Dear All,

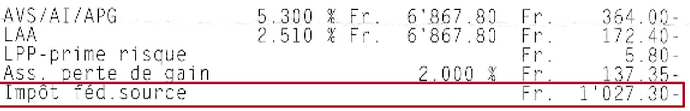

In 2021, I was taxed at source and paid approximately 30K CHF. In September 2022, I received an tax bill for 7K CHF that I need to pay.

My tax advisor identified a mistake: the source tax paid with Chômage was not accounted for. He discussed the issue with the tax officer, and my tax advisor informed that I will receive a corrected bill (approx 6K CHF) and then pay the new bill.

After two years, now I received the revised tax bill, but I see that has included two additional charges:

- Intérêts moratoires sur decompte ICC: 2400 CHF

- Intérêts moratoires sur decompte IFD: 450 CHF

From my understanding, “Intérêts moratoires” are interest charges applied when taxes are not paid on time. But, if I was awaiting a correction from the tax office, should I still be responsible for this interest on the pending amount? And that’s the interest charges total 2.8K CHF on the pending ~7K CHF bill?

Over the past two years, I have contacted the tax office 2-3 times to inquire about the status of the corrected bill and they told me they are working on it. I did not intentionally delay the payment. I thought I need to wait for correction (2021 is the first time when I filed the taxes).

Today I visited the tax office (Vaud), and they advised me to write a letter to contest the charges, which I plan to do. But I am wondering if I have made a mistake, and such penalties are still applicable despite the tax office has told me they are in process of making correction during last 2 years.

Thank you very much!