Hi Mustachians, I wish to benefit from tax deduction 2020 with 3A but am still doing some research about my 3A choice. I will emit the money from UBS via Ebanking, do you think the value date as tomorrow would be enough? or even a value date of 31-12 is enough? (normally I can input the transfer in Ebanking tomorrow 30th for the 31st) Thanks a lot. I have to know if I still have tomorrow 30th Dec to decide or only today 29th Dec or it’s already too late for 2020

Any payment arriving in 2020 should / will probably be good enough.

Would I risk it for a (likely) 4-figure tax savings?

Probably not, if I could avoid it.

Also, we’re talking a maximum contribution of less than 7’000 CHF here. If you want to put it on a simple savings account, there’s 100s of banks - and everyone will have an interest rate close to zero. As for the number of institutions that would and/or in practice could open up a new account before the end of the year, this is diminishing fast.

What more research are you planning to do? Viac, Finpension, frankly all seem reasonable if you want to invest in funds. It’s exactly not rocket science. Most providers with management apps will let you subsequently change your asset allocation anyway, if you don’t like it. Usually “for free” - at transaction cost, that is.

Actually that’s not entirely true.

I have gone to the cantonal tax administration’s office to drop off my request for refund of tax at source (due to 3a contributions) in their mailbox on the very last day of the hand-in deadline. More than on one occasion.

However I won’t recommend this to anyone of state “yeah, you’ll be alright!”.

thanks, I still need to know which company to choose among VIAC, Finpension etc and understand how it works with them. do you mean we can always transfer our 3A money between companies any time in the year as frequently as possible?

I think the main message ist that it’s probably better to handle transfer costs (if any) than to loose the potential tax savings

If anyone is interested tho. FAQ of frankly states the following:

Der letzte Einzahlungstermin für die frankly Säule 3a für das Steuerjahr 2020 ist der 31.12.2020 um 16.30 Uhr. Wir empfehlen dir, die Überweisungen bereits Mitte Dezember vorzunehmen.

Yes, you can move the 3A account in 2021 to the company of your choice.

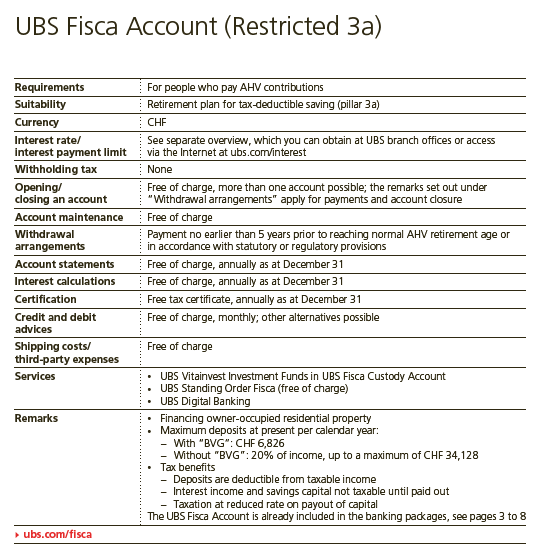

thanks, does anyone know if we could always transfer our 3A account from UBS to Viac/Finpension etc during the year and what is the cost? I checked the UBS website and find so it seems it is free? but there are so many tricks with banks/insurance companies so I am not sure.

Transfering UBS 3a accounts is free.

thanks Cortana, we are talking about the same thing: transfer money from UBS 3A to VIAC/ Finpension 3A is free right?

Yes, did the same thing with 2 accounts in 2019.

I just opened accounts with VIAC and scheduled the payments for tomorrow