That’s a really good margin; were there any special considerations? The lowest I have got is 0.85%..

VIAC gets you 0.65% SARON margin but they have more restrictive requirements compared to other banks…

Interesting read:

Its paywalled. Possible to paste the contents here?

The condition was to become a Raiffeisen member (2x CHF 200), and using the account as a salary account is desired but not formally specified in writing as a requirement.

3 posts were merged into an existing topic: VIAC launched their own mortgage offering

A data point from this week, UBS, 1.85M SARON at 0.7% margin, LTV around 70%.

If the 10 year rates dip a little more, we will probably switch.

Hi all, just wanted to run a quick study by you and check for inconsistencies / mistakes.

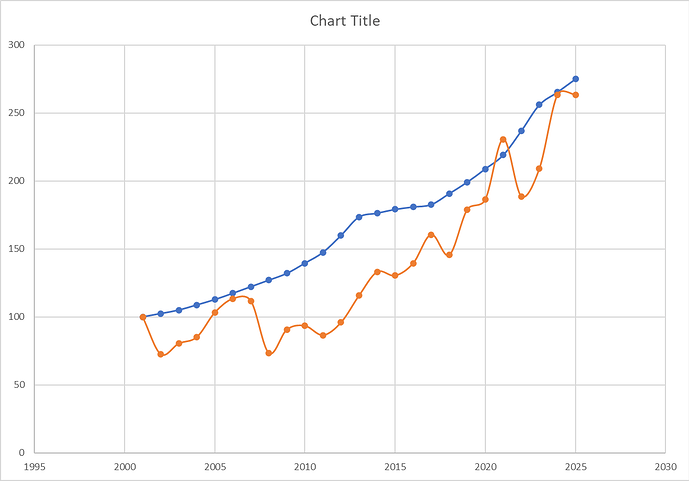

I am comparing Zurich real estate returns (i.e. price appreciation, ignoring leverage) vs MSCI World CHF returns.

resources:

Zurich RE: https://realadvisor.ch/en/property-prices/8032-zurich (data points extracted semi manually)

MSCI: https://www.msci.com/documents/10199/79624682-811a-4b31-41d7-5f4980355f7d + some extrapolations for years prior to 2011, offered by Perplexity

basically, index 100 end of 2001 (I know it ignores the 2001 market crash), in 2024 both end up around 265 in 2024, but with a much higher volatility for stocks (in orange)

So the conclusion would be: rush into Zurich RE, no? Volatility much less, performance can be boosted by (much safer) leverage over the period.

What’s the counterargument, simply on the risk/return profile of these 2 investments?

To start with, it’s fairly off topic.

Second, it really depends on what you expect from your investments.

Owning real estate is comparatively illiquid:

You either sell the whole place, or you can take out a Home equity loan against value increases.

Additionally, you have a capital gains tax when selling.

Also, owning one property may or may not give you the calculated value increase.

It’s a very concentrated risk if you own one apartment. You have ongoing maintenance and depreciation costs that you have failed to include in your calculations.

ETF investments have no capital gains tax. They are broadly diversified and can be sold in small pieces. They are for all intents and purposes cheap to buy and to own.

Also, past performance does not guarantee future performance.

Completely different asset classes, as the previous answer also gives a few pointers on liquidity.

Also the leverage you have on real estate is subject to strong T&C, an ETF is not. If you have liquid collateral that allows you to leverage on the safe side, then on the other hand it makes more sense to diversify by having both.

I think you should rather compare stocks against a REIT.

Before further discussion.

Are you thinking about buying a real estate yourself as a home, OR a rental property OR you are thinking of investing in Real Estate Funds to get a diversified exposure to Swiss Real estate/Zurich area real estate ?

Next point -: I noticed you are comparing Price indexes. This means you are ignoring rental income from Real estate and also dividend income from MSCI world. Is this a right comparison?

Hi guys, I had a thought the other day, not sure how feasible it is.

How common/possible is house hacking in Zurich Canton?

Buying a 3-4 unit apartment building, leaving in one unit and having the 3 other units pay for the mortgage. I know this is common in the U.S. but I haven’t heard of anyone doing so here.

Would a bank finance this arrangement?

I did this. I bought a house where there was a separate entrance for the upper floor. I rented the smaller top floor and it was enough to pay the mortgage so I essentially lived for free.

I even tried house-sharing for a short period so lived with 2 others in the bottom floor for a year (more to help out friends who needed temp accommodation). It was very MMM, but after living on my own for so long, I was not really enthralled with sharing and stopped after a year.

Large upfront capital investment. Costs for repair / refurbish / upgrade units. And good emergency fund for ongoing maintenance. And a lot of knowledge so keep maintained costs low. Super super involved work, I would guess.

Not to say massive concentration risk in 1 building and largely in real estate.

Edit: as @PhilMongoose described, if you have 1 or half extra unit, it could be side income source. But 2-3 units then become it own thing.

Something with a granny annex is nice as they can bring in good revenue but typically are not priced at a premium to a normal house.

In 12 more years, tenants will pay off the remaining mortgage.

With swiss tax regime it’s actually more efficient to not pay down the mortgage but rather invest the surplus (with the added risk and volatility of the surplus investment of course).

Well, I meant only conceptually. Cash flows from properties have been directed into the stock market, so in reality, they probably paid it off already due to the stock market gains.

Some of it has been used to pay down the mortgage though and I do plan to pay down mortgages entirely to use as the ‘bond component’ in my portfolio if at the time of mortgage renewal the rates are not favourable.

I think on the free market it is rare to achieve the ROI you are looking for. I think in switzerland this hack is rarely possible, due to prices and conditions for mortgages.

My best bet would be, as already mentioned, something with a spare room/studio which you could rent or use for airbnb.

Anyway, if you find a opportunity it is definitive a great thing

SARON mortgage should become increasingly more interesting Switzerland cuts 2025 economic outlook as trade war risks weigh | Reuters

It’s always been the best option if you look at the past 20 years ![]()