As I am reluctant to invest in funds and companies which would be contributing to doing bad things to our planet and to its inhabitants, I try - as much as possible - to find ways to only place money on the ‘good guys’ and have some positive impact. It might not be the most profitable but it should still be better than keeping all my savings in the bank.

I am now using Inyova (https://inyova.ch/) and I would like to know what is the opinion on this forum on them. The offer “Inyova Invest” with which you can chose specific companies in which to invest, with their guidance, and Inyova Grow, with which you can deposit an amount and progressively dispatch it in ‘green’ companies obligations for 4-5 years with an interest of 6-8% per year. They also have 3A.

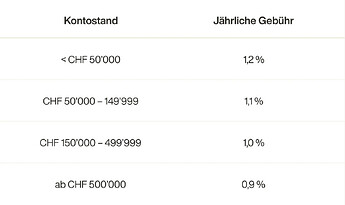

Any opinion on the solidity, the risks, etc.? I think Inyova is more expansive in fees than brokers which just provide you ETF, but the service is different I guess.

I think to make a decision, you should be able to answer following questions

- Is Inyova active stock picking or passive investing

- Who decides if the companies the invest in are good or bad? An ESG index or their team?

Do you know answers to these questions ?

Their fees are IMO prohibitive.

As for your desire to “do good” I’d give the same answer as @Compounding – ESG is now just (another) vehicle for the finance industry to extract more fees from the investor.

Note that these are bonds with companies that often lack a credit rating and have an actual risk of defaulting … unless you know exactly what these bonds are, I would not pile money into them …

Their whitepaper answers some of this although the details remain a bit murky. I think they pre-filter based on Refinitiv, an ESG data provider, do some further filtering with their “Inyova Engine”, exclude some companies categorically (e.g. Defense) and then present those companies as choices to the retail investor who can do some further tailoring based on their tastes.

I looked at the (few) companies listed in the whitepaper and they’re IMO almost all maybe interesting as companies but rather shite as investments.

Oatly Group: no earnings, horrible price action, missed earnings estimates 100% of the time.

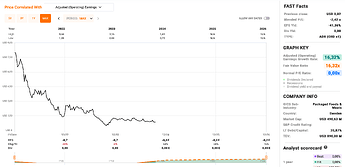

Orsted: flat earnings, horrible price action, lots of debt, cut their dividend completely.

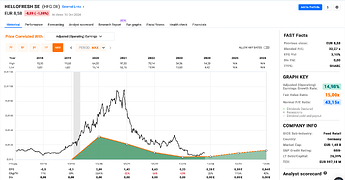

HelloFresh: terrible earnings history, horrible price action, misses earnings estimates half the time.

Uponor Oyj: a Finnish company that sells products for drinking water delivery, radiant heating and cooling, acquired by Georg Fischer in 2023.

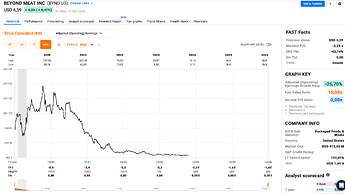

Beyond Meat: no earnings, terrible terrible debt situation, misses earnings 100% of the time.

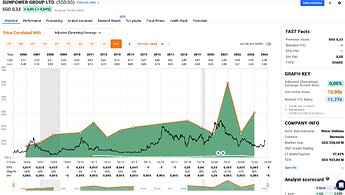

Sunpower Group: mostly flat earnings, stock price all over the place, misses earnings 100% of the time.

After looking at this sample – notably hand selected by Inyova as shining highlights for their whitepaper – I have a bunch of non flattering adjectives for their approach, but in short it boils down to:

I would not “invest” any money with them!

My suggestion: Invest in a low-cost All World ETF. Calculate what you have saved in terms of TER (for example 0.5% on 50,000 is CHF 250) and donate the amount every year to an organization of your choice. The impact is probably bigger.

Don’t sweat it. Consider that you yourself are harming the planet just by consuming according to the Swiss standard. Then it is very difficult to optimize for E, S and G at the same time. And who is to say that alcohol is bad but natural gas is good? The catholic church is trying to avoid investing in companies that go against nature, e.g. provide alternatives to breast feeding or produce birth control drugs.

Unless you have lots of money you should not be picking individual stocks (for risk management reasons) and as a moustachian you should try to avoid excessive wealth management fees.

I second @Compounding and @markus654 that charity might be the best way of doing good. Get out of the church tax and donate!

Of course, if there’s a benefit to be had people will be lightning fast to find it.

As I’ve writen about it before, capitalism, in developed markets and also in some like China and India, in its present form is actually good for the environment. Newer machines and processes are not only more efficient and productive, they are also inherently far cleaner. In the past it was profitable for companies to “pay to pollute” as Tim Harford of The Undercover Economist fame had put it, whereas increasingly it’s just better for business and productivity to invest in up to date machinery and processes, and being cleaner is an added benefit.

The flipside is that there’s still a ton, if not MORE shady practices in countries with lower regulatory threshold and more room for corruption, in my wife’s native country a mining company with a very bad name among environmentalists (the Nestle of mines, it’s been called) is essentially bribing politicians to turn half her country into an open pit.

May be slightly off topic: a good summary of sustainable investing can be found here

In addition to what has been mentioned previously, I will also recommend to watch this explanation from Ben Felix

Each person’s values are at least slightly different, so stock picking based on thorough research would be the only way to create a portfolio that more-or-less matches your values. If you use a broker with very low brokerage fees, etc. you’d come out cheaper than using a service like Inyova. Hypothetically, the risk could also be minimized by creating a portfolio with broad stock, sector and geographic diversification (at least in the hundreds of stocks), assuming there are enough companies that match your values.

But as pointed out above, that is a somewhat expensive luxury. Compared to using ETFs, you’d have much higher costs in terms of fees paid and time spent on research.

Many thanks to all. Appreciate all the insights. Lots of food for thoughts!