is everybody avoiding gold like the plague (or covid?) or are there people with large (but not too large) allocations around?

Precious Metals at 4-5% of NW.

Silver, Gold, Platinum - in decreasing order of weight.

Then I would like to ask: how do you store them? And what are the associated costs?

Physical or financial? ![]()

lol, ok, ok, valid question!

come to think of it, the order applies to both financial and physical weight.

but I meant financial weight ![]()

Mostly stored in Metallkonto at Swiss bank at 0.23% p.a. (unfortunately increasing steeply to 0.5% in April).

Some in SIVR & PPLT ETF at IB (0.3% TER)

And lastly some in bullion (not telling where ![]() )

)

I’m a lazy rebalancer, but when I do, I rebalance with the ETF’s. Although there’s sometimes some strange anomalies re Premium and Discount on these ETF’s. (never understood why that should be).

The buy-sell spread on the Metallkonto is approx. 3%, AFAIK, so I reckon the ETF’s are at less than that spread.

But it’s really all less transparent than shares IMO, the Metallkonto spreads, the ETF premium etc.

Crypto is the new gold. 3.5% of my NW.

Unfortunately, this is the most interesting part where I would like to hear about some first hand experience.

Going to original topic: if I would to invest in physical metals, it would be in platinum and palladium. There are clear use cases which are expected to increase price of those metals above inflation.

I would say “Bitcoin is the new gold” is actually a very good comparison, as they both are pretty useless beyond decorative purposes. Then, Ether is the new platinum.

One option is a safety deposit box at a bank.

approx Fr 100 p.a., so if you have a NW of 1M and 5% gold then 0.2% p.a.

Anybody invest in a good safe for home? That may be an option if one owns a house.

Ok, call me a boomer ![]() (even though I’m not).

(even though I’m not).

Different strokes for different folks ![]()

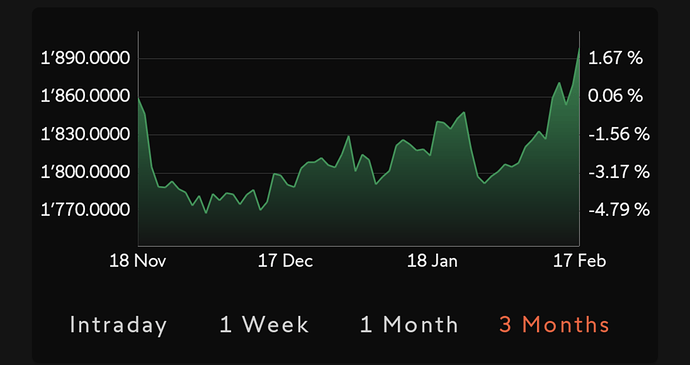

seems gold reacts more directly to imminent wars than bitcoin.

my problem with bitcoin (aside from not understanding it) is its more-or-less completely random ups and downs.

“The vast majority of palladium, more than 80%, is used in these devices that turn toxic gases, such as carbon monoxide, and nitrogen dioxide, into less harmful nitrogen, carbon dioxide, and water vapour.”

If the demise of legacy car manufacturers really is nigh (see “that other thread”), doesn’t sound like a rosey future for Pd. It even gets recycled from the catalytic converters of used cars, so once more ICE cars get trashed than come on to the market, demand for fresh Pd may get killed.

There are tons of other applications.

Nice thing about platinum and palladium is that they are scarce, precious (high price per weight), used to make juwelry and also in industry. Copper is also very useful, for example, but you not gonna keep 5 tons of copper at home.

Having said this, I note that I am not investing in any metals and commodities in general and don’t have intentions to do it next 10-15 years.

What does MOAR mean?

e.g. “When the amount of material provided that is relevant to the end-users interest is insufficient to meat their personal requirements”

I found it very interesting that the efficient frontier with high gains but also much lower pain is achieved with portfolios with significant amount of Gold (but not too much, i.e. 60% allocation is terrible but 20% is pretty awesome?) and small caps. And that it has much better returns than the 60-40 or even the 80+ stock people consider long term appropriate.

I wouldn’t say it’s useless. Gold is very very important, but since it’s super easy to spread thin, we don’t need that much of it.