Hi everyone,

I’m not sure how to categorize this topic. I’m going for real estate, but it could be taxes or even inventing. So please let me know if i should change the category.

End of this year my 2nd rang mortgage will reach its end date so I need to renew it. I have pretty much discarded to pay it out, as it’s very expensive tax wise, and would require to use my 2nd pillar (but please change my mind).

When i bought my apartment i did not use my 2nd pillar and I had around 30% for the down-payment. So I’m in a pretty good position to increase my mortgage. I can increase my mortgage and use my existing “cédulle hypothécaire”.

I ran some numbers and I came up with a plan. I would appreciate your inputs to improve it or identify any flaw.

My plan can be summarized as:

- Increase mortgage, and get around 100K in cash from the bank

- my mortgage payments will increase 100CHF per month, or about 1200CHF per year. this is after discounting taxes, using 40% marginal tax rate. This is something that i can pay.

- With the 100K I can

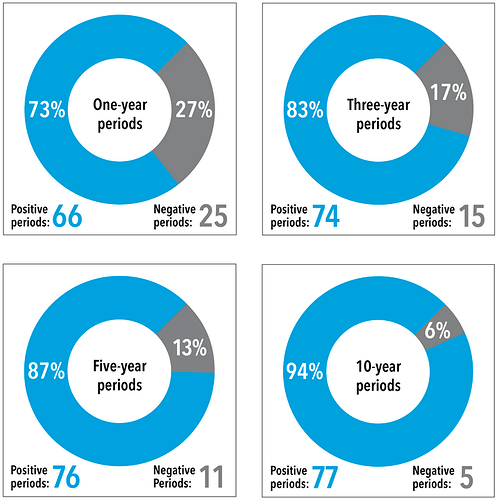

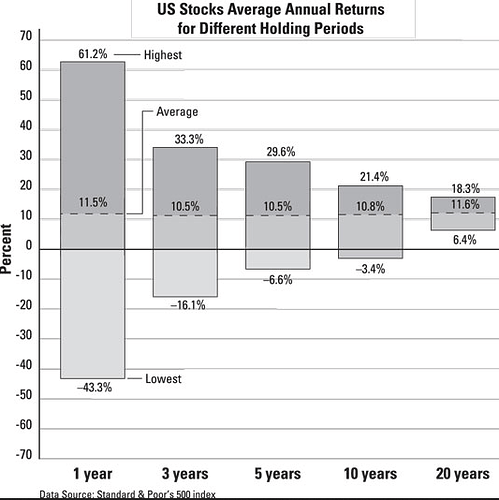

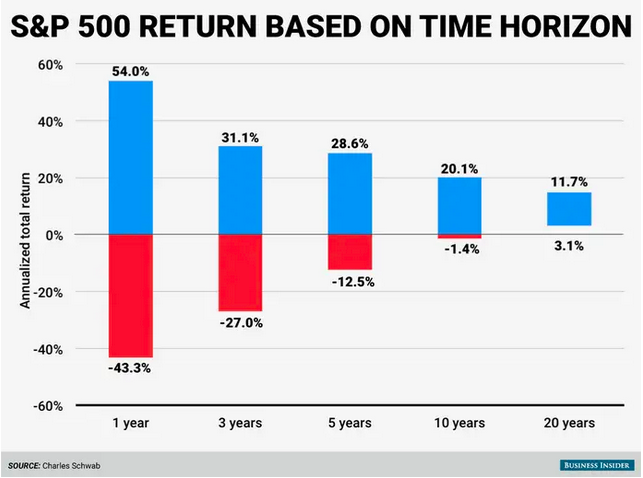

A) buy shares (VOO, VT, etc). In 10 years take that money and pay back the mortgage.

B) buy 2nd pillar. I’m leaning towards this option (again, please change my mind). This is my preferred option.

Option (B) is more elaborated. I’m thinking to, buying 2nd pillar in 2 fiscal years (2021 and 2022). That will allow me to pay very low taxes and free all that cash to … you probably guessed it → buy shares! Then in around 10 years I could sell the shares and pay back the mortgage. According to my calculations, with 7% growth i should be able to pay back the 100K and a bit more. And i will have 100K at 2% in my 2nd pillar. Another option is to use my 2nd pillar to pay back the mortgage. However I prefer to sell the shares, as in 10 years I could actually repeat the whole thing.

Risks management:

- real state market crash, if this happens and the bank ask to get their money back (basically if my apartment is worth less than the loan) i could take the money from my 2nd pillar or from my shares. Probably i would take it from my 2nd pillar as the shares could tank at the same time, like in 2008.

- interest rates increase, I should be covered from the mortgage point of view, as I’m planning to go for a fixed rate. the shares will suffer , but the 2nd pillar should yield more than 2%. So I think that I’m still covered.

- stock crash, in this case I won’t be able to pay back the loan with my shares, but I’m covered by the 2nd pillar.

There are other options to use the money, like buying a 2nd apartment for rental income. But that would would expose me too much to a real state market crash as I higher portion of my net worth will be tied to real state price. And I would pay even more taxes and mortgage. Which will significantly reduce my net profit.

Has anybody gone through this analysis? I would appreciate your inputs.

… Right?

Cherry on the cake

I don’t know if this is possible, but i will ask to the bank. I’m thinking to use my 3rd pillar to payback the mortgage and ask the bank for the same amount. So the money goes out of my 3rd pillar, the debt is the same (plus the increase that I’m requesting) and I get the money from my 3rd pillar as cash, which I can put on my 2nd pillar and make the whole thing more interesting. Between me and my wife we max out ours 3rd pillar every year. that around 14K per year, in 5 years it’s 70K plus any appreciation (hello ![]() VIAC), at 40% marginal tax rate that’s 28K in tax that could go to investing.

VIAC), at 40% marginal tax rate that’s 28K in tax that could go to investing.

Why to buy 2nd pillar on two fiscal years?

I did a simulation with VaudTax and it’s better to split the money in 2 2nd pillar purchases, this maximizes the tax savings for 100K and my personal situation. Basically whatever amount of money that you put in your 2nd pillar will not push your tax to zero or negative, so you need to find the sweet spot.

Why not option (A), just buy shares

Well, this option does not have the tax savings part. The stock market returns should be higher than mortgage interest so in theory it’s interesting, but it’s more riskier. The interesting part with option (b) is that has less risk and higher return.

As I said at the beginning, not sure how to categorize this topic. I’m looking at this mainly from the tax saving point of view and how to use the tax savings to maximize profit.

I would really appreciate your inputs. Specially if there is any flaw that I’m missing.

Cheers!