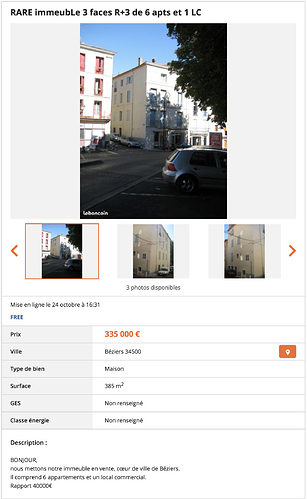

Lately I have been seriously reconsidering investing in Real Estate in France, when I realized that some cities like Béziers were offering many opportunities like this one :

The ad is in French so I’ll explain the main features : this is a multi-units rental property consisting of 6 apartments and a commercial space on the ground floor. The building is for sale for 335kEUR, and the annual revenues from the rents is 40kEUR, so roughly 3333 EUR monthly. We are very close to the one percent rule! If this property can autofinance itself it would be perfect.

The pros :

-Regarding the financing, in France it is still possible if you have a very good financial condition (for example high salary and high savings and equity) to get a loan for the totality of the acquisition price of the building. With the current rates, and borrowing over 25 years, that would lead to a monthly mortgage reimbursement of 1550 EUR. Compared to the 3333 EUR of rent, this is quite good. It might be more difficult to get such a mortgage for a non resident, that is why i never closed all my accounts in France before going to Switzerland, so I could keep good relationships with local bankers.

BUT:

The french taxes are really killing it:

- First, a property tax (“taxe fonciere”) would have to be paid, I estimate it around 3-4kEUR per year. (so between 7 and 10% of the income)

- Then, the french state would take 15.5% of social contributions on the rent (yes, even if i am not getting the benefits of the social system as a non resident), that would be 6000 EUR

- Then we have the income tax, which cannot be less than 20% of the income for non residents. Once can perhaps deducts some expenses, but the final result is still not nice… I’d expect between 6000 and 7000 EUR of income tax.

That makes already around 15kEUR of taxes out of the initial 40k EUR of revenues!

Then I have to take into account maintenance costs : a rule of thumb is 1% of the property value per year, so around 3500 EUR.

Then, since I will not be there managing everything by myself, I need to hire a managing company to handle tenants, clean the shared areas of the building and so on… usual prices are around 10% of the rent, so 4KEUR!

And at least, the mortgage reimbursement of 18600 EUR per year.

We can see that at in fact, this investment will not be (or in a very light way) cash flow positive.

And this is in the best case scenario! If anything goes wrong, I will have to put more money in it, with a high opportunity cost (I could have put this money in the stock market).

For instance, if a tenant won’t pay the rent, french law are very much against the owner, so I’d have to wait on average 18 months to get him out…

So all in all, even if the initial ad was very yummy, a back of the enveloppe calculus makes me think that it is not that good at all, particularly because of french taxes and tenant friendly laws…