I’d like to have your views regarding the level of income tax in canton of Geneva especially for single people, a topic that does not seem to impact so much Geneva in terms of reputation despite its high-level income taxation (around 25-30% higher than canton of Zurich).

Geneva tax authorities rejected my request to deduct a portion of my rent because of home office arguing that teleworking due to Covid19 is not durable…

Same here. Although it was clearly stated in the tax guidance how to deduct for teleworking, I was very surprised by their rejection. I did not challenge it further though. Not sure if anyone managed to convince them?

I was not surprised because this cost deduction would have had too much impacted on tax revenues. Therefore, they issued this guidance in March by opportunity to avoid an adverse effect on the level of income tax collected. They even issued another guidance to inform that deductions for meal and transportation would not be considered for teleworkers, which in a way makes sense but all in all result in higher income tax collected! But most importantly, I would emphasize the huge gap in terms of income tax burden between french speaking cantons and others: for a single person, the difference of annual income tax between Geneva and Zurich is around 25-30% ! Because Geneva spends too much and for no additional value on tax payers… The level of income tax in Geneva is more or less similar with France…and not many people know that.

Ouch. Do you have a dedicated room not used for any other purposes and did you state that and did you provide a copy of your rental contract? As I understood from the circular they sent out that was the condition.

If they didn’t allow that, did they allow deductions for meals at work and travel costs?

Yes I had a separate room and attached also the rent contract. In their explanation back, they told it was basically not “sustained” way of working, they do not accept the home working only for “covid purposes” but it should have been a sustained change of ways of working. Makes no sense but I felt like they will only accept for workers without offices.

Anyway, they added back the transport and meals at work instead. So, still slightly worse off, but if they do not accept there is not much I can do, and at least they treat you fair by adding back the meals.

They reproduced the same statement that home office because of Covid19 is not sustainable and cannot be accepted (I provided the rent contract also). They only allowed the CHF 1,697 deductions for professional costs. I can hardly claim travel/meals costs since I only went to the office for 2 months and half in 2020.

Anyone can use this tax calculator to realize the huge gap between cantons, including Geneva vs Zurich:

https://www.ubs.com/ch/en/private/pension/calculators/tax-calculator.html

That’s bad news. Below is the circular published on their website and reading it again I realise they aren’t going to allow any deductions for C19 home office.

The example they gave me before the pandemic of when they would allow a deduction for home office was if you are sewing or knitting using a room in your house and your employer doesn’t provide you another place to work.

In my case I work outside the canton and have to sleep over as >8 hours return journey. The only way it works with the family is wfh a couple of days per week, I have a dedicated, permanent office at home and they don’t allow me to deduct the cost. I should really move to another canton…

" J’ai dû télétravailler durant la période de la pandémie de COVID-19, que puis-je déduire?

Sous l’angle fiscal, le télétravail se définit comme l’occupation durable d’une pièce uniquement dédiée à l’activité professionnelle lorsqu’aucune place de travail n’est mise à disposition par l’employeur pour l’exercice de l’activité de son employé.

Dans le contexte spécifique du COVID-19, le télétravail rendu nécessaire en raison de la pandémie n’est pas considéré comme une activité durable. "

If you decide to move to another canton, I would strongly recommend you ensure all requirements are met to transfer your fiscal residence, because Geneva tax authorities do not easily let generous tax payers move to another canton and they will do their best to consider that your fiscal residence remains in Geneva…their leeway to interpret the important concept of fiscal residence in their favor is important…

My kids go to school so changing canton would involve uprooting them and starting a new social life elswehere. So they have me trapped just like the UDCs famous milking cow!

Life is good, but sometimes it feels we are progressively adding disincentives for me to continue what I am doing. My alternative is to claim chômage (which I don’t like) / retire early / move, in any of these scenarios I am no longer a net contributor to GE taxes

Income taxes are eye wateringly high in Geneva (despite the outward perception of Switzerland being light touch on taxes), but if your company has some sort of scheme to pay you in shares and there is a lot of capital growth, it can work out well as there is 0% CGT. Everyone’s situation is different and it will depend on the structure of your pay package, but I was definitely a lot better off in the aggregate with a cost of living increase and 0% CGT compared to living in London. Most of my colleagues felt similarly.

