Hello everyone. I am very happy that a colleague recommended me this forum. I’ll be a great help in my current, quite urgent, situation.

I am leaving Switzerland to move to the UK end of October for two years. Not sure if I will come back - I am a researcher, and therefore go where opportunities are!

Despite the contradiction between sustainability/anticapitalism and capital investiment (which still puzzles me), I am forcing myself to think in the long term and especially want to have more control on where my money is and how it is used. For this reasons, in the next weeks I plan to do two things:

-

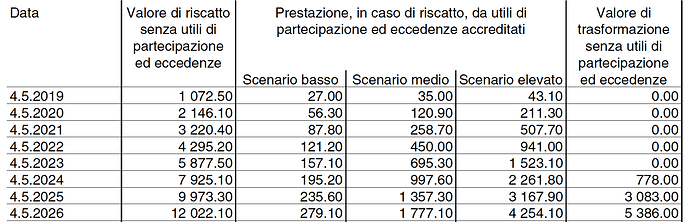

I don’t have to, but want to take out my 3rd pillar which I had mistakenly opened with a life insurance when I arrived in Switzerland in 2017. My insurance allows me to switch from a 3a to a 3b, or take it back. N.B. that I can only get back half of what I’ve put so far, as per contract conditions (about 4900CHF). I have not put too much, so I’d loose approx. 3500CHF.

My first question would be – how? There are several ways from what I understand:

a. transfer it to another 3rd pillar (like VIAC or Inyova), which however would loose the advantages it provides in Switzerland, etc. (therefore the question, does it make sense?)

b. take it back, and invest it with some additional money. (I suppose I’ll pay a tax on it, in this case?) -

Since I am leaving the country, I want to take back my 2nd pillar - instead of storing it into some bank or untransparent place. Again, what makes the most sense?

a. take it and invest it in Inyova (no 2nd pillar anymore)

b. take it and ‘store it’ in the libre passage of VIAC (keeping 2nd pillar)

N.B. What bothers me of VIAC is that it is affiliated with Crédit Suisse, and that the companies that are considered for the ‘sustainable’ investments are often Nestlé and others, which is not the case for Inyova. I’d be more interested in the second, depending on the 2nd pillar strategy you’ll recommend me.

Some background…

I grew up in an environment in which nobody ever discussed about economy and finance, and I’ve studied and conducted research in the past years on topics that were not addressing it directly. Working in the field of sustainability, I’ve always looked with diffidence all what was related to investments. But I did hear several talks of sustainability experts encouraging young generations to use their money wisely. These talks and messages slowly started making more sense to me in the last months.

At the end of my PhD, several things happened simultaneously. The reading of the book The Ministry for the Future, a stimulating discussion with my colleagues on sustainable economy, a documentary on BlackRock, my move to the UK and the letter of my current employer clearly asking me to decide where I wanted to put my pension money, as my contract came to an end.

I am now encouraged to study, inform myself, and understand better. I think this process also involves discussions that I have not engaged in so far, and that I am now willing to.

I am sure I will find help through your experience and knowledge.

Looking forward to your advices!