I have a Saron margin of 0.45%, meaning 1.66% interest. Mortgage is 700k, so CHF 970 per month. If SNB goes down to 0.75% (which they might in 2025), that‘s CHF 680 per month. I see no appeal to switch into a fixed-rate mortgage.

I guess with rates stable and maybe heading down, I can understand that. At what rate would you be tempted to fix for, say, 10 years?

At or below 1% ![]()

Same, but only if I plan to keep the apartment/house long-term. Which I don’t right now.

Yeah, for me at <=1% it is a no-brainer decision to fix. Though, I think I’d also think that I’d still fix a bit higher than that.

yep, would fix at 1%

Rates keep decreasing. Now 1.5-1.7% for 10 years are possible again.

I am in a hunt for a mortgage to start next year and my advisor sent a message this week for 1.68% for 10 years.

I think they will go down a bit further end of the year and locking at 1.5% for 10 years could make sense?

The swap 10 year is indeed below 0.9% those days, the probability of a rate decrease in september is almost certain.

update, I’ll have to lock in my mortgage in the next two weeks or so. Rates for fixed term have further fallen, for once the market timing is excellent for me. Current rates for my employer with staff discounts:

| Term | Current Rate | Margin |

|---|---|---|

| 1 Yr | 1.15% | 0.1% |

| 2 Yrs | 1.10% | 0.1% |

| 3 Yrs | 1.05% | 0.1% |

| 4-6 Yrs | 1.10% | 0.1% |

| 7-8 Yrs | 1.15% | 0.1% |

| 9-10 Yrs | 1.20% | 0.1% |

| Saron | 1.41% | 0.2% |

Again with +0.55% penalty for fixed term, +0.45% for Saron when leaving the firm.

I was initially heavily leaning towards Saron, but given the rates are now quite attractive, I’m thinking about the 3-5 years fixed. I’m planning to stay at least 3 years at my company, so this is probably short enough that if the penalty applies, it does only for a limited time. Also, I’m not so sure if Saron is realistically going to drop below 1.0%, so the potential upside over taking a 3-5 yrs fixed is limited, while “insuring” the rate is comparably cheap. Any flaws in my logic?

Sounds like UBS ![]()

No flaws in your logic, same thoughts. The drop by the SNB seems to be priced in.

Would also aim for 3-5y; always depending, you plan your future with at your employer.

I know from a lot other persons, that this is the main argument not to have a mortgage with the employer, but to continue with an another bank, who may be more a bit more expensive (e.g. 1.45% on 10y).

Who knows, maybe we‘ll be back to 0% SNB rate by end of 2025.

For me, 1.2% is low enough to lock in for 10 years.

It is 1.2% only if OP stays with the same employer, so not exactly the same.

What is actually the reason why medium term mortgages (3 years) are cheaper than both short and longterm?

Flat yield curve. A priced in expectation of lower rates in the near future.

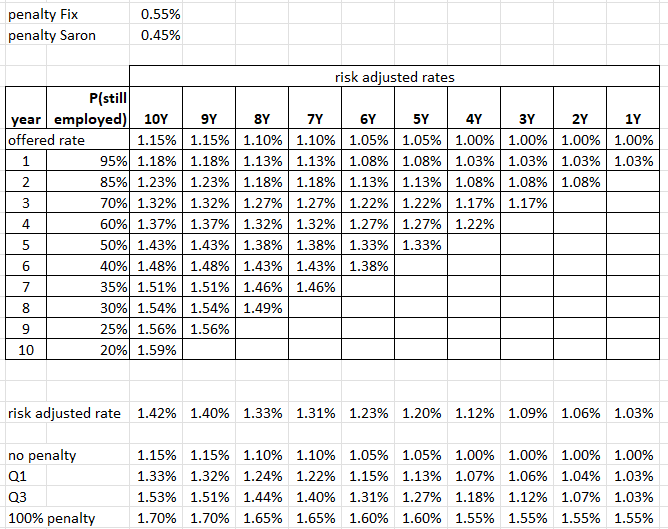

exactly, I thought about a risk-adjusted rate.

I suck a stats/probability math but tried my best to model it. I made a very rough assumption about my probability of still being employed at my firm. The risk-adjusted rates for every year is offered rate + (probability of penalty * penalty) and then averaged over the duration of the mortgage. And yes, the rates were lowered again yesterday afternoon.

Probably overthinking it… just looking at my table, the 4 Yr looks very attractive. Low rate (1.0%) and high probability of still being employed, so a risk adjusted rate of 1.12%.

What about chosing a Saron and then switching into a fixed rate by end of the year to get a lower rate? Would that be possible?

do you also have numbers without discounts, so that I can have some reference?

Just look here but keep in mind these are the rates when you and your property get the best rating from the bank:

(Tiefe Hypothekarzinsen durch Digitalisierung – ohne Provisionen)

If you own several properties the rates can be at least as good as with an employee discount or even better, depending on the total mortgage volume and additional securites or pledges.