Do they have to beat the fundamentals, or do you think an uncorrelated stream of returns would be beneficial to your portfolio Sharpe in it’s own right?

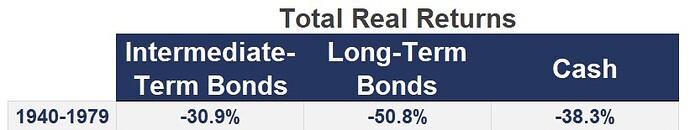

I’m not comparing trend to equity, but to bonds, because I need to lower portfolio risk before FIRE (lower my equity beta to reduce sequence risk in retirement). Bonds can have like 40 years of negative real returns. Can trend too?

BTW, here’s some further food for thought. Let me know what you think of it if you got some time. It’s written by a trend shop, so beware ![]() TSMOM’s the buzzword, you might want to run a regression

TSMOM’s the buzzword, you might want to run a regression