Or even worse: Being so mad that I missed the bottom of the crash that I would be stubborn enough to wait for the SP500 to drop again below 2500. Which might have never happened again in my lifetime and thus resulting me of never investing in the first place.

… like dropping decades of savings into a “why wait!?” exclamation? ![]()

You are still young, I believe you haven’t yet experienced how it feels to be in minus 6 figures with your portfolio, which probably is multiple years of savings for most of us (2 to 5 years, depending on kids, etc).

But just imagine the OP asking the same question in 2021 December, saying he’s eyeing a VT/TSLA/BTC allocation. This forum just would’ve told him to “drop it in and sleep well”. And now he would be about 100k poorer. I know it’s Captain Hindsight talking, but I have a very strong deja vu.

There has been 42 years(!) of easy and easing monetary policy, which seems to have turned now significantly. There has been a secular bull run since 2009, which is the last 13 years, basically non-stop…

Many of you don’t know anything else then a bull market and V shaped recoveries.

imagine yourself being 22 yo, investing in 1998 with a “drop it in and watch it grow” mentality, only to be at the same spot 15 years later at 37 yrs old, at net zero results.

How about putting 50k in every 6 months, or 25k every 3 months, to be fully invested after ~1.5 years?

One can also extend it even further to let’s say 3-5 years.

I just think that waiting on the sideline shouldn’t be an option. Do you start when the market should fall another 10%? Or another 15%?

Important to note, that money that’s invested in the stock market, should never be needed in the next at least 10 years, ideally 15+ years.

If there is a possibility, that a good deal of the money may be needed in 5-10 years, I’d only invest part of the full amount and let the rest uninvested.

Wrong. Starting your investment career in the late 90s would have been ideal. Nobody invests a lump sum and stops investing for the next 15 years lol.

A young investor should pray for a big crash in his early career.

Thing is, you‘ve been (as I recall) a huge proponent of investing a lump sum - and 200‘000 over 10 years (just to coincide with the 2007/2007 financial and stock market crisis) is more than most people save.

Imagine you‘d have invested a 200k lump sum in 1998 and another 200k from employment income over the next 10 years. You‘d be facing a loss on your capital (and probably only barely a gain with dividends) on your invested capital.

Would you have had the enthusiasm - or stomach - to continue going all-in on the stock market, because it’s been proven superior over the long term?

Feeling a bit insulted by the “lol”, because this is part of my story.

Started in '98 with then first 5 years of work savings, about 5 swiss blue chips (remember no ETF’s back then, blue chips were supposed to be the safest bet), one or two tech’s of the day (internet was exciting), a meme stock or so.

All good for 2 years, then lengthy draw down, drops significantly below entry points for the blue chips (Novartis, Nestle, ABB), heavy losses for the tech’s, even total losses (SAir Group = swissair). Dotcom crash, 911, it was just no fun.

It’s difficult psychologically going “hurray, everything is on discount, cheaper stocks for me!”

Yes, I practically stopped investing new savings until about 2005. I was sick of losing hard-earned money, seeing the negative performance after 5, 6, 7 years.

2005, started investing new funds again, a little later it’s 2008, same thing again, thoroughbred blue chips like Swiss Re crash -90%.

Is it “Hurrah, discount baby.” No, it’s more like, “is this going the same way as SAir?” I’m “proud” I didn’t sell, but no, more buying… just didn’t have the balls, sir. And just when you thought things were stabilising and going up again, double dip, and another year of losses.

But why not at least reinvest the dividends I hear you say - dividends were obliterated in 2008-2011, there wasn’t much to reinvest, unless you wanted to throw new capital in.

By 2012 I was still down, after 15 years.

It’s ok, laugh, I don’t take it personally, I just don’t believe in the “throw it all in, nothing can go wrong” , nor do I recommend it. Even it’s actually theoretically the best thing, based on the past, it can mess you up psychologically.

I didn’t mean it like that. I meant that people in our community are saving and investing on a regular basis. But why don’t we run the numbers with a simple 55% US 45% exUS stock portfolio (representing something close to VT)?

