Hi guys, I’ve been thinking about how I can utilise 2/3pillar more optimally. We bought our primary residence without needing to pledge it so was thinking of changing this and then using the excess capital and get another mortgage for an investment property. We’re complete novice in this area so would appreciate any advice. Another consideration is that i just realised how high is the lump sum tax where we currently live so thought we can buy the investment property somewhere where it’s low, e.g Schaffhausen, near Bodensee or even Appenzell, then move there before we take P2/3 out

You cannot withdraw pension assets to buy a property which is not your primary residence. So yeah you need to use a two step process.

But if you move out of your property before retirement , then you need to pay back the pension fund as far as I know.

For lump sum tax calculation, link here

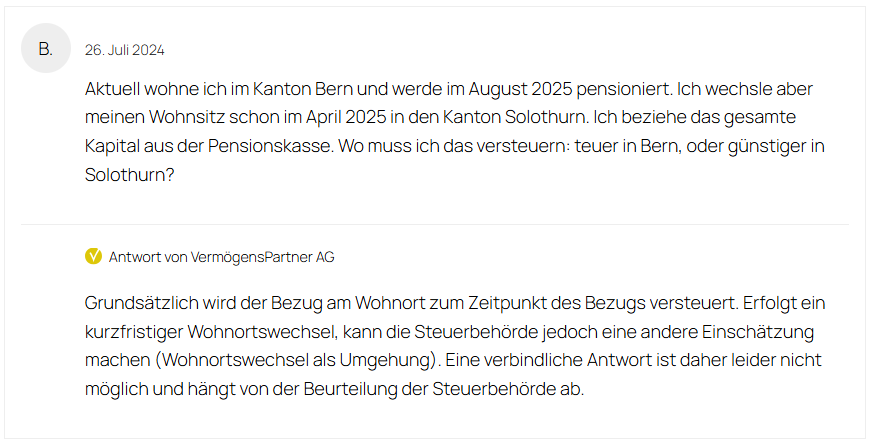

And you pay the 2nd pillar withdrawal tax according to your place of residence at the end of a calendar year. So you would have to move first to profit from lower taxes.

Correction: you pay at the time of the withdrawal. And should you move residency in a slightly suspicious manner, the tax authority might not accept your new residency.

Source: https://www.123-pensionierung.ch/steuern-sparen/steuern-kapitalbezug/

Maybe you can plan it in stages e.g.

- Move mid 2026

- File tax return in new canton

- Buy property in new canton and withdraw pension for this

Assuming your PF is not in your old canton, they shouldn’t even see the withdrawal.

Thx for the website, lots of good info to read!

I’m curious about what can be considered suspicious. And wonder if moving primary residence but keeping current property would be considered that.

Side topic, after reading that site you sent, I found an even more interesting possibility of moving to a double tax treaty country that charge no tax on pension withdrawal. Which could possibly result potential refund of even the tax charged based on the address of the pension fund o_O if I understand it right i.e zero tax on the pension withdrawal

Wow, now you’re really thinking out of the box ![]()

There are some country where the zero tax approach works. Thailand is one of them, if I am informed correctly. Personally, I withdrew whatever capital I could from my pillar 2 fund in Luxembourg. With proper planning, I ended up paying less than 1% tax on it.

Bit off topic but do u mind sharing how you did it? Always cool to hear first hand cases ![]()

Sent DM as I have posted the link to my blog article somewhere on this forum before.

what’s your blog?

Let’s post this again. Here you go: Kapitalbezug der Pensionskasse im Ausland – Primal Matrix