I asked them when it will be available and they said at the end of March. ![]()

Edit:

Dividend report is now available on IB. But only as HTML or csv. You have to convert it if you need it as pdf.

Is “payment in lieu of dividends” accepted in your tax declaration?

Do you declare them as dividends and can you get the retained taxes back?

I thought tax authorities didn’t allow reclaims against these.

In my IBKR there are not all the dividends in the dividends section when enabled the SYEP. It is not to get taxes back, but it is to declare somehow the dividends.

Exactly: there are dividends and then there are “payments in lieu of dividends” (which are NOT dividends).

You probably need to declare the payments as revenue, but the tax authorities will not let you reclaim withholding taxes on those payments.

See Substitute Payment in Lieu of Dividends - Tax Professionals Member Article By Larry Hurt for more details.

I see two different fields called “Dividends” when I create custom template. One includes "payments in lieu of dividends”, another doesn’t.

Good point @SwissDan and @Dr.PI !

The two sections have the same name “Dividends” in the generated report

So remember to select the “Combined Dividends” and ignore the “Dividends”, as shown in the picture

Included with other info, you can find it also in PDF

The first file is there (and it’s the one I usually use for taxes)

I have mostly the same. Just no Bond Interest as I don‘t have bonds and I include the Trades.

Without trades there is no way to know how many ETFs you had at each dividend payout?

Do you mean the number of shares?

I have also another question ![]()

Since IB is withholding Taxes for CHSPI, does that mean that I need to request back also those with the DA-1?

No, that’s Swiss withholding taxes (Verrechnungssteuer), for which you’ll get a credit with the regular ‘Wertschriftenverzeichnis’. DA-1 is only for foreign withholding taxes. The domicile of the broker doesn’t matter.

That makes sense, thanks.

Usually I add just the total amount for each broker, and for the tax office was ok so far.

So I guess there is no way to get back that 30%

Why wouldn’t you be able to get back the Swiss withholding taxes (35%)?

You simply need at least two lines, one for WV (tax value and dividends of securities without foreign withholding taxes) and one for DA-1.

If you also hold securities that pay dividends without any withholding (e.g. ETFs with an Irish domicile), you need to specify two income values on the summary line for WV, one with and one without Swiss withholding taxes.

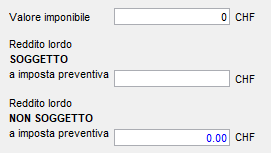

Good point. In the eTax for TI should be this one:

Valore Imponibile: taxable value

Soggetto ad imposta preventiva: withholding tax

Non soggetto ad imposta preventiva: no withholding tax

I knew that the withholding tax part should be related of taxes that are paid in CH?

Or is it exactly where I need to add it and then automatically I should get the 35% back?

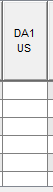

Then for DA-1 I fill out this part

But then I need to add it manually anyway in the module present in the program

Yes, in the middle field enter the gross dividends that are subject to Swiss withholding taxes and in the bottom field enter the gross dividends not subject to Swiss withholding taxes (e.g. Irish ETF).

You’ll get a tax credit for 35% of the value entered in the middle field.

Exactly. How do you calculate number of shares at each dividend payout?

Total amount of dividend received (gross) by you

/ dividend per share (gross), as published by fund

= number of shares you‘re holding at record date.

Am I missing something?

I thought it would be that easy, but I kept getting wrong numbers.

you could also create a flex query with the dividends and the number of shares.

You can then execute it for the month you want to retrieve the number of shares.

In my case, I declare each VT purchase and the tax software will compute the accurate dividend amounts.