Based on what I heard you need a US address on file (even for US citizens living abroad).

@Compounding i’m a swiss resident.

@Tony1337 I never checked if I could buy these. You have an ISIN or an example of a product so I can check it?

I checked some mutual funds like FSPCX I they are not buyable.

MFTFX is not possible. There I must be registered as an US resident. But QMHIX is buyable ![]()

I can‘t imagine the order to go through for QMHIX.

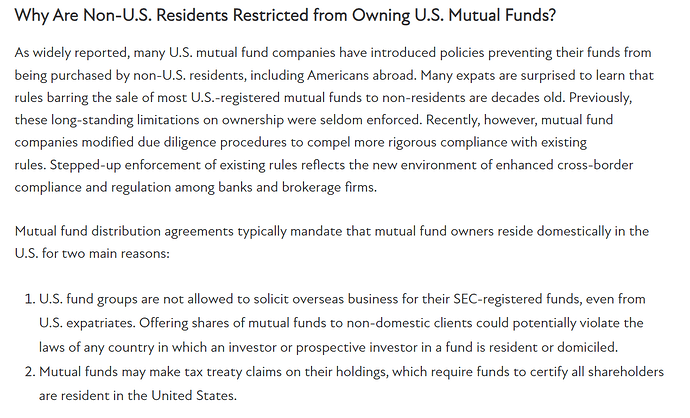

By regulatory reasons, non-US resident cannot buy US mutual funds.

It would be an error in my opinion.

I think it‘s mainly tax related. But I don‘t know the details

Out of curiosity

Is there any advantage for Swiss residents to buy US mutual funds vs US ETFs? What exactly are we missing out on?

Special products that don‘t have an etf equivalent.

Particularly in the managed futures space. AQR, probably the most famous managed futures company, only offers mutual funds for example.

And other stuff that‘s only really viable to execute in a mutual fund structure (some reasons below)

For managed futures and the way they trade a mutual fund structure is actually more beneficial.

There is also no tax advantage for etfs basically, that you normally have (avoiding of capital gains distributions).

With a mutual fund you can trade way more markets and especially smaller markets, such as cocoa recently, more efficiently. Spreads would otherwise get way too high in etf form due to the intra-day liquidity requirements.

This makes mutual funds be able to be more diversified more easily.

Most managed futures etfs therefore don‘t trade more than 20-25 markets. While mutual funds trade around 100 and more most of the time.

Now the question is how much more markets really do for you, and if you trade the big ones (like oil, treasuries etc), you‘ll already capture most of the benefits anyway.

The available etfs are still really good and perfectly fine, some more access to mutual funds would be nice though.

Glad that the ucits mutual fund space grows and you have have access to the Alphasimplex fund for example, that trades around 100 markets.

Got it

Thanks

For time being I am very simple investor so it seems my needs are covered with ETFs

Absolutely covered ![]()

Hi folks

so I have some updates about my US account and I also wrote to the support after I tried to buy some QMHIX and it didnt worked. So I have an US account this is true but my account is restricted. So I have no access to US mutual funds as you said because i’m not a US resident. They gave me the permission as an UK account but only with the possibility to buy crypto.

Hi all,

Quick question regarding IBK as a Swiss resident : it is normal that the US ETFs we buy (VT for example) are listed as “UK Securities” (In the “portfolio tab” > “balances”) ?

This was asked/answered here some time ago, although I do find the explanation or reason given a bit strange.

Short update: had a chat with IBKR support.

Due to recent changes there is no possibility anymore for Swiss residents to open an IB LLC aka IB-US entity account anymore. Every new account will be under IB UK entity.