I believe CGT for non professional investors is the same through CH = 0. Geneva did have a favourable treatment of stock options versus some other Romand cantons on the past, not sure that it is still the case though

Just checked and my bonus is taxed at ~46% in Geneva vs ~29% in Zug. (marginal ICC+IFD+Social deductions).

And would save like CHF15k on base income taxes and have cheaper rent + more modern housing… Is Zug the promised land?

I think Geneva does have higher childcare contributions but being a single earner with no kids seems to be pricey here.

Well for a single earner like myself Vaud is not far off either. And let’s not forget about the impact of wealth tax. I calculated the taxes delta at some point with Zoug and the difference was also well above 10k for me. But I speak good French and kaum German… in terms of integration I would have a hard time leaving the region.

Le Temps newspaper has released an interesting article about how public funds are spoilt with associations like Bains des Paquis…with repercussions on tax payers and level of income tax in Geneva…

Les Bains des Pâquis et Genève-Plage font perdre une fortune aux Genevois

Les revenus des activités commerciales devraient permettre de baisser les subventions des lieux de villégiature au bord de l’eau, a déterminé la Cour des comptes

[

La buvette des Bains des Pâquis n’a jamais fait l’objet d’aucun appel d’offres, regrette notamment la Cour des comptes. — © Martin Ruetschi/Keystone

La gestion de la buvette des Bains des Pâquis, ainsi que celle des Voiles, à Genève-Plage, coûte cher aux contribuables genevois. Les loyers encaissés pour ces deux activités commerciales déployées par des privés sont très en dessous des normes. La loi prévoit pourtant que le subventionné doit tirer pleinement parti de ses propres ressources financières. Ce principe n’est respecté dans aucun des deux cas. En clair: le manque à gagner est comblé par les subventions, donc les impôts. Une meilleure gestion, recommandée par l’auditeur, doit permettre de baisser ces dernières en proportion de ce que rapportent ces deux lieux de villégiature.

La Cour des comptes est parvenue à cette conclusion au terme d’une enquête menée à la suite de communications citoyennes. Elle s’est concentrée sur ces deux lieux car une même logique y est à l’œuvre. Les Bains des Pâquis et Genève-Plage sont subventionnés respectivement par la ville de Genève et le canton. Chaque plage sous-traite une activité commerciale à un privé. Rive droite, la buvette est gérée par une Sàrl alors que rive gauche, un espace autrefois dévolu au basket a été transformé en une zone bar-restauration-animation appelée Les Voiles et confiée à une société externe depuis 2013. C’est dans cette relation entre subventionné et prestataire privé que l’auditeur a trouvé des dysfonctionnements qu’il a présentés à la presse, de même que dans la surveillance du canton et de la ville.

Massages offerts aux employés

Les Bains des Pâquis ont l’image d’un rendez-vous hors du temps où les plats du jour sont bon marché et le soleil généreux. Le rapport de la Cour des comptes nous apprend qu’un autre type de générosité a cours dans les bassins sauvés de la destruction par un vote populaire en 1988. La politique salariale des employés de la buvette bat des records. Certains salaires, dirigeants compris, sont deux fois plus élevés que les standards observés dans la profession. Le responsable de la buvette se défend en insistant sur le rôle social que l’institution jouerait. Comme dans la banque, des bonus sont versés. Et «pour motiver le personnel», a détaillé le responsable à la Cour des comptes, des prestations en nature leur sont octroyées: des massages (pour 61 000 francs en 2017) et des consommations gratuites (98 000 francs en 2019). Tout cela alors que le loyer versé par la buvette à l’association qui gère les Bains (AUBP) est fixé à 187 500 francs. Il n’a pas bougé depuis 2010 et représente en moyenne 2,7% du chiffre d’affaires, très en dessous des moyennes observées ailleurs, qui varient entre 5% et 12%. Ce loyer mis en place en 2010 a remplacé un système fluctuant qui était beaucoup moins avantageux pour la buvette.

Autre anomalie: le ratio entre l’achat de denrées et le chiffre d’affaires est de 47%. Là aussi, la profession fait en moyenne bien mieux. C’est que, selon le responsable de la buvette, un accent est mis sur les produits genevois et bios.

