Wait, are taxes usually revised for inflation and, when so, is it really toward the downside?

In ZH both deductions and tax brackets are adjusted for inflation every two years. However, due to a bit of deflation between 2011 and 2021, it has been skipped since 2012. I expect an adjustment at some point this year, which will then take effect for the years 2024 and 2025.

An adjustment has already been made for the federal taxes for 2023.

On the topic of Geneva taxation - its my first year filing taxes in this canton and was wondering how people do the DA-1 here.

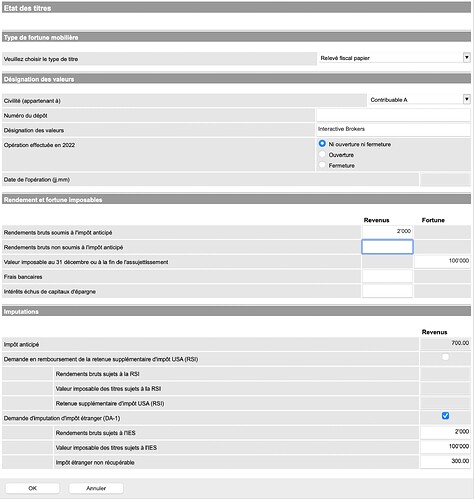

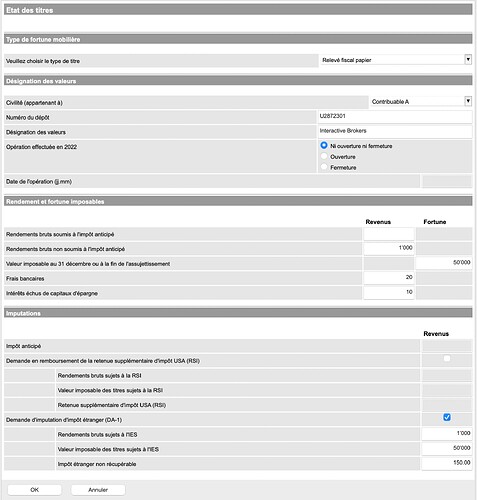

Can you do the entire brokerage statement in 1 go with the “Relevé fiscal papier” category like in the screenshot below? Not sure how to get it to just take 15% US wht and not the 35% swiss default.

In my case I declare my US shares individually with all the purchases and the software calculate the wht amount correctly.

Think I figured it out, summarising below:

- Under Etat des titres choose Relevé fiscal papier to do your whole brokerage paper statement in 1 go.

- Fill in your brokerage details (name, account number)

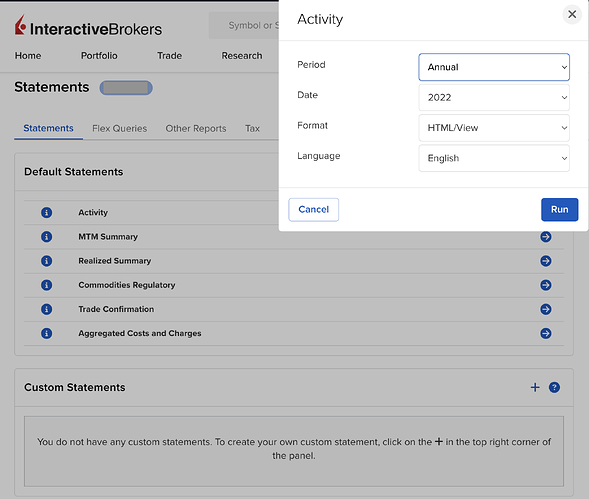

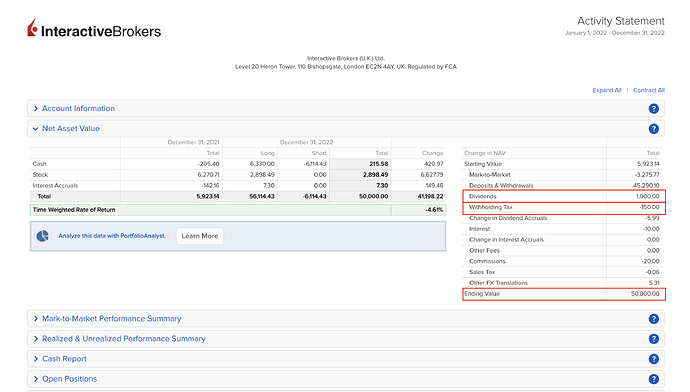

- Put your dividend income for the year and portfolio value on 31st december in the taxable returns/wealth section. You can very easily find those numbers by generating an activity statement on Interactive Brokers for the previous year. You can also deduct any fees/interest accrued which the statement will display. Important: put the dividend income as not subject (non soumis) to withholding tax. If you put it as subject to then it will assume swiss stocks at 35% which is not the case.

