 0.18%.

Global EU-based ETFs are rather expensive, but it’s changing. Amundi Prime Global, LU2089238203 has a TER of 0.05%.

Until cheap ESG ones become available in Swiss francs, I stick to a portfolio of a few proven ETFs per region : Cheap, accumulating, listed in Zurich and in Swiss francs, like XSPX.SW, XESC.SW, XMME.SW