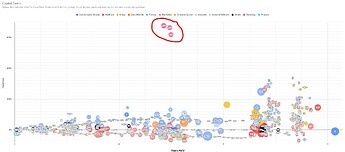

Yeah, same for my dividend growth portfolio: it’s a total outlier that started as a dividend growth play but became a capital gain thing like nothing else, really (at least for my portfolio).

I only have soft rules:

- dividend yield drops below 2%: company goes on (sell) watch list

- position size grows above 5%: company goes on (sell) watch list

- other attractive (according to a separate list of soft rules) companies move into buy territory: sell some of the companies matching the above criteria, buy some of the new “attractive” ones

I’m able to follow them, mostly. ![]()

Whenever the tax man shows up, Cuban Pete puts on his green mask. He in fact included an accurate film documentary excerpt about a showdown between him and the tax office in his introductory post: Allow me to introduce myself: they call me cubanpete