make sure whatever bank you use has the terms listed for SARON cancelation clearly stated in the contract. As maybe they would ask for longer than 3 months

In the last weeks UBS sent me more information about Festhypotheke than usual. Last one was on offer to get a 10 year for the rate of a 7 year.

I am currently on a saron with 0.5% margin. Seeing the margin increase on hypotheke.ch etc up to 0.65 I think they try to increase the margins also in their existing portfolio

Yeah worst case scenario they could increase your SARON margin if it’s not a fixes contract.

No so common but it could happen. These last months banks really increased their margin!

Currently

1 year IRS 0,43

2 year IRS 0,35

3 year IRS 0,37

So bets are open when will we see SNB null rate again?texte en gras

That’s what I went with.

Anyone with a Raiffeisen mortgage? I got an offer Saron+0.7% but with 5 year lock in, i.e. can switch to fixed for the remainder of the term when Saron starts rising. Is this a good spread or should I be pushing for better conditions. 0.6% spread maybe? That’s for a 60% mortgage. Switching from another bank after initial 5 yrs.

I wouldn’t. You get the worst of both worlds ![]() .

.

They offered me 0.65% margin. Sounded interesting until I dug deeper into the fixed length topic. I found they didn’t do a good job explaining that to me in the due detail.

Thanks. The other option was 1.42% 5yr fixed

Shop around. That sounds pretty bad indeed. Personally I would never accept a SARON with a lock-in larger than 6 months, and if requires a 6-month lock in, it should also allow you to amortize every 6 months minimum (if you so choose).

Aim for 0.6% margin if you go SARON

Check Hypotheke.ch and Moneypark.ch (I can’t recommend either of these personally as I have not yet tried them, but I am willing to try them when my renewal comes to term). But if you do try them please report back on how it all went.

I am currently 50/50 with Fixed 1.0% / SARON.

Also, 1.42 for 5yr also sounds bad to me. Swaps dropped again today so 1.18% - 1.24% is what moneypark / hypotheke are estimating for 5yr right now. I would want a 10yr for that rate.

BVK currently offers 1.37% for 5 year.

I don’t see 0.6% margin for SARON anywhere, it is actually achievable?

Hypotheke.ch says 0.83% at best for my location, though VIAC has 0.65% apparently. Otherwise lowest I could find was Migros Bank at 0.8%.

SwissQuote has 0.55% for 3 year contracts and 0.65% for 1 year contracts, best deal I could find so far.

For SARON - I think there were a lot of people saying that the banks raised the minimum from 0.5 to 0.6% on margin within the last 1-2 years.

I can tell you I was offered 0.6% margin in that timeframe.

So I’m guessing it is possible to still get 0.6% since both websites seem to show that. As for what specific bank and what requirements, income statements etc factor into that I’m not sure.

Quick question to all, why is ZKB interest rates so bad? It’s like 0,5% higher than the moneypark.ch and hypotheke.ch. I know that what is listed on these two websites are not achievable, for buy-to-let. Adding 0.1% or 0.2% I can understand, but ZKB, adding 0.5%, seems so bad…

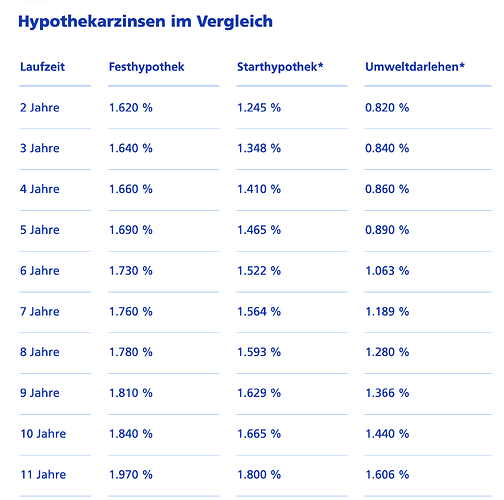

- fixing 10 years 1.84%

- and saron margin is 1.1%

Is the bank known for this bad rate? It is our default bank and it would be nice to go with them, but this looks like “cannot-be-worse”. Any first hand experience interacting with ZKB for the mortgage rate?

My experience with ZKB is that they are that bad. Had direct discussion and showed also counter offers and the rate they were offering was a bit better than what they have on the website but still far from what others could offer. I think they just have so many “lazy” people that have them as their house bank and just use them by default that they are not interested in offering better rates.

thanks for the reply. In your experience, are they generous with the affordability, namely offering better LTV ratio? Or as strict as other banks? If LTV is better, then maybe that’s one good reason to go with them nevertheless. Otherwise, it is just hard to find an advantage.

I can’t say that was not a discussion point in my case.

These are their website “rates”, therefore only indicative (and pretty terrible). Pretty sure the website rate are a worse case scenario, or maybe it’s just to rope in anyone gullible enough to sign up cause that’s where they bank (without shopping around or asking for a competitive rate).

I’m sure if you were to talk to a rep. they would send you a pdf version of their daily “competitive” rates which will be better than the posted ones.

(still doubtful you will find rate leaner as what might be obtainable from a broker, since they have a good “brand” & customer service).

What this shows is that they have no appetite to finance old buildings which is actually a recent trend as renovation costs tend to explode and are therefore more risky to have as collateral for a bank. ZKB is not the only bank with different rates based on energy efficiency of properties… Their environment friendly building rates are in line with other banks published rates.

I looked into it a bit. It is anyway maximum 5 years with the discount rate (0.8% ), which seems to be very good if it is true.