Could it be possible to write a short summary of this article?

Exactly that’s what I meant with real estate was always expensive. You have 1% rates today with a hot market, or you had 6-8% rates in the mid 90s, where it was a challenge to pay your mortgage month by month.

About the TA article. In my opinion it makes only sense to buy a house, if you decide to use your 2nd pillow money as down payment. Because that money is “dead” with the current interest rates.

I agree.

Unfortunately today you need at least 10% in cash. Can’t use 2nd pillar alone anymore.

It is a detailed comparison between buying a house/flat or buy vs renting it. But of course some parts are missing like using partly your pension to buy in. And invest the other part in the market. Also having the advantage to sitting behind the wheel related to the mortgage. In comparison having limited control, when your land lord is moving the mortgage costs up and down.

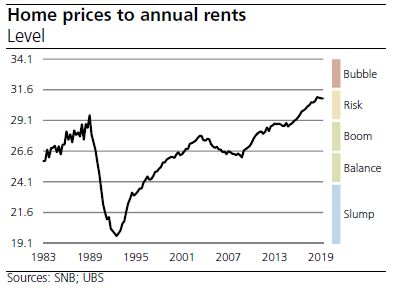

Accoring to the charts from the most recent UBS report, we can see that home prices have been rising, relatively to rent, since 25 years. But we also see that a drop can happen very fast.

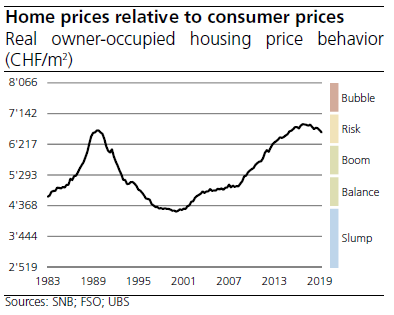

Average price of a square meter. Again, it’s been good for years, but I wouldn’t bet that it will go even higher.

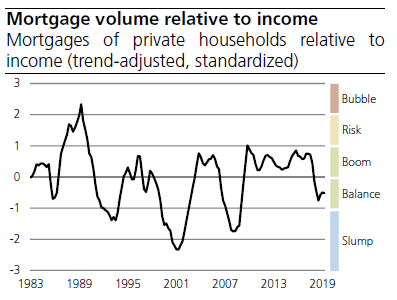

This chart actually surprised me. I was sure that due low interest rate, the cheap credit would cause much bigger leverage and a bubble, but it’s been fluctuating up and down.

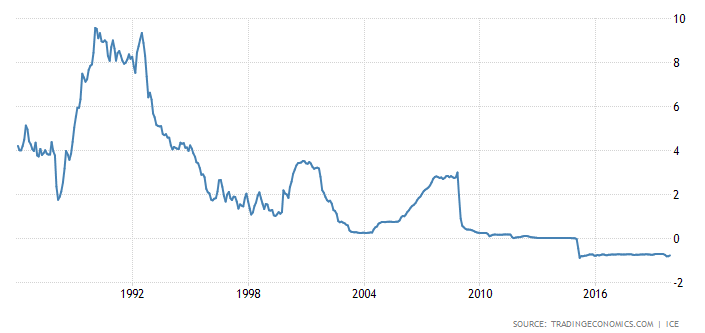

And here the actual LIBOR CHF for comparison:

I think your second last chart is surprisingly good because bank are still forced to check mortgage interest against 5% rate and not the real rate. So right now only the very high income that can pass the 5 % check receive a mortgage. That could explain why debt to income is in good shape

I think I heared the quote that there never was a soft landing after a long rise of RE prices in Switzerland

I would be interested how banks behaved at the time the prices were going down sharply, which if I’m not wrong was strongly connected with raising LIBOR rate.

Were they aggressively trying to cancel “fixed-rate” mortgages using the clauses someone already mentioned on this forum?

What about people whose mortgages reached the due date? I guess they were forced to pay not small amounts to reach again max. 80% ratio (if it was there at that time) before getting the new mortgage?

I hope someone “old enough” reads this forum or at least people who know the people who still remember what was happening :).

Even if the banks behaved nicely between 1988 and 1997, this information is of no value. They were such different companies… SBG and Kreditanstalt before they merged and so on.

Of course they weren’t behaving like a charity, they were always banksters. They wanted enough Eigenkapital to cover their asses. That is what management made the bank employees at the front enforce.

I have an aunt who had a small company (hotel) & significant debt on the property (bought late 80ies), which I presume wasn’t covered fully & she moaned every time about how she can always pay the interest but the bank is trying to quit the credit. She had to pay some kind of penalty interest in addition just to not lose it all. The bank always wins.

This is just an idea I had:

One consideration, which might be important to FIRE, is that buying a house or appartment can reduce the risks of fireing.

Let’s say you want to retire at 45 in some place and intend to live there for the rest of your life. You still have around 30 years of housing to pay for. In expectation, owning and renting will cost you the same.

