Yeah, and today everyone is buying Commodore Stocks for 60k each pretty sure that they’ll reach 1M soon (and then 10M from there, else who the fuck would buy Commodore Stock at 1M?)

Interesting debate… even if I doubt anyone can be “right” as it’s only guessing…

My 2 cents : “long term” should not be placed before (or after) the term “cryptos”. No one knows what it will become long term. No one. And “cryptos” should not be put in the same bag as “blockchain”. The understanding of the difference is important here.

If you consider just in terms of financial “investement”, crypto is the same as selling shoes, stocks, forex, gambling… then all the discussions can be interessting.

If you consider about the futur, will it replace money, is it a bust, is meme coin and kitties NFT are the next things for the next millienial… then you can stop thinking too much about it, it’s just close to impossible to predict.

What blockchain (and crypto) are today imo: compare to Internet, two nerds used Arpa-net to send a message from on side of the state to the other. Then a third guy came in. And another one. And they called it Internet. And they start thinking about how it will change the world to be able to send those “electronic mails” in the future. That’s it. That’s what blockchain and cryptos are today, in terms of maturation.

The difference is that we have internet and more brains available. And a lot more money incentive. But the guys from Arpanet could not have predict a Netflix or Amazon, or even HTML 5 and the end of Flashplayer and eMule… Same no one can predict how the blockchain will impact our lives, what techno/brand/concept is here to stay or to disapear in flames. Just live the moment, observe, educate yourself, stay away from the tons of buzz content, be smart.

TLDR; don’t think “long term” with crypto. Ride the wave, take profit, and stay sharp.

I’m a crypto noob but I’m really interested in protocols. From that point of view I think bitcoin is quite cool, I also love the fact you can just go on github and see the source code.

However I can’t gloss over the fact that a lot of energy is consumed calculating hashes for “nothing”. In the current era we live in, where we start to talk about climate change it seems wasteful to keep going in this direction. I really believe we should be thinking into improving this because it is probably possible, that’s why I’m not entirely sure bitcoin, as it exists now, will be here in 20 years. Probably not or if it is it will have changed a lot.

At the EPFL a lab is exploring some other ways of doing this for example : DCL – Distributed Computing Laboratory - I honestly don’t know if it holds any merit but I think it goes in the right direction.

Software is bound to evolve and bitcoin is not different than others on this.

If you are interested in protocols, continue to explore how the bitcoin blockchain protects itself against double spending or how the mining difficulty is constantly adjusting. You will see, it is not for nothing. Actually, it allows for over $50b in exchange everyday without the involvement of a government, a bank or a third party. Not bad!

I apparently failed to convey the tone of my first few line. Don’t take these too seriously, it was just some stupid meme jokes in reaction to the tone of your article. I genuinely thought you used this tone on purpose in a theatrical and humoristic way as I’ve found it SO over the top. But no, it looks like you’re just really fucking mad at Bitcoin.

Rest assured, I’m not a crypto fanatic. I probably won’t be wandering in a mustachian forum if that was the case nor would I have said that you made valid points in you article.

Of course BTC is far from being perfect and yes, its energy consumption is one of its most blatant flaws.

But it looks to me that you see Bitcoin as something that is in a fixed state; a finished product in some sort. But it isn’t. It keeps on being updated small step by small step.

Regarding its energy consumption I think it will eventually come to a point where it will be forced to evolve or die. The evolution could either come endogenously by a change of its consensus mechanism or exogenously by political forces that would fight the use of non renewable energy by mining farms for instance - or even a straight ban. Its futur is uncertain but it will eventually get the chances to try to surpass them. Will it succeed? Nobody knows.

But maybe all of this is not important to you because from the beginning you just don’t get the point of a system like Bitcoin. Which would explain your urge to throw it in the trash can.

Hi,

Concerning your blog post, these absolute terms

Everybody is “investing” in crypto because they want their money to 2-10x in the short term.

Everybody is just betting, looking for a greater fool.

Full stop.

are rather antagonizing and not helping the debate unfortunately.

I have been around this technology since 2011 and not looking for a greater fool for as many years. It reminds me of this meme we (early enthusiasts) used:

It was not the intention to make money off others but to get everyone on board.