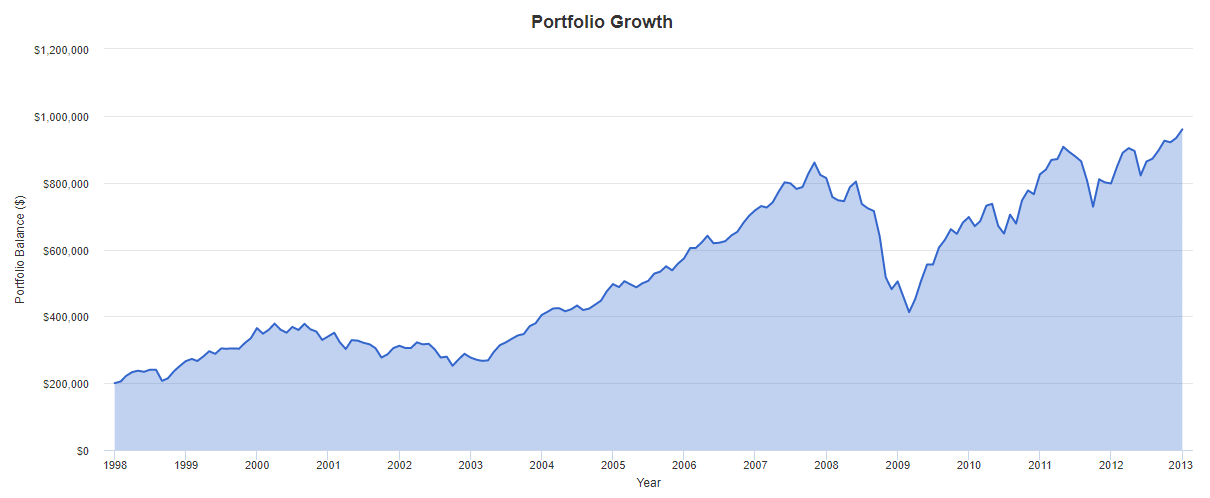

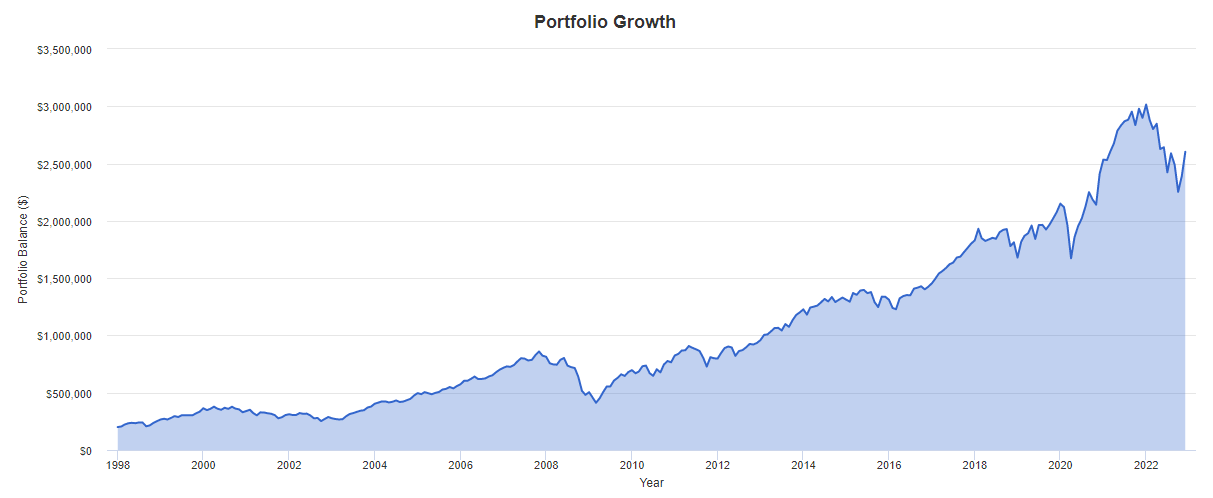

While it was an unpleasant time for sure, someone who invested 200k at the beginning and then 2k/month for the next 15 years, reached a balance of 960k by end of 2012 (+71.4%). If this person continued his journey up until now, we would look at a balance of 2’600k (800k invested, so +225%).

My conclusion: investing is easy, staying on the course is hard. If you manage to do it, you’ll become very wealthy.

Would’ve could’ve should’ve. ![]()

I invested then more lump-sum style, trading fees were steep back then, investing amounts of 2k per month was simply not feasible. Diversifying outside CH was ok-ish, but also not as easy as today. But that’s history, not relevant for today.

What is relevant even today, looking at your backtest portfolio is that, the “nice performance” that you show, these performance charts are in USD, I live/earn CHF, so I measure my performance in CHF, that’s a massive difference, USD approx. halved in value to CHF 1998-2012.

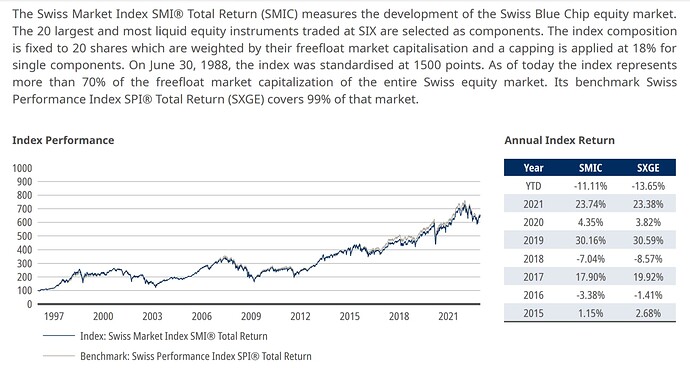

Here’s the performance of a diversified basket of swiss stock with dividends reinvested, i.e. total return “SMIC”, in CHF.

Flat as a pancake from 1998-2012 ![]()

Then subtract dividend taxation and bank fees and it’s probably flat 1998-2014 ![]()

it can happen again, for a lump-sum investment of 200k, the topic of this thread. That would/could be 2022-2038…

Fair point with FX rates (USD went from around 1.40 to 0.95 in that time) and the different investing world back than.

