Why should I keep my SARON+0.8 margin (currently paying 2.01%, still waiting for them to digest the last rate cut, I suppose will happen EOY) when the same bank now offers (on the website, so with a margin of negotiation) 10y fixed for 1.3%? I can change now at end of year with 10 days notice, next time would be end of March.

First and foremost never use the three month SARON rate, one month should be preferred IMHO since SARON is around 0.95% right now so you lag quite a bit behind. You also gain flexibility to change every month into a fixed mortgage if you feel like (although I’m a 100% SARON enjoyer/adviser).

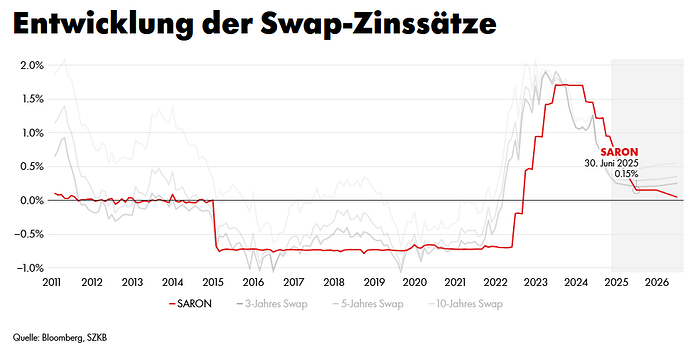

We are on our way to zero interest rates somewhere at the end of 2025 as things stand right now. SARON is expected to drop to around 0.2% in mid 2025 with current market and geopolitical situation:

All the Banks i ve worked with do quarterly interest payment and 3 month saron compounding. In terms of calculation I don’t think there’s much difference between 12 periods of 1 month compounding vs 4 of 3 month compounding since the saron rate is anyway calculated daily. I d be curious to know which bank offers a 1 month compounding ?

That’s also my experience.

SARON is calculated daily but the SARON interest is fixed for three months whereas with one month you profit faster from falling interest rates (but you also pay faster if interest rates go up).

Here is a graph from ZKB showing exactly that (sorry it’s in german):

One example:

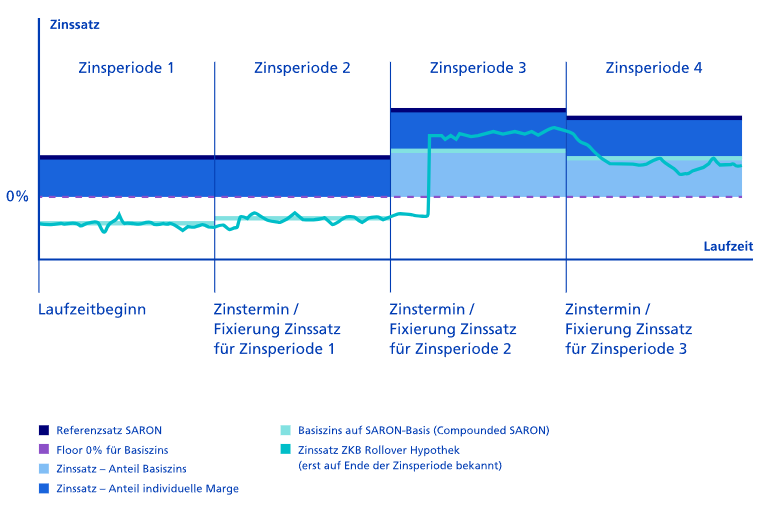

Microsoft Word - rollover-finanzierung_1-monat_final.docx

Be patient and pay more for still a few month.

1% 10y fixed is coming back as stated by cortana

Based on my experience the compounded saron is only known at the end of the period based on the daily rates of the observation window (in that case the last 3 months). In that case if there’s a rate cut in the middle of the period you still benefit from it.

I’ve checked the ZKB website and they actually describe what I m saying, does not matter if the observation period is 1 or 3 months.

- Der Zinssatz wird für jede Zinsperiode jeweils zwei Bankwerktage vor dem Ende der Zinsperiode fixiert und dem Darlehensnehmer per Ende der Zinsperiode belastet.