Now, I have moved from one blockchain to another over time, got a tad disgusted by a number of people, but still believe that it is bringing something to the table of society.

I understand that you were having a bit of fun, which I understand and actually enjoyed. Just be careful not to box your own mind while trying to put others’ in boxes. ![]()

There is much to say about the rest of the blog post, but I won’t have time in the coming weeks to address it.

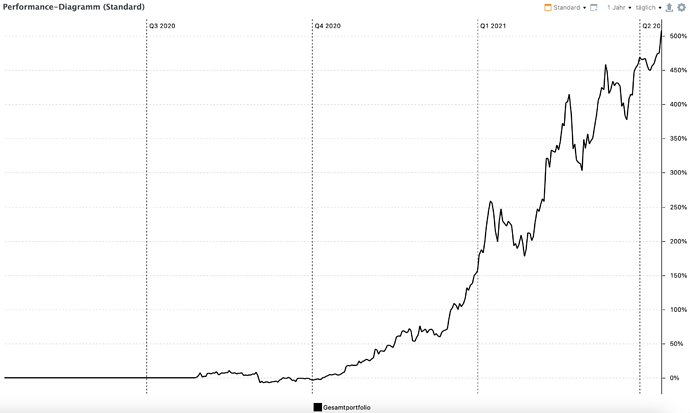

Very good forecast. I am impressed.

What’s your next move! Sell now and hope there is a dip to buy even more before the next ATH at 3’000? Or will you stay invested?

I dont HODL but trade with pitchfork and trade between those lines. So here I sold 50% and wait if there is support 2300-2330, then it would go further up. The bottom line support is around 2250. Once this breaks it will go further down to the next line.

i have to say i am really pleased with my portfolio (45% eth, 50% btc, 5% polkadot) performance.

overall 2-3% of my total nw. added recently to the eth portion (to give it the same weight as btc). i am bullish for this year but plan to fully liquidate the portfolio in late q4.

That is a lot of technical stuff ![]() I agree there is probably a lot of optimization by trading cryptos in a more active way than simply holding. How to you call this strategy… Is it some kind of technical analysis analoguous to stock market? Do you have any resources/documentations that you would recommend?

I agree there is probably a lot of optimization by trading cryptos in a more active way than simply holding. How to you call this strategy… Is it some kind of technical analysis analoguous to stock market? Do you have any resources/documentations that you would recommend?

I am thinking about learning it, because holding is good in this bullish times, but I’d like to be ready when it turns bearish.

Polkadot worked very well for me too. And I am staking it with 12% annualized returns on top!

yes - i do the same. really nice extra benefit

Neat!

I am currently just HODLing a simple mix of BTC and ETH (long term, roughly 70:30 atm), and only due to your chart also noticed a similar 5x (edit: yes, your 500% is actually 6x!) since last Sept.

Nearing my 5% threshold though, I might let it fly over for the moment.

Why full liquidation? You could also DCA selling small chunks just in case it keeps growing so this way you secure some benefits while enjoying the eventual run.

i want to buy some real estate next year – so i enjoy this bull market year and then liquidate all my holdings. pretty sure they will be another bear market … i will probaby slowly dca into that one.

Excellent call, you will see how this will push (already started).

Have there TP even to 71 with DOT USDT.

The pitchfork is used in bullish (long) and bearish (short) times. It is just a change of mindset to trade the shorts.

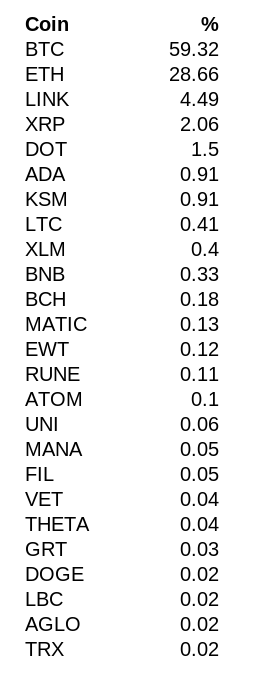

I’m bullish on LINK and - yes - XRP.

My holdings:

After a pump of a coin against BTC, I usually put 60% to 90% of that coin in BTC or ETH.

I don’t think that you’ve educated yourself sufficiently on the economic impact of Bitcoin.