If you calculate how much this will cost you without owning your appartment, you have to make some guess about how the relative price of renting will develop. This comes with quite a bit of uncertainty. [Just think if someone retired in Zurich in 1985, expecting their rent to appreciate according to inflation.]

By buying an appartment and controlling the mortgage, you can gauge quite exactly how much housing will cost you for the rest of your life.

One way to ease that ‘rental rate risk’ would be to choose some upper bound for how you expect rents to develop. Or maybe get an appartment somewhere, with rent regulation and profit from bad politics ![]()

But I’m really not sure if that argument makes sense. What do you think?

Real estate ownership as an hedge against market fluctuations is a pretty standard reason. This assumes that housing will be a big part of your expenses, and that you’ll be settling there long term.

The other reason I know of is forced savings, for many people paying back a mortgage forces them to save money. It’s psychological, but it works.

https://cs007dotblog.files.wordpress.com/2018/09/cs-007-session-9-real-estate.pdf while very us focused still covers a lot of common things.

Zurich actually has certain rent controls. So if you have been in the same place since 1985 you’re probably ok, and rent has only gone up moderately.

And if fire’ing and your place chosen becomes a hotspot 20 years later, show some flexibility and move a few km’s. A 20km move should be within everybody’s comfort zone.

And how to control mortgage? Fixed interest mortgage for 30 years? Mortgage - that is uncontrollable & there is a risk it goes up, at the same time property price drop & it’s difficult to sell without a loss.

According to this source, the rental rate index has doubled since 1982. However, inflation has also gone up ~63% over the same period. (I don’t think this index is inflation adjusted.) So you are probably right, that it wasn’t a very good example.

And I agree on the rent control aspect ![]()

On a side note, I find rent control to be such an infringement of private property. The law is dumb in a similar way as minimum wage. Rent control works like this:

- More people are coming to the city than there are flats

- Demand is higher than supply, so rents go up

- Government steps in, forbids to raise rent

- It’s a signal for developers not to build more and for private renters not to buy more

- So the law benefits the current rentees, but it hurts renters and future rentees, who won’t be able to find a flat easily (castings, etc).

Price controls laws are insult to 200 years of development of economics and plain horse common sense of an intelligent general educated person. They should be called supply shortage laws.

I see renting as a way to adjust my flat to my needs. I am sure with 45 I will need a 4-5 Zimmerwohnung. And 20 years later a 3 Zimmer will be enough for sure.

But I am personally pro renting anyway.

Yeah renting is slightly more expensive (probably, it depends) on the long run but it allows for at least two things:

-pick your desired lifestyle

-it’s an hedge vs life situations

For instance we wanted our family to grow in an apartment with garden in the middle of a larger city. Renting is 1700 for a 5 piece relatively new (I’m nit putting the NK), buying a similar property near the station is 1.5 mil +, which is too much for us.

So renting allows you to live where you want, while buying usually involves compromises

I found that purchasing an old house that requires renovations to still be cheap comparing to rental, in the Basel area where I live those houses can be found with a 20% discount vs new buildings. This is mostly due to the fact that most people will prefer to pay more to avoid the headache of the renovations.

Advantages to buy old:

- 20% discount vs market (will require a lot of search but it’s possible);

- Renovation cost are tax deductible without limit;

- Wealth tax: the estimated value of an old house is calculated by the gemeinde and is normally significantly lower than the purchase price. Consequently your wealth tax will be reduced.

well you just need to be careful because not all investment in your house can be deduct from the tax. Actually in the case of old homes it may be a gray area. You can deduct measure that keep your home value, not measure that increase the home value. So replacing an old kitchen for a new one with more appliances will not allwo you to deduct all cost from your tax burden. There is a piece hier in german:

" Werterhaltend oder wertvermehrend?

Wenn Sie effektiv abrechnen, müssen Sie alle Kosten auflisten: Datum, Leistung, Empfänger, Betrag. Abzugsberechtigt sind werterhaltende Arbeiten, die den Zustand der Liegenschaft erhalten (siehe Tabelle «Übersicht: abzugsfähige Unterhaltskosten»). Wertvermehrende Massnahmen wie An- oder Umbauten, Erschliessungen und Luxusausstattungen können Sie nicht abziehen. Der Grat zwischen werterhaltend und -vermehrend ist schmal. Nehmen wir an, Sie wollen Ihre Küche renovieren. Die Kosten für die Einbauschränke und Geräte, die Sie gleichwertig ersetzen, können Sie abziehen. Wenn Sie zum bisherigen Backofen einen Steamer einbauen, wird das Steueramt die Kosten kaum akzeptieren. Wenn Sie aber die alte Mikrowelle durch einen Steamer ersetzen, dürfte das Steueramt die Mehrkosten – Differenz zwischen dem Preis für einen neuen Steamer und dem Preis für eine neue Mikrowelle – akzeptieren"