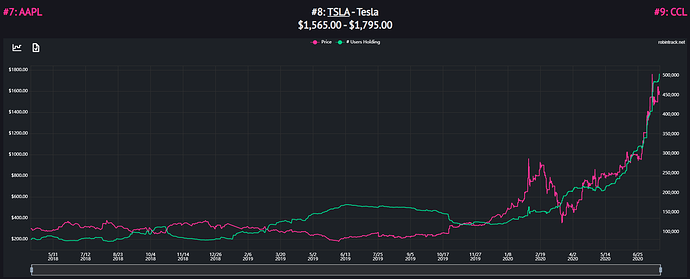

For sure you heard about the new trading platform Robinhood, in which you can easy and cheap trade anything. There is an very interesting site called Robintrack.net, which shows charts showing the relationship between price and popularity with the Robinhood users. Enjoy!

Could you expand, what makes it interesting?

Sure, check for example the company Hertz (HTZ) a rental car company who went for chapter 11 in May 2020. While going trough the process of liquidation the Robinhood users bought this “dead” share back from 0,56$ per share to over 5$. It is interesting how trending certain share are and you see that in real figures now.

Caveat: “# Users Holding” looks almost the same on every stock because Robinhood just grew

this should be considered.

It seems there two strong behaviors: "Buy the Dip" (AAL,XOM,) and “FOMO” for others AMZN, MSFT

TSLA seems a mix of Fomo and Love for Tesla/EV

I’m concerned about Robinhood account statements for Swiss tax reporting.

Robinhood account statements are reported as ‘margin’ accounts even if you don’t borrow money. This is because when you deposit your earned cash it automatically gives you 1k to use immediately and then the additional funds are available within 3-5 business days when the cash lands in the account.

I’m concerned how CH tax will handle this ‘margin’ categorization on the statements. i.e. use it to tax earnings at your income tax rate vs. the investments rates.

What do you mean ? I don’t understand

There should be no capital gains tax unless you are considered a ‘professional trader’ according to 5 criteria… one of them being no buying on margin. If classified as a professional trader then normal income tax rates are applied to my investment income

Shouldn’t matter if you don’t use that “loan” at the end of the year anymore. Relevant are only the cash balances and holdings in the account for tax reasons.

Thanks, that’s a good point! Didn’t think of it that way. I only recently noticed that my account statements are listed as margin accounts and it could cause confusion.

I recently got another steuererklaerung request for all my years investing with robinhood, haven’t heard back yet, but I’ll update here if anything interesting pops up as a result.

What’s more you didn’t read the criteria carefully. If the interest rate (I assume you pay 0% interest during that period), is lower than your average dividend, you are NOT violating that criteria.

can we open account @Robinhood in Switzerland now?

How would you check that if you wanted to do it yourself?

(I’m not sure it’s more efficient for someone to get the answer than for you to search (learn to search) for it  )

)