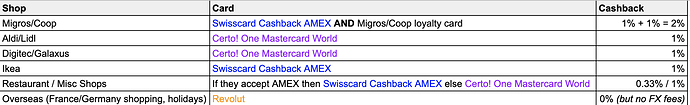

From a pure cashback perspective I see it like this:

Assumptions are that you select Aldi, Lidl, and Digitec/Galaxus as the 3 favourite merchants of the Certo card.

You are free to select others from the below list, however, do not select any which accept American Express (e.g. Migros/Coop/CFF) because then you can just use the Swisscard cashback card.

Migros, Coop, CFF, Zalando, SWISS, Manor, Lidl, Decathlon, Aldi, H&M, Netflix, Spotify, Airbnb, Booking, Microspot, Digitec Galaxus, Ochsner Sport & Shoes, Interdiscount, Denner, Landi.

Some good answers on insurance above which may make other cards more interesting. Personally I prefer to just pay for insurance separately if I find value in it.