Pas de moyen de paiement électronique à cause du microclimat

Enfin, l’obligation faite aux consommateurs de payer en cash et l’absence de caisse enregistreuse digne de ce nom représentent un double problème. La masse de cash expose la buvette à des risques de vol et le manque de traçabilité des paiements rend tout contrôle difficile. Un audit du contrôle financier de la ville de Genève avait soulevé ce même problème en 2009 déjà. Le Conseil administratif avait fait un rappel en 2018. Rien n’a bougé. Le responsable de la buvette a répondu à la Cour des comptes que le microclimat des Pâquis et le taux d’humidité empêchent d’installer des moyens de paiement modernes.

La gestion de cette buvette n’a jamais fait l’objet d’appel d’offres ni d’aucune mise en concurrence. Peut-être parce qu’elle est dirigée par un des fondateurs de l’association qui gère les Bains depuis le sauvetage de 1988? En 2019, le chiffre d’affaires de la buvette a été de 8 millions de francs. Sur la période 2015-2019, il a connu une hausse de 37%.

Christina Kitsos, magistrate chargée du département de tutelle des Bains, a annoncé sa volonté d’aligner le loyer de la buvette sur le barème moyen appliqué en ville de Genève, soit 7,5% du chiffre d’affaires. De la sorte, c’est la totalité de la subvention qui serait économisée, soit 1,2 million sur la durée. Mieux: l’AUBP disposerait de plus de moyens qu’aujourd’hui pour mener ses activités. L’élue socialiste n’avait pas renouvelé la convention entre la ville et l’AUBP en 2020. Elle a dit vouloir implémenter les recommandations de la Cour rapidement: «Il n’y a pas d’autre chemin possible.» Mais à la question de savoir si elle veut le faire avec les personnes en place, elle répond qu’il est «exclu que l’on tue ce qui a été construit aux Pâquis en y introduisant des personnes dont la seule motivation est de faire de l’argent».

Le gagnant proposait trois fois moins d’argent

A Genève-Plage, la création des Voiles date de 2013. Le loyer était de 75 000 francs par an. Si le chiffre d’affaires dépassait 3 millions de francs, 15 000 francs supplémentaires étaient versés. Pour 2020, saison finalement victime du covid, un système d’appel d’offres avait été mis en place à la demande du magistrat de tutelle, Thierry Apothéloz, et le loyer devait doubler. Des dysfonctionnements ont été mis au jour par la Cour des comptes dans ce cadre. Le comité de sélection s’est en effet fixé des règles qu’il n’a pas respectées: il a choisi un dossier, celui de l’ancien exploitant, malgré le fait qu’il n’était pas celui qui devait rapporter le plus à l’association Genève-Plage, but avoué de la création de cet espace de détente. Son offre devait rapporter trois fois moins que celle du dossier arrivé en tête.

Dans le cadre de ses recherches, l’auditeur a dénoncé des faits potentiellement répréhensibles au Ministère public concernant Les Voiles. Est-ce en rapport avec ces nuits d’hôtel à l’île Maurice offertes par l’entreprise qui gère Les Voiles au responsable de Genève-Plage?

La Cour des comptes préconise de baisser les subventions des Bains des Pâquis comme celle de Genève-Plage. Un meilleur système de contrôle en interne doit être instauré, de même qu’une surveillance accrue de la part du canton et de la ville, afin que les principes de bonne gestion soient respectés. Toutes ces recommandations (neuf au total) ont été acceptées. Il est à noter que les éléments permettant de surveiller les activités des privés sur territoire subventionné existent dans le cadre des contrats signés avec la ville. Ils n’ont simplement pas été appliqués. Du côté du canton, ils n’existent pas. Le département de tutelle ne pouvait ainsi pas avoir accès aux comptes de la société privée qui gère Les Voiles.

Le canton, par la voix du porte-parole de Thierry Apothéloz, a annoncé sa volonté de baisser la subvention de Genève-Plage de 110 000 francs. «On attend de la bonne foi de la partie subventionnée. Cela n’a pas été respecté dans le cas présent. C’est un regret», a conclu Henri Della Casa.

La mise en œuvre des recommandations permettra de générer des économies annuelles allant jusqu’à 355 000 francs, soit environ 1,7 million sur la durée des contrats liant le canton ou la ville de Genève et les entités subventionnées.

