Where would you park CHF in that case? Interest in broker accounts are measly and it’s not that fun to keep in cash due to lack of full protection.

I’d put it into my pension fund and get a ‘return’ via the tax deduction benefit. I could then either withdraw it to pay of mortgage or transfer it into a VB scheme on retirement to maintain stock market exposure.

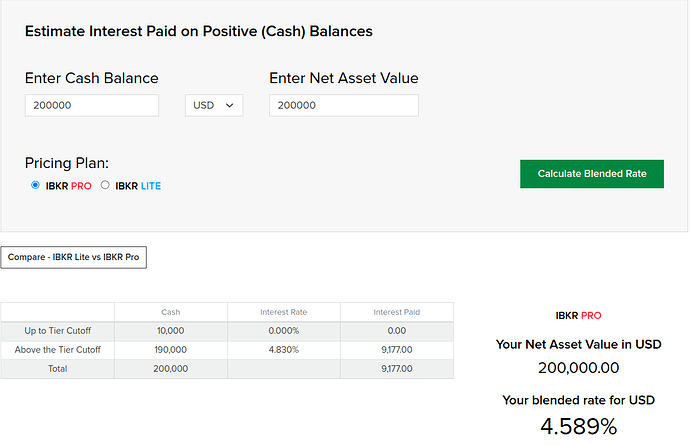

you can get 4.58% on IB on USD.

4.75% on wiLLBe

(20 char)

Quick update Dec23.

So I’ve been DCAing 10k every month this year on VT which I’ve found quite easy to manage ![]() I literally check my account no more than once or twice a month and having no active maintenance is perfect for me as I have quite a time-consuming and demanding job.

I literally check my account no more than once or twice a month and having no active maintenance is perfect for me as I have quite a time-consuming and demanding job.

I reached my first milestone this month which was to actually break-even after the losses of my initial investments back at the end of 2021. I know this has been massively helped by the recent rally, but to me showing a positive ROI for the first time was an important step in my road to FIRE ![]()

Onwards and upwards one hopes, with probably a few bumps along the way.