The legend of the ZKB illustration is quite confusing to me. The light green line represents the calculated SARON rate at the end of the period and on top they add the margin, while the dark green one is the daily SARON rate and I do believe that the comment in brackets related to the fact that the rate is only know at the end of the period should apply to the light green line and not the dark green curve. For instance during the period 3 there’s a rate hike and as you see the green line finishes below the dark green one because you benefit from the blended rate and of course there’s a contribution of the initial negative rate days in the result. If the rate had been fixed at the start of the period the rate would have stayed negative for the whole duration.

LIBOR used to work the way you describe it, i.e. with a fixing date for the period but SARON is completely different.

Swap rate for 10 years is down to 0.32%. Heading down to 0%. Maybe we‘ll really see 0.90-0.99% 10Y mortgages by the end of this year ![]()

Yes, I can confirm it is free, and it will be converted every 3 months period, so typically, whether you want to change it on January the 5th or March 20th, it will become a fixed rate on April 1st. I’m gonna go for it since I can get a bit more visibility in the coming months on the swap and Saron projections.

Where did you find this graph? Thanks for sharing

Zinsprognose - Schwyzer Kantonalbank

It’s normally updated if any major bank changes interest rates.

So Raiffeisen on their last forecast announe SNB rate at 0% on 31.12.2025.

I am still ok paying more with SARON than fixed and patiently waiting for null rates to come back again ![]()

Yeah you might end up with 0.6-0.8% that way. And who knows, maybe we’ll stay there for several years again.

hello guys. The construction is going to be finished by Summer 2026. So now with the expectation(or just hope) of rate going further down next year, between

- the choice of fixing the forward interest rate right now and

- the choice of waiting a bit longer until the construction finished (or half year before that) and then fix the rate,

Is it obvious that I should go with the second choice, aka wait? Any input?

Depends on your risk appetite. If you want to have a safe rate then fix now if not then wait.

As things stand right now the rates are going down so you will most propably end up paying less if you wait but there is still a chance that interest rates might increase again.

For me personally it would be a no brainer to wait as with current available data that’s most propably the right choice.

That’s what I (and the banks) thought when the rate offered to me for a 10-year fluctuated between 0.7% and 0.8% (maybe 0.6% on the billboards or for others?) a few years ago.

And here I am, lurking again with my big, expensive SARON mortgage, rethinking my life choices all over again ![]()

Look at it long-term, it’s like the stock market. There will be years which are painful, but in the end you’ll end up with more money. Historically (last 40 years) 5-10 years mortgages did cost you 1%/year more than having a variable mortgage (Saron these days).

If your risk appetite allows it, you can stay with Saron long-term and it will (should) be worth it.

Fair enough, but that’s for short vs. long term in general.

Several people seem to be set on fixed, and just wonder about the timing. What I’m trying to add is that this might go either way. It’s not a no brainer.

If it were, it would already be reflected in the rates.

People complaining when SARON is high but forgetting that SARON was basically 0 from 2011 to 2022? Data clearly shows the thruth as shown here when comparing 10 year mortgages to SARON → Festhypothek oder Saron-Hypothek - Was ist besser? (although it’s starting only from 1996).

Obviously the difference is the highest with ten year fix vs SARON and the shorter the mortgage period the closer you get to the SARON mortgage and the lower the difference will be.

It might go either way, agreed, but data shows that it’s highly likely going down and not up. Everything else is guessing, this way you at least have some data to back the decision.

The decision is personal as it depends on risk tolerance, capacity to pay higher interest, positioning within the portfolio and timing.

When I fixed my home mortgage, I had the choice of SARON+0.65% or 10 year fix at 0.75%. For me it was a no-brainer to take the fix.

I recently took a 10 year fix on another property at 1.49%. Although interest rates are falling and I could potentially secure a lower rate by waiting for rates to fall, I really didn’t want to take the risk. Even if the trajectory is lower, there are always the unknown unknowns which can throw a spanner in the works.

By fixing now, I also have my mortgages overlapping at 5 year intervals. In 3 years, I’ll start to look at whether it makes sense to fix the first mortgage when it comes up for renewal in 5 years time.