I’m also looking for something like this too. I got quite confused because if you calculate net liquidity minus unrealized gains you get a completely different number than what you originally invested.

I’m not aware of a setting to properly track overall portfolio performance in the base currency. It might be possible with virtual FX positions, which are available with TWS. I haven’t checked whether it’s possible to conveniently use them with the web portal or one of the mobile apps.

In my opinion, this issue makes the total P&L numbers useless for investments in foreign currency. That said, as I track my net worth across more than just IBKR (secondary broker, 3a, bank accounts), I track everything externally anyway, so it doesn’t matter too much to me.

Hi guys,

I transferred some CHF to IB and exchanged it to EUR.

I then tried to transfer the EUR to my EUR bank account but got an error message stating that I need to wait 3 days for the trade to settle. Unfortunately, I need the money in my account ASAP.

I have a cash account and my idea was to change it to margin, use the margin to withdraw the EUR.

Does this work? How long does it take for the margin account to be approved?

Thank you

Hi!

I have bad news: just so you know, it was reported on this forum that IBKR can send warnings to customers who use it to convert currencies and immediately wire to another bank, even for people who do have positions and who made transactions earlier. They say cheap currency conversion is only offered as a convenience for trading customers.

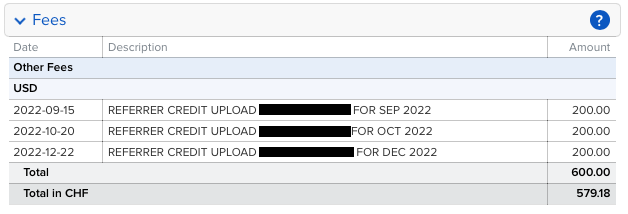

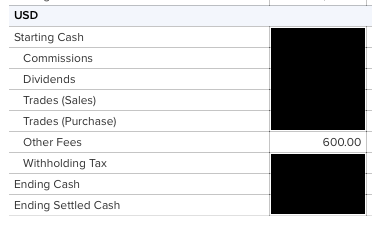

One question regarding the IBKR referral program. Upon a successful referral, what can the $200 ‘fee credit’ be used for? Can it be used for stocks purchases and currency conversion, or are those considered ‘commissions’ and not ‘fees’?

It will be credited to your cash statements but they seems hard to get.

Ah, you’re right! It got credited cash in USD. Sweet!

In the standard “Activity” statement you can see the referral credit in the “Fee” section:

And a corresponding entry in the “Cash Report”:

-SNB website says SARON is currently 1.70%

-IBKR website says the IBKR Benchmark rate for CHF is SARON. It also says that as at 27 July 2023 their Benchmark rate is 1.309%

Does anyone understand what is going on ?

No ![]()

Was mentioned already somewhere.

Could anyone please tell me if iShares MSCI ACWI UCITS ETF (Acc) (IE00B6R52259 / SSAC) can be bought fractionally or with recurring investments on SIX in CHF?

Thanks. ![]()

I haven’t seen issues with that.

I keep getting email from IBKR about a Mutual fund advisory to check that some of my ETF have an equivalent and cheaper version available. Is it possible to see this advisory without having the main app installed?

TradingView, one active alert is possible with a free account.

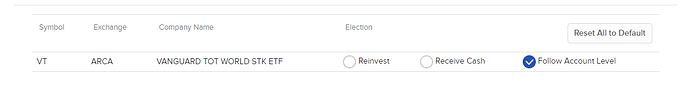

Has anybody ever changed the dividend election under settings in IB?

Can I basically make VT a accumulating ETF (with trading fees, I assume)?

I keep it off. Reinvesting the dividends satisfies my urge to ‘do something’ so I keep my fingers off changing the main positions.

Every other month I use to exchange CHF to EUR by IB manually.

Can I automate and schedule the #2 and #3 process steps in IB?

- transfer CHF from my bank to IB

- exchange CHF to EUR

- transfer EUR from IB to my bank account

1 and 3 yes, 2 maybe kind of (create a bunch of market orders valid after some moment in the future).

Is this working for all ETF’s? Can’t imagine since some of them have a different Symbol or ISIN as:

VWRA - Vanguard FTSE All-World UCITS ETF (USD) Accumulating

VWRD - Vanguard FTSE All-World UCITS ETF (USD) Distributing

Both on London Stock Exchange in USD

I set a Buy 500 USD monthly for VWRA. Where can I see the buying fees in IB?

I want to see how much cost this operation, so in case it is too much I will increase the recurring invested amount or instead invest once every 2 months.

Is this buying fee a fixed fee? or is it relative to the invested amount?

Now that I see this. I understand that the operation just cost 0.35 USD. So 0.07%. Is this right? it looks very very competitive.