- In order to reclaim the 15% from us domicile (or any other country depending on your portfolio/broker) tick the Demande imputation d’impôts étrangers (DA-1) form at the bottom. Again, put in the total dividend return for the year, the portfolio value, and then the withholding tax amount. For me all my dividend paying investments were US domiciled so all applied 15%. It might vary for you, best to again copy directly from the activity statement from interactive brokers.

Example screenshots (note: fake account number / values, just for demonstration purposes).

To generate the statement on Interactive Brokers:

Key lines from statement:

Hope this helps someone ![]()

It will be interesting to know if they accept your declaration as it is and refund the wht.

They rejected it for me last year and could not make them change their point of view.

What reason did they give you for rejecting your declaration?

I had the DA-1 rejected in the canton of Vaud in the past because I was also claiming interest payments on debt. But with that debt paid off I got it refunded in future years.

You can find more information in this thread. Basically the tax specialist believed that I couldn’t reclaim DA-1 on etfs but only on US shares.

I wrote them a letter with the full explanation but they never acknowledged it nor got back to me. It was for 150 usd of wth so I gave up.

I will give an update this year and if it is still the same I will phone them again and wrote to them electronically.

Very odd. Well I know many who have successfully reclaimed in Geneva so seems you got unlucky with someone clueless in the tax office. Will see how mine goes this year ![]()

At the last cantonal elections in Geneva, politicians who got the majority made a promise to reduce the income tax for individuals. To date, I have not seen any anouncement from authorities regarding any potential reduction for the taxation of 2023 revenues. In Vaud authorities made the same promise and they votes for it! Come on Madam Fontanet!

Despite the announcements of politicians from the right-wing coalition which won the elections in 2023, no reduction in personal taxation has taken place! Furthermore, I note that the income tax scales have been revalued by 1.7% since 2021, or 0.85% per year, well below the level of inflation. This insufficient revaluation of the scale is therefore a loss of purchasing power for all of us. Thank you to the political authorities of the canton for keeping their promises.

Sorry, what inflation has to do with income tax scale and the purchasing power? The way you formulate it, you pay lower tax for the same inflation-adjusted income.

I think that it is illusional that you will pay less taxes in Geneva. The Canton is putting a shit lot of money for public infrastructure and need money for that. Moreover, 40% of the population don’t pay taxes in Geneva and only 1% of them pay like 80% of all the “income” of the Canton, so… It will raise again and again ![]()

Wow that’s a really uneven distribution… But i realised i have no idea how it looks elsewhere. Where did you get that statistic, i would be very interested to see the numbers for Zürich

To stay on the same topic

Prestentation given by Nathalie Fontanet last November in Bern. Interesting statistics in relation with “taxes” in Geneva

Thanks for the presentation!

It would be interesting to know how many of the 36% of the contributors that don’t pay taxes work for the UN.

And how much this practice of not having to pay taxes is hurting the Canton of Geneva

Hi, while not identical to the traditional income tax levied on individuals, United Nations staff are subject to a similar withholding mechanism known as “staff assessment”. This deduction typically amounts to 20-30% of their gross salary depending on their duty station.

« Staff assessment deductions are credited to the Tax Equalization Fund. Those Member States that do not impose income tax on United Nations earnings receive a portion of the Tax Equalization Fund as an offset against their assessments for the United Nations regular budget, peacekeeping and tribunal budgets ».

Source: Frequently asked questions | Income Tax Unit

I would be curious to know whether anything is remitted to the canton of Geneva by Switzerland.

I may be wrong but I don’t think UN are included in the figures: 36% refers to tax payers who do not pay any income tax because their income is too low. UN employees are not liable to tax and come on top.

It seems that the document you linked refers to UN personnel in the United States.

In ungeneva.org I’ve found this document stating (section 15b) that

“Officials [of the United Nations] shall be exempt from taxation on the salaries and emoluments paid to the by the United Nations”

Also on cern.ch (link) it is stated that

The members of the personnel are exempt from federal, cantonal and communal taxation on financial and family benefits paid by CERN

So yeah, it seems that all this “international organizations” people have a very favorable taxation (in some cases are not even taxed) while they enjoy a clean city, public transportation, schools, libraries, parks and all kinds of services.

Services paid by working people taxed at 30-40%…

But remember, from Section 17 (same document as above):

Privileges and immunities are granted to officials in the interest of the

United Nations and not for the personal benefit of the individuals themselves.

Mmm sure!

The staff assessment (20-30% of the gross salary) is deducted from your pay if you are working for the UN in Geneva, it’s not only the case in the US. Then, they do not pay income tax in Switzerland, you are correct.

And it’s probably still favorable, I agree with you.

But it’s necessary to correct the point you made that implies that UN staff do not contribute to the society due to an absence of withholding tax. It’s not the case.