Inspired by the post from @assemblyrequired , I thought I should also share my story.

My story of investing is rather short. For most of my life, I assumed investing in anything other than Fixed deposits is like gambling and it’s not for me. I believe some of this has to do with the movies I watched growing up where most of stock investing was shown as gambling ![]()

Anyhow, one day one of my friend read two pages of „rich dad poor dad „ to me. And I was shocked about my ignorance. I decided to learn and start the journey

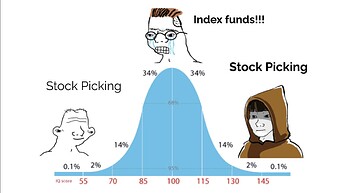

Prior to this all of my „investments“ were defined benefits pension buyback , 3a savings and fixed deposits. So it was time to do some research and start from scratch. As I started, someone told me about index investments and I thought why should I invest in all the stocks when I can invest in top performing ones. That didn’t make sense to me. Michael burry‘s comments also made me convinced that Index investing is bubble. I decided I will be the best stock ninja ![]() (I know what Ben felix says)

(I know what Ben felix says)

So I started being a stock ninja, carefully selecting stocks using whatever models, lot of fundamental analysis done by analysts etc. I started with 10-15 stocks and it was going very well. But as I progressed I learnt following lessons

- everytime the stock was making big moves, I was tempted to either take profits or add to position

- I traded in and out mostly at wrong times (not a loss though). In hindsight, I would have been better off not doing anything with my positions.

- most of my moves didn’t really produce added benefits

- for curiosity I was tracking myself against S&P 500 and concluded that all my ninja skills were only for entertainment purposes and my portfolio more or less performed similar to S&P 500 or below.

- so by end of 2021, I was convinced that I should keep my life simple and focus on index investing.

- started with VOO, later moved to broader VTI and as portfolio grew, I diversified internationally too.

Today it’s mostly VT (or alike i.e VWRL, SSAC) with additional home bias for CH and IN. That’s about it. Fun fact is that if I look at my „lifetime“ MWR performance , I am outperforming VT but underperforming IWDC. I track it just for fun. Most likely India helped me outperform VT while hedging and no EM exposure worked well for IWDC

In addition, I also reduced random costs for high cost accounts and credit cards. And recently I decided to diversify my banking and brokerage after this CS fiasco.

I have learnt a lot during these years. This forum was source of information during the years and I have always been surprised by depth of knowledge. I am glad I joined the forum too and I can share some of the insights.

My key lessons are -:

- you can only learn when you have skin in the game. So it’s best to start investing rather than researching (too long) to find the best strategy.

- no one can teach you how it feels when your portfolio is -20% and you wonder „why did I start investing“ . You need to live through this experience

- in investing, the most difficult thing is to „do nothing“ and stick to strategy

- it’s important to focus on costs but not get obsessed (there will always be a lower TER ETF, a better tax advantaged fund etc). So start and optimise as you go.

- while being frugal is good, it should not come in way of enjoying life or investing in yourself (physical, mental)

- investors should definitely learn the difference between expected future return and past return. This in my view is the most underrated point.

- I also learnt a lot about lot of companies and regions while I was researching . This has made me knowledgeable about other industries as well. It’s good for general knowledge. This was the good part of being stock ninja for a while

- for people who are afraid to invest, the only question I have is „what would you do when you will have a large sum to invest? Because you will have that situation at some time in your life. For sure at the time of retirement (unless you take annuity) If you can’t invest 5000 CHF, would you be able to invest 1 million?“

P.S -: the reason I track IWDC is because when I was originally invested only in VTI, my idea was that it is suboptimal to buy the world if US market is best investment. At that point someone told me he just buys IWDC and chill. So it always stuck with me that sometimes keeping things simple is best even though it doesn’t seem so.

P.S -: Only point that I am still a bit concerned about is if my beneficiaries would be able to manage this whole US estate tax stuff if unexpected things happen. Since majority of my portfolio is US domiciled. That’s why you see some comments about this topic from my side.