It would be very interesting to have a Pillar 3 that just does buy and hold of basic crypto. Is anyone offering this yet?

Why? Capital gains are not taxed (for private individuals). There’s nothing but capital gains (and losses) and wealth in cryptos. Why not “invest” in cryptos through taxable and use the tax deferred space for things with dividends/interest?

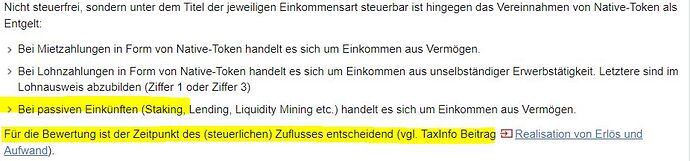

Isn’t staking coins a form of quasi-interest?

Systematically there’s no reason to tax it any different, is there?

Yes, and staking is indeed taxed as income in Switzerland, as far as I know, same as interest on fiat currencies.

I believe that is not going to happen anytime soon. I work for an Anlagestiftung that offers funds for pension funds and 3rd pillar accounts, therfore I know a bit what others are doing/planning as well. Most of them don’t even plan anything in this direction in the near future as it is too risky and the others are only starting in the next years to take a deeper look at cryptos as a possible addition.

Also for strategy funds this would be a nightmare to rebalance due to the high volatility of cryptos, incurring high transaction costs, heavily pulling down performance.

I’m not even sure that BVG restrictions would allow investments in cryptos.

Pension funds (pillar 2) are allowed to invest in crypto. It’s part of the alternative investment category which is limited to 15%.

I also don’t think that pillar 3 will offer crypto soon, same for pillar 2

It is, indeed, and given the returns available on that, I guess it would make sense to have it in a 3a. I wouldn’t touch the risk adjusted returns of it with a ten foot pole but hey, who am I to tell other people what to do with The People’s tax money? ![]()

I just checked the relevant article (BVV2 Art. 53)

An excerpt:

4 Alternative Anlagen dürfen nur mittels diversifizierter kollektiver Anlagen, diversifizierter Zertifikate oder diversifizierter strukturierter Produkte vorgenommen werden.

So it would only be possible with a crypto fund or similar with a diversified set of crypto currencies.

Wow, my first post and I see it’s a very active and interesting community.

Great feedback, and interesting additional thought on whether interest from staking is taxable (yet).

Liquidity mining is more than often resulting in negative outcome (vs holding the coins and waiting), so can we deduce the loss from tax?

As a non-professional investor you typically can’t deduct such losses. I assume for liquidity mining you only get taxed on the earned trading fees. And you probably don’t want to be classified as a professional investor by the tax authorities as in that case your capital gains would be fully taxed as well.

But, as non-professional, you are taxed on the earned fee on swaping, this mean it’s much higher than what you really make if you count the impermanent losses. Taxing like that is really unfair and showing that they have no idea how such DeFi platform are working. I was already thinking that DeFi liquidity mining was not really worth it but if you had to pay tax on the earned fee without taking any other loss or cost (transaction fees) into account, it’s definitely impossible to make any money out of it. Good to know.

This doesn’t necessarily have anything to do with knowledge how such platforms are working. Fairness is often a subjective measure and it’s difficult to design a fair tax system without loopholes. Others might argue it’s not fair that capital gain of tokens is not taxed.

There are many other situations where tax laws could be considered unfair. E.g. many Swiss gov. bonds currently have a negative yield to maturity. However, many of those still have coupon payments. The coupon payments are fully taxed as income yet the capital loss can’t be deducted as private investor. However, you can deduct negative interests paid on bank accounts. This makes bonds even less attractive outside 3a.

That is truly sad to hear. I agree that crypto is ridiculously volatile, but we allocated a small percentage to the blue chip ones (BTC, ETH, Matic, Solana), ignored the volatility and just held. If you don’t stress about ups and downs, the gains are just fabulous over the years, pity we didn’t allocate more. The problem is possibly that funds like that might be obligated to rebalance, which won’t work with crypto until they mature and lose the volatility they have now. But by then, prices will be hundreds of % higher from today. Look at BTC or ETH over the last 4-5 years, the same is playing out with SOL and MATIC is probably next. For crypto, you really have to buy, ignore everything, never sell no matter what, and look at the overall gains.

Past performance is no indicator for future performance.

I would not want my pension fund to buy any single cryptos, that’s like stock picking and pension funds are like the majority of the investors bad at choosing individual stocks.

Hi, look, the last thing I want to start is a crypto debate, but I will state my opinion after having spent about 500 hours reading and researching this subject. What you wrote really sounds like an EXACT echo of my own thoughts about 2 years ago (no intrinsic value, greater fool theory, ponzi scheme, bubble etc). Basically what people said about the internet in the 90s. I thought all that myself.

However, on the subject of crypto assets (now worth over 2 trillion dollars with a T and with a network growth that is much faster than the adoption of the Internet) now I am just looking at the numbers and educating myself.

If you are interested in learning more, I would suggest “The Bitcoin Standard” as a truly interesting read which will help you develop your thinking on the subject of “what is money” and start your own learning journey. There are several really smart and highly respected billionaire (with a b…  ) investors like Ray Dalio, Carl Icahn, Paul Tudor Jones, Michael Saylor, Sam Bankman Fried, George Soros’s family office and plenty more who have revised their initial negative opinion and embraced Bitcoin and several other quality crypto assets (with real use cases, 99% are obvs garbage) for their businesses and their personal funds. Look at the public statements they are making - and most importantly, at what they are buying. Look at the institutions and big companies investing in crypto - are they really all so stupid?

) investors like Ray Dalio, Carl Icahn, Paul Tudor Jones, Michael Saylor, Sam Bankman Fried, George Soros’s family office and plenty more who have revised their initial negative opinion and embraced Bitcoin and several other quality crypto assets (with real use cases, 99% are obvs garbage) for their businesses and their personal funds. Look at the public statements they are making - and most importantly, at what they are buying. Look at the institutions and big companies investing in crypto - are they really all so stupid?

(Of course there are superstupid YouTube accounts shilling rubbish, don’t follow those. Follow a pro like InvestAnswers and watch their TA and fundamental videos)

It does need time and research, but especially in these inflationary times with all the money printing it’s well worth it. Our central banks are all collectively printing trillions of dollars and euros, and billions of swiss francs and our currencies are debasing at an unheard-of rate - have you looked at the rising prices? I would argue that our currencies smell more like a ponzi scheme by now that is losing 10-15% purchasing power per year, while Bitcoin is rising. I think within the next 12 months it will at least double, and I’m probably on the conservative side. It might quadruple and then halve again or do something else crazy like that, no-one knows. But its adoption is rising constantly and the supply is finite.

So yes, as long as my pension fund allocated a small percentage to the best 3-4 cryptos, I personally would be very happy. Most cryptos (95-99%) are pure garbage, but the quality blockchain tokens/technologies are in my opinion the tech of the future. Even my last Covid Test was verified on the Ethereum blockchain, I was surprised to see the ETH symbol on it. It’s all here, and becoming more and more evident.

All the best with your studies!

@Bojack

Can we maybe split this up into a separate discussion? In my opinion the original question has been answered and now it turns into a debate about crypto in general.

Indeed this is discussed elsewhere on the forum so I deleted my question. Apologies.

No need to apologise  it was also not directed at you, just in general the discussion goes in the “wrong” direction.

it was also not directed at you, just in general the discussion goes in the “wrong” direction.