Mechanical Strategy Execution for Softies

I’ll sneak this update into this topic fully aware of risking @cubanpete_the_swiss unfriending me. Maybe I should have delayed posting until Thursday when he’s on his flight to Spain …

The harsh reality is that he never friended me anyway. ![]() [$]

[$]

TL;DR: Exchanged about $120 of (yearly) income from Broadcom into about $760 of (yearly) income from Edison International, Ingredion, Keurig Dr Pepper and Pepsico.

Net: +$640 of yearly income.

Cutting the Flowers (Selling Your Winners)

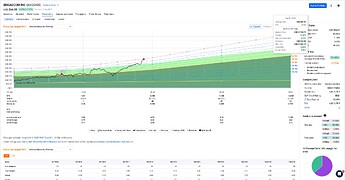

Sold some more of my AVGO position. Just love the smell when the sell tranche (again) exceeds the buy price of the entire initial position.

Subsequently lost $118.18 of annual income.

This income grew at a Compound Dividend Growth Rate of 12.80% over the past 5 years.

Reason for selling: the invested sum in Broadcom only generates 0.66% in dividends and the expected (mostly capital gain) return over the next couple of years – assuming the PE multiple does not fall below the fair value of 33.5 (given their current earnings rate growth of 33.5%) – is sub-par.

Of course, if they continue to be valued at 56xP/E I’ll have forgone quite some capital gains.

Ah, well, I’ll wipe the tears off my face with the dollar bills from the dividends gained from my substitute investments.

Watering the Weeds (Holding Your Losers – Or Even Adding to Them!)

With the profits from the AVGO sale I bought some more EIX, PEP, INGR and KDP.

Subsequently I’ll get an additional $758.5 of annual income.

-

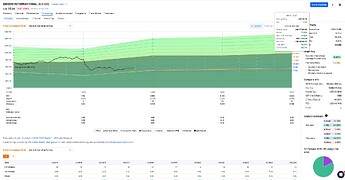

The income for EIX[EIX] grew at a Compound Dividend Growth Rate of -1.12% over the past 5 years and 4.09% over the past 20 years.

Reasons for buying: undervalued, nice earnings yield[Earnings Yield] of 10.28% -

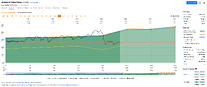

The income for PEP grew at a Compound Dividend Growth Rate of 7.29% over the past 5 years and 9.61% over the past 20 years.

Reasons for buying: undervalued versus its “normal” multiple (if it goes to the fair multipe of just 15xP/E I won’t make capital gain money on this, so a little speculative), acceptable dividend yield, strong brand (but some management issues, apparently).

Somewhat weak conviction, hence smaller position sizing. -

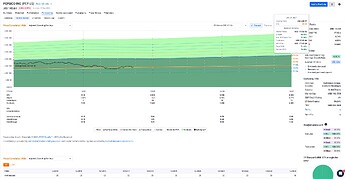

The income for KDP grew at a Compound Dividend Growth Rate of 9.89% over the past 5 years and 27.04% over the past 15 years.

See the stockpicking topic for more details, e.g. starting here: Any Stockpickers out there? - #1015 by Your_Full_Name -

The income for INGR grew at a Compound Dividend Growth Rate of 5.55% over the past 5 years and 13.72% over the past 20 years.

Reasons for buying: undervalued, nice earnings yield[Earnings Yield] of 9%.

Additional Notes

Abbvie, Cummins, Cisco, Lowe, Tanger and Simon Properties also made the sell candidate list but didn’t feel as richly valued as Broadcom.

Met Life, Bank OZK and Sun Life made the buy candidate list, but since they’re all financials, and I already have a bunch of those, I decided to pass.

Eversource, Magna and Smucker also made the buy candidate list, but for various reasons did not make the cut (full position, unsure prospects, etc).

$ Just going for maximum forum drama to attract clicks. Otherwise just 100% joking. Sorry. ![]()

[EIX] Edison International cut their dividend in 2024 as a result of their fun role in the L.A. wildfires earlier this year.

Long term they seem committed to growing their dividend.

It’s a risky trade.

[Earnings Yield] aka EPS Yield Also called “owner’s yield”: if you bought the entire company at its current price, this is how much you would expect to earn every year going forward on the price you paid just now.