Note that this offer is limited in time and will end on Dec 31

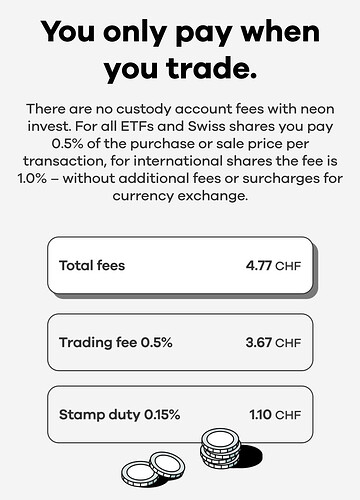

With neon invest, you normally pay 0.5% fees when buying or selling ETFs. With our offer, we are now also removing this last small entry hurdle: for the beginning, we will cover the trading fees for you. Namely for two Invesco ETFs – the Global Stocks (FTSE) and the Global Stocks ESG Climate Paris Aligned. There are no custody account fees or currency costs with us anyway. The only remaining costs are the state stamp duty and the product costs of the ETF. Investing like this pays off.

The offer is valid until 31.12.2023 and the trading fees will be reimbursed to your neon account on the business day following the execution of the purchase or sale.

Sounds very good to me. Great offer and even better if it is longer than 31.12.2023.

Diese Email habe ich gestern auch erhalten. Die beiden erwähnten sind aber erstens sehr jung

Ivesco Global FTSE IE000716YHJ7 (Auflagedatum 26.06.2023!!!) AuM 10 Mio.

Invesco MSCI World ESG Climate Paris Aligned IE000V93BNU0 (Auflagedatum April 2019) AuM 4 Mio.

Ich verstehe nicht wie Neon diese Fonds ihren Kunden guten gewissens empfehlen kann. Tiefe Gebühren allein dürfen nicht massgebend sein. Beim Global FTSE gibts massiv grössere Fonds die wenistens eine gute Handelbarkeit gewährleisten. Siehe Details bei Justetf.com

Danke dir für das Feedback. Also ich finde beide Indizes sind recht gut gewählt. Habe es mir gestern mal angeschaut und bei einem ETF ist das Volumen ja relativ unwichtig. Es würde theoretisch einen Einfluss auf die Handelskosten haben aber die werden ja eh von Neon übernommen. Von daher ist es wichtig, dass die ETFs günstig sind. Im Vergleich zu den usual suspects Ishares und Vanguard die doch relativ teuer sind hat hier Neon einen echt guten Job gemacht mit dem Partner Invesco…

Klar die Spesen sind günstiger als bei den Konkurenzprodukten, dies aber wohl um möglichst rasch Kunden und Assets zu gewinnen. Ob dies mit Neon Kunden gelingt scheint mir fraglich.

Die Vanguard Fonds haben immerhin AuM von 7.3 u d 10.4 Milliarden und der Grössere besteht schon seit 10 Jahren.

English, lads. ![]()

Not a German subforum.

We speak about the Neon offering. You can trade the FTSE All World without any trading commission via Neon Invest and at the same time the Management Fee it is also over 30% cheaper than Vanguard. Only drawback is the ETF is not a couple of billions but I don’t see any issue in that as this would only have an effect on the spreads but if these are compensated by Neon then it is the best in the Swiss market that you can get if you want to trade ETFs

Got an email from Neon:

If neon invest were to enter the ring, how would the boxing match between neon and the other trading apps end? (spoiler: We win the most rounds

). Let’s take a look at the specific comparison between neon invest and Interactive Brokers:

neon invest is convenient: You can manage your everyday finances and investments in a single app. You can easily find investments using the ISIN number and don’t have to make a transfer nor convert your CHF into another currency. Because we do it for you, without any exchange rate fees.

No headaches with your tax return: With us, there are no complex forms. You receive a simple, electronic tax statement so that the tax office can access your pre-filled trading information. It’s as simple as that.

Say hello to user-friendliness: Finally an easy-to-navigate and good looking platform!

![]()

![]()

![]()

Where is this coming from?

I didn’t try the trading part of the app, so I don’t know how it is user-friendly. But at least, it is sure that it is simplier to use for non-aware people that want to make a first step in investment (like Yuh).

Although, comparing themselves againt Interactive Brokers is very ballsy ![]()

Ask them how the fees compare…

I don’t know either why they would compare themselves to IBKR. Their target audience has probably never even heard of them. Swissquote or Postfinance would make much more sense (and not just because those are the companies behind Yuh).

E. g. they could show how buying ETFs for CHF 500 each month (automatic investment feature is coming) is cheaper than Swissquote.

My guess is they know IBKR has the best fees and is often recommanded (at least on these boards) and they are targetting the people who feel the alleged (I’ve never used it) lack of user friendliness is a big drawback by saying “hey, look, we have an interface! That’s the threshold to meet, right?”

It still seems very silly to me.

With all respect Neon Invest is for me the go to app for my FTSE All World Investment. No FX charge and no commission as they are zero fee ETFs… as this is the only ETF I invest in it is for me the best option by far

They’ll reimburse you the following day.

the trading fees will be reimbursed to your neon account on the business day following the execution of the purchase or sale. (source)

For anyone deciding between Neon and Swissquote for ETF investments, keep in mind that in addition to the CHF 9 flat fee, there is an addition CHF 2.20 stock market fee with Swissquote. So up to CHF 2’240, an ETF transaction is cheaper with Neon.

From Neon: The offer is valid until 31.12.2023 and the trading fees will be reimbursed to your neon account on the business day following the execution of the purchase or sale.

What will happens after that? Will Neon continue to apply this special offer? I doubt it, but if they will continue it, it could be interesting.

I am very certain that they will keep the 0 fee ETFs. Why should they only do it for 2months? And at the same time do the marketing vs Interactive B. If they keep the 0fees for ETFs then for sure this is the best offering.