Have you tried on the FlexQueries under the report section ?

You can display all the dividends perceived during a period,

Wouldn’t that be the Projected Income widget in the PortfolioAnalyst (under Performance & Reports)?

Sorry for the late reply ![]() .

.

I’ve tried this option but I can’t get the cumulative performance on. At best, I systematically look at the performance of the shares and the payment of dividends separately…

This only gives the dividend projection but not the compound performance.

Perhaps my logic is wrong and I should indeed consider the performance of positions separately from the dividend yield.

It seemed logical to me to have a cumulative performance on the total assets deposited at IBKR, but a priori this does not seem possible to generate via a report…

Hi,

I have some Euro in a savings account at UBS and would like to transfer this (in Euro) to IBKR. I see that there are two possibilities, either I use Wise or I use a regular bank transfer (the money gets sent to Germany to JP Morgan). Does anyone know if using Wise is cheaper although I am not looking to exchange any money, just transfer?

Thanks

Wise is a Belgian account and IBKR has a German account. You‘d pay the same for a SEPA transfer (in EUR) from UBS to both of them. So no point in using Wise as an intermediary.

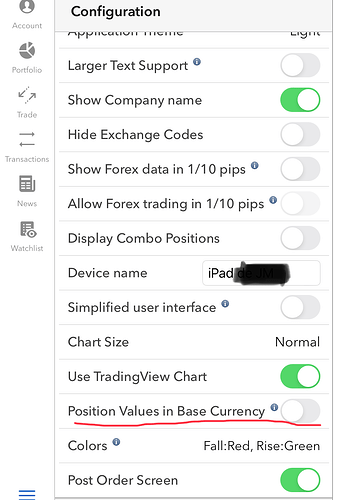

On the IBKR app for iPad, it is a simple setting in Configuration. It is probably similar in other interfaces.

Hi all. I have been wondering about the following in a long time:

I have an account on IBKR with only one ETF: VT.

The ETF is in USD, the setting of my home currency is in CHF. The P&L of the total portfolio is calculated in CHF, the P&L of the single position is calculated on USD.

So on a single day (it also true for the total time period), the P&L is always:

(P&L of VT in USD) * (current FX rate).

If VT went up, this will be a positive value, if VT went down, negative, no matter what the FX did (because the current FX rate cannot be negative). But if the FX rate went down more in percent, than VT, I actually have less money.

To me it would make more sense, that it would take into account the P&L of the FX rate for the calcuation for the total P&L in CHF. Is there a setting for this?

Question on Market Data subscription

I signed as a non-professional subscriber and don’t think I need real time data for now. But it seems I still need to pay based on the snapshot counter? I am not sure how this works. Could someone help me understand? Thanks!

At least on the app there’s a “use base currency” setting that does that.

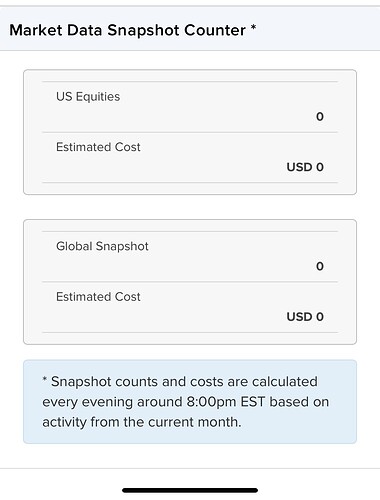

Depends a bit. You have quite a bit (enough for passive investment) of snapshots for free, see: Market Data | Interactive Brokers LLC

Hmm I don’t see any option to not use the snapshot data or cancel the subscription. How will I know if I will be charged or not?

Sorry, I did not understand you question. I think, you cannot opt out. Just don’t click the button for the snapshot. I think it’s the green refresh button.

How to see, if you are charged or not, I’m not sure. It is 0.01$ for US Securities and IBKRs gives you the first dollar for free. How often do you plan to check the snapshot?

yes that answers my question. thank you

Also found the snapshot use instruction https://ibkrguides.com/tws/usersguidebook/thetradingwindow/snapshot_data.htm

I’m also looking for something like this too. I got quite confused because if you calculate net liquidity minus unrealized gains you get a completely different number than what you originally invested.

I’m not aware of a setting to properly track overall portfolio performance in the base currency. It might be possible with virtual FX positions, which are available with TWS. I haven’t checked whether it’s possible to conveniently use them with the web portal or one of the mobile apps.

In my opinion, this issue makes the total P&L numbers useless for investments in foreign currency. That said, as I track my net worth across more than just IBKR (secondary broker, 3a, bank accounts), I track everything externally anyway, so it doesn’t matter too much to me.

Hi guys,

I transferred some CHF to IB and exchanged it to EUR.

I then tried to transfer the EUR to my EUR bank account but got an error message stating that I need to wait 3 days for the trade to settle. Unfortunately, I need the money in my account ASAP.

I have a cash account and my idea was to change it to margin, use the margin to withdraw the EUR.

Does this work? How long does it take for the margin account to be approved?

Thank you

Hi!

I have bad news: just so you know, it was reported on this forum that IBKR can send warnings to customers who use it to convert currencies and immediately wire to another bank, even for people who do have positions and who made transactions earlier. They say cheap currency conversion is only offered as a convenience for trading customers.

One question regarding the IBKR referral program. Upon a successful referral, what can the $200 ‘fee credit’ be used for? Can it be used for stocks purchases and currency conversion, or are those considered ‘commissions’ and not ‘fees’?

It will be credited to your cash statements but they seems hard to get.

Ah, you’re right! It got credited cash in USD. Sweet!

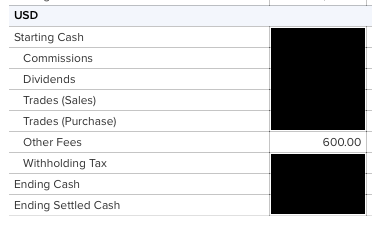

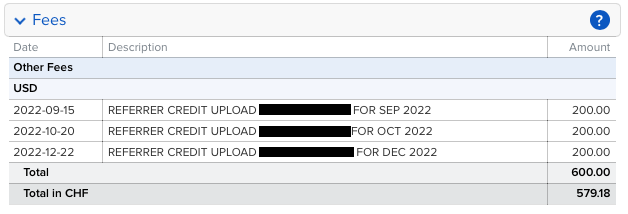

In the standard “Activity” statement you can see the referral credit in the “Fee” section:

And a corresponding entry in the “Cash Report”: