How long have you been waiting for documents? Thanks!

That’s quick. So you just sent them online form or you needed come in person to apply for kassenobligation? Thank you!

Thank you! Need check it then, I was thinking of long term deposit but not sure if I move abroad in year or so they would allow me keep long term obligations (i.e 5 or even 10 years as interest is competitive compared to oder products in chf).

As swiss frank is good option to diversify risk (I would not convert all to foreign currency taking into account currencies forecast) and in case comming back it’s also not bad idea. Perhaps you have right, that they would not care as you provide them with funding which will be gone otherwise.

Something to keep in mind is that a 35% withholding tax is automatically deducted from all interest payments. As far as I know, it depends on the double taxation agreement with the respective country whether you get these amounts back if you live abroad. So I would definitely check this to avoid a situation where you lose a significant part of the interest.

But it looks like Cembra will close the account anyways. From their terms of conditions for medium-term notes: “Verlegt der Kunde seinen Wohnsitz (einschliesslich des steuerlichen Wohnsitzes) ins Ausland, so ist er verpflichtet, das Konto/Depot vor seiner Ausreise aufzulösen. Anderenfalls hat die Bank die Möglichkeit, das Konto/Depot gemäss Art. 10 zu saldieren.”

Has anyone had any experience with Hypo Vorarlberg?

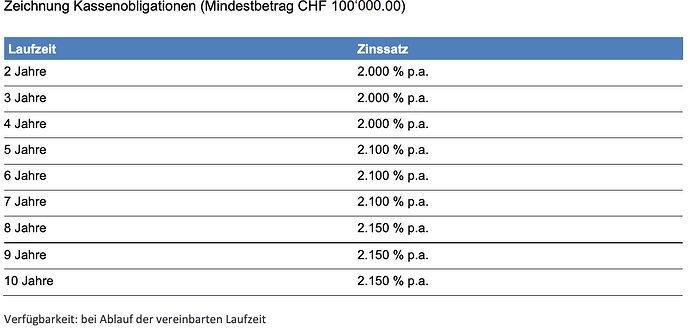

2% for 2 years is not bad, but the two years also cost CHF 72 in bank fees.

Good point, on their website they only write:

Darüber hinaus offerieren wir unseren institutionellen wie auch privaten Kunden attraktive Kassenobligationen ab einer Anlagesumme von CHF 100´000.

I didn’t find this limit on their website. I’ll ask them ![]()

When it comes to the desired obligation of 1 million Swiss francs, we do not scrutinize it too strictly for new customer connections. We want to address the background of your assets and willingness to continue working together in advance and expect that your commitment with us.

I continue to search…

Could it be that they accept lower deposits from German-speaking customers, but require a higher deposit from non German-speaking (German non-speaking ?) customers to compensate for extra efforts😆?

I didn’t know about the wir’s 1.8% for ~10 months.

Den aktuellen Zinssatz gibt Ihnen Ihre Kundenberaterin / Ihr Kundenberater auf Anfrage bekannt.

I’ll ask them tomorrow. ![]()

Sind mit Laufzeiten zwischen 3 bis 12 Monaten möglich. Die Mindesteinlage beträgt 250 000 CHF bis maximal 3 Mio. CHF (Tranchen von jeweils 10 000 CHF gestattet).

Is quite high, at least for me.

Sorry, my quote was misleading. I asked them in German and the answer was also in German.

What I don’t like so much there is the following:

Bei Bezügen über 20 000 CHF gilt eine Kündigungsfrist von 6 Monaten.

Do I have to wait another 6 months for repayment after the ~10 months‽

Damn, I subscribed for a 4-year bond less than a month ago.

Medium term notes can be bought without opening an account ? Or one needs to open bank account first ?

A post was merged into an existing topic: CHF accounts with best interest rates: discussion

In the case of Cembra, the bank will open a savings account to receive the money.

I never grasped the concept of buying “Kassenobligationen”, even in the case of Cembra (and yes, even if the look relatively attractive): buy the respective bond (ideally with low coupons to reduce tax / maximize after tax yield): Bond Explorer | SIX → in the end i) your yield after taxes will be much higher and ii) you’re certainly more liquid than in a “Kassenobligation” if you need to cash out.

Aren’t they more senior compared to bonds? (so in case of a CS-like event, the bonds can be wiped out long before the notes are), and iirc they’re also covered by esisuisse.

fair point: for up to 100k Kassenobligationen are under “Einlagenschutz”. However I wouldnt consider that with the CS Event as those were AT1 Bondholders that were wiped out (i.e. no senior bonds).

A post was merged into an existing topic: CHF corporate bonds