But what’s the actionable advice for someone aiming for financial independence today? As we don’t know the future, what’s the best strategy for the next 20 years? What has the highest probability of reaching a goal like FIRE?

A basic plan for someone aged 35 and in employment would be a regular monthly investment equivalent to monthly savings into a tracker like VT. This way the lump sum “problem” does not get worse

In addition there are mandatory contributions to 2 pillar which increase with age

For the accumulated lump sum if you can’t stomach the risk of investing it in one go then deploy it gradually over time. With such a plan you could do worse than parking some of the savings in the structured product that was discussed recently - although heavily criticized on this forum I think in this situation it could serve a purpose

You also should take into account the different inflation rates in the US and CH. The lower inflation in CH over that timeframe compared to US means that a lower nominal return in CHF is required to achieve the same real return compared to USD.

The US inflation between 1998 and 2012 was ~41% [1] while in Switzerland it was ~11% [2]

Thus your “flat as a pancake” return in CHF might look better in USD, but after taking into account the inflation the real returns should be roughly similar in both currencies.

[1] $1 in 1998 → 2012 | Inflation Calculator

[2] Switzerland Historical Inflation Rates - 1983 to 2024 | Inflation Rate and Consumer Price Index the rate can be calculated with a simple spreadsheet using the Annual rates for 1998-2022, I got 10.98%

wanted to add here some more: namely, life happens in between.

In the dotcom-crash I was still at the university, no capital to invest, other problems in life.

I started working full time in 2003, by 2005 I could spare the downpayment of my first apartment, so there goes all my money, plus 150% debt to it.

By the time 2008 came, I was starting to invest in local blue chips (in Hungary), which melted down by -70%, leaving me with nothing but hopium and the big leg wins upwards in 2009-2010 almost brought me to net zero. ![]()

By 2010 I was totally pissed in my first crappy apartment and I was eyeing a bigger place with my then-girlfriend together, which happened to fall into our lap as a lucky accident, so we had to buy. Liquidated everything, went all-in for the payment. We were sleeping on 1 mattress without a bed frame for 2 years.

By 2012 I had enough of Central-European cleptocracy and went for the Swiss route with emigration. Capital goes down-down-down in the first 6 months. Then I had to support my partner finding a job (even more drawdown)…

We got “lucky” in the middle that we didn’t get 2 kids in between, financially speaking.

So by the time I had investable money after the 2008 crash was around 2015 and that was only life in between. If we had 2-3 kids as “planned” between 28 and 35, I would still be broke ![]()

So it’s easy to say maybe this one crash was unluckily timed, but you’ll do better next time - the next time might be very different, in terms of circumstances. Not everyone stays single and lives with their parents by 40 yo.

This inflation difference resulted in the devaluation of the USD. Pretty much spot on if you look at the FX rates.

Thanks to all for taking the time to answer - some interesting thoughts and ideas.

Quite a few of you were mentioning my ‘fear’ - maybe my OP wasn’t well written. I don’t have a fear of investing and didn’t sell anything. Rather, given this was the first time I was buying stocks like this, after seeing the losses month after month (for the first 3/4 months), I was wondering if I was doing something wrong, and therefore stopped investing. I think the takeaway from a lot of your feedback is to look at the long-term strategy and not be so focused on monthly fluctuations.

I also plan to gradually increase my stock exposure (probably over the next 6/12 months, and probably mainly VT) from the 25% currently up to 60% of my assets.

The question of whether to rent in Switzerland or buy a property is probably a dilemma for another day.

A post was merged into an existing topic: Clarification on buying vs renting

4 posts were merged into an existing topic: Might the imputed rental income have a chance to disappear?

bump up on this thread.

I’m looking into a small windfall (50-80k) to invest short-term (somewhere else than the stock market) for the next 1, max 2 years, and I’m a bit puzzled.

- not willing to lump sum VT or DCA VT for the time horizon

- looking at real estate (especially Crowdhouse), the previous yields of 6-6.5% evaporated to 3-4% now with some further RE valuation downside risk and “SARON interests moving up”-risk in the next 5 years

- looking at crowdlending and corporate bonds with around 7% yield, minus 35% interest tax, doesn’t look very appealing for the risk taken, but the opportunities I see coming are still sold out within hours.

- looking at (ZKB) AT1’s - still afraid after the CS “incident”

Is there any platform to secure a ~5% net yield without everything looming above your head?

Or shall I just keep it in cash/obligations in CHF and wait for the eventual stock market crash (that’s never coming)?

thanks Cap’n ![]()

I was not asking for a secure yield above SNB interest, but to secure a yield (=options to look at) close to 5% net, besides crowdsourced property investments.

I’m not going to promise you any % that this will produce because I don’t know the future but as your timeframe is this short I would propably go for a money market fund like this one: https://products.swisscanto.com/products/product/CH1220495068?productCategory=‘Privat’&assetCategory=‘Geldmarkt’&lang=en

Also term deposit given the known horizon might make sense (since you don’t need immediate liquidity).