Interesting article, thank you

Subsidies are a hot topic and not only in Geneva.

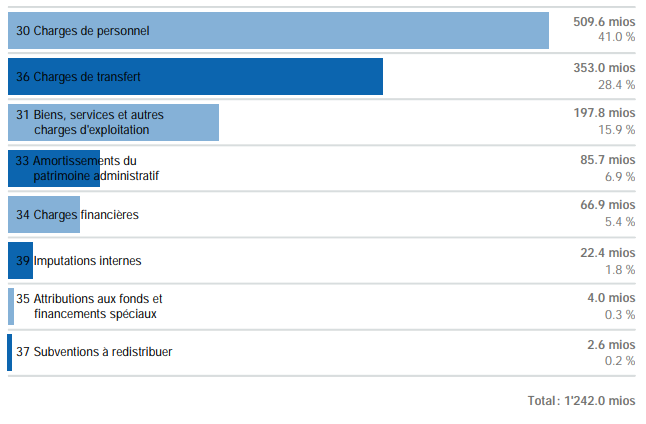

Some figures to put this specific issue into perspective. Ville de Genève budget for 2021 → 1.242 billion

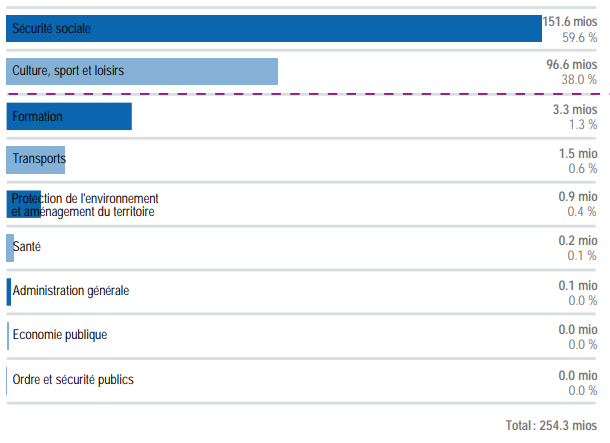

Subsidies are included into “Charges de transfert” for a total of 254 millions

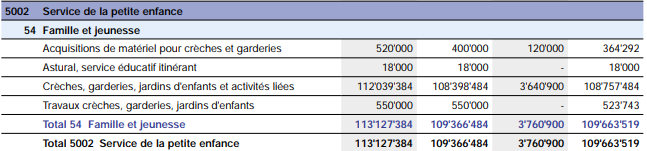

Almost 50% of it is going for child care services (113 mio is only one of many line in the Famille et jeunesse section)

Subsidies are going to hundreds of associations for various reasons.

I’d like to know how they control the good use of funds distributed. Can they control everyone ? probably not. Are they less strict with some associations than others ? probably. Bain des Paquis not accepting cash isn’t new.

You won’t see the subsidy they talk about in this budget, because it is a “a not perceived income”. Basically the rent for the place is too low if you compare it with the rent around it.

(on the other hand, you could argue that the rent around is too high…)

And in my understanding, subsidies of Bain de Paquis would be in position 37 (where it actually says subsidies). Position 36 is social subsidies like child services, old age stuff and others.

That’s not correct.

Both perceived and non perceived income are included in the annual report.

Position 36 includes a lot of subsidies, not only the social ones. cf page 8 for the total with the details on page 15. There is 97 millions for Sports. The Bain des Paquis is included there.

They receive 245 KCHF per year (subvention monétaires p.108), as well as a non monetary subsidy of 105 KCHF (p. 112)

The same figures are shown in the Bain des Paquis 2020 annual report on page 8. https://www.bains-des-paquis.ch/sites/default/files/2021-10/RapportAUBP2020.pdf

Position 37 is not really clear, looks like a charge transfert. It is almost entirely related to the Grand Théâtre de Genève (p.71)

Nice new initiative to increase Geneva wealth tax by +0.5% for the “rich”. Defined as anyone with more than 3M CHF - which would probably capture those who plan to FIRE here (you need at least that much in my pov given the high cost of living)

Q) Does anyone know what “ rendement fictif de la fortune” relates to?