I disagree. I give a potential solution. What’s your helpful solution?

Meine Erfahrungen mit VIAC und der Kontoauflösung / My Experiences with VIAC and Closing the Account

Exactly. No matter how you slice it, there’s always a delay. Even if VIAC executed it instantly, and you transferred it same day to your broker. And then you immediately put in a buy order to get back into the market, the market could have still dropped by 5% in that time.

The only way to mitigate is to implement some kind of hedge e.g. buying at the same time the sell takes place (difficult unless you have lots of idle money sitting around or a lot of margin capacity) or you use some derivatives.

For small amounts, it probably isn’t worth it, but if you’re talking multi-millions, it could make sense to hedge.

I agree

This exit question needs to be asked everytime one adds money to the portfolio.

My working assumption is that anytime I add any „new“ money to my equity portfolio, it’s locked in for 7-10 years (min 5 years)

Same is true for keeping any „old“ money in equities to remain invested, same question needs to be asked.

Any money that I would need in next 2-3 years, I don’t put in equity investments. The tricky part is always around 5 years as it falls in the middle.

Would it possible/feasible for the fund provider/manager (VIAC or any other) to “lock in” market values the instant a sell order is sent, and then execute it whenever they do their trading? I guess not because then the provider would end up making a loss or a gain according to the difference instead of the owner of the funds?

Don’t enter Share positions in one go but spread investments over time. Even if you invest every single penny the moment you get hold of it (aka you lump-sum that penny)… over your investment live you have spread all your investments…

And in reverse, do exactly the same. Don’t take shares off the plate in one go but distribute the dis-investment process over a few years. If you can’t dis-invest over a few years because you need the cash in a certain point in time and that point in time was closer than 4-5 years; you should have not had invested the funds in the first hand.

My conclusion is: The OP should have not had invested but stayed with a cash account. The question is if VIAC did its job in educating the investor what they were getting themselves into or not. Legally - they have for sure but morally, I am not so sure…

Might as well use an ETF and real time trading.

(btw wouldn’t be surprised if 3a providers don’t provide “realtime” trading to not encourage things like day trading which might make FINMA unhappy if you’re perceived as nudging towards speculation rather than investing)

I know. You read my post out of context. It was a reply to the post one post above mine who said that selling manual would cost more for viac (fees) than the unfortunate taiming in this case.

7 posts were merged into an existing topic: 3a solution from Finpension [2024]

By the way. We should also be a bit empathetic towards OP. It’s normal to feel bad when one gets impacted by bad timing and perhaps not exactly knowing how the back end process works (rebalancing, trade order for funds, etc).

While we make suggestions, we should be a bit kind. It can happen to anyone

Haha, empathy in a FIRE forum, nice one ![]()

My point is that the work implementing this realtime hedging is higher than the cost of switching to ETF where you’ll get the property natively. (It’s basically the cost of real time trading, plus all the hedging stuff, where some hedges might be non trivial since the future/options markets might not be 100% similar to what is in the funds).

If you’re good at doing that, I think you’re onto being the next Jane Street and can make a ton more money than being a 3a provider ![]()

You are right, having over 50 answers within a day all saying it’s your own fault isn’t helpful. Maybe some geteiltes Leid ist halbes Leid helps? I had (temporarily) lost nearly 200k in unrealized gains on August 2nd and 5th alone. It sucks, but you have to look at it long-term. And while not great, she still had a return that was adequate and within expectations over her five year investment period for a 20% equity allocation, and she definitely still did better than by just having it cash on an account only.

I disagree, and think you are taking an extremely hard stance on FP here. I very much support their solutions, and it needs someone to push the boundaries of what is legally possible to see a positive development on the market in general (e.g. VIAC had a tremendous positive effect on pillar 3 investment solutions in CH). And having served on multiple pension fund supervisery boards, I can you tell you two things:

(1) The supervision of pension funds is generally taken very seriously, not just by the relevant authority but also by the third party expert and your auditor.

(2) The law, supported by court rulings, still leaves you with a very decent amount of freedom to act. And it does so, exactly because you are a wealth manager, and not a simple broker. You can absolutely allow a certain share of the fund, or even all, to violate the recommended BVV2 investment principles and policies.

The opportunity cost of being in cash would lose out far more than the loss of on the few days of volatility. This is throwing the baby out with the bathwater!

Stock markets have been up around 100% in the last 5 years. My view is either live with the volatility or use hedges to reduce that last bit of risk. I think that makes more sense than staying in cash.

What can they do?

Unlucky but that can happen. I went from +25% mid July to +5% early September. And now back to +17% (all YTD).

I guess if trading is every Tuesday, tell them to sell on Friday, or call them Monday and ask if closing on a Monday that means it will be sold next day. Unless much happens overnight, you have more safety that what you get is what you are looking at on Monday.

Personally, I would always recommend converting equities to cash well ahead of withdrawing assets from the pillar 3a – at least if you need to be able to count on a specific amount.

It is very normal for equities to fluctuate by a couple percentage points, even on a daily basis. By withdrawing early, at least you know the actual amount of money you have ahead of the withdrawal, and can plan accordingly.

Viac processes the order once a week (each Tuesday). When you make a withdrawal, there is also the time required to process the withdrawal. A lot can happen in the stock market in the meantime.

Converting to cash will still have the risk that the market goes down between the time of ordering the sale and the sale being executed. And it sounds more like OP was angry at the drop, not necessarily that they desperately needed that 2k.

Convert to cash gradually. 4-6 months before you need the money, convert 25%, then a month or two later another 25% and so on.

You’ll might still hit a down day, but hitting one on 4 different days is very unlikely.

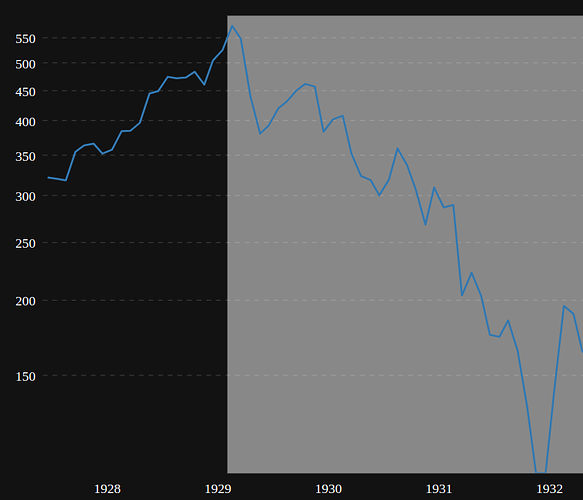

In a bear market, it will go down further on each purchase. e.g. if you spread your sales between 1929 and 1932. While you are invested to the stock market, there’s no escaping the potential for losses.

I think you picked the most extreme downturn in the history of the stock market …

What a long thread.

Let’s make a summary:

OP is upset for the weak reasponse.

Viac might help by just having a warning and a javascript that warns that the next trading day is X days from when the person decides to close. “Problem” solved.

Even the solution “go full cash first” has the same problem, you need to do it the evening before a trading day (if you agree with the prices).

End of thread.

![]()