What do you mean? EUR.CHF is a classic pair (and IB has it).

Well, I should have checked, but I was too lazy, so I just assumed ![]() Sorry, and thanks for the correction.

Sorry, and thanks for the correction.

Thanks @Bojack and @nabalzbhf

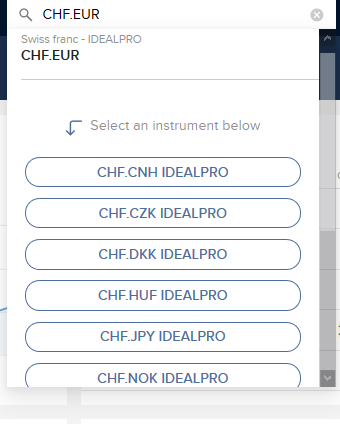

Here’s where I got stuck when I tried to exchange CHF into EUR on the portal (see pic) - I typed in CHF.EUR, and the list offered me pretty much any conversion from CHF - except of EUR.

That’s when I gave up, thinking this simply can’t be, I must be doing something wrong.

The next day I used the app, and it was super easy.

Any idea why IB doesn’t give CHF.EUR option in this list?

Thanks @rolandinho - I stayed away from the TWS, but even in the portal I struggled (see underneath re trying to convert my CHF into EUR…)

App is stellar though for the conversion.

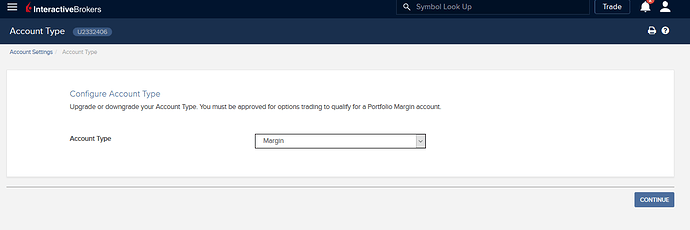

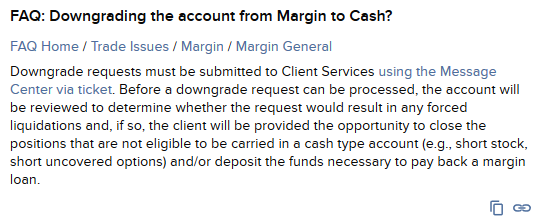

You can’t really see in on the pic - but when I use the drop-down, I can only choose between margin and portfolio margin - guess I have to contact them to downgrade to cash. Thanks for the help anyway though!

The pair is EUR.CHF, not CHF.EUR https://en.wikipedia.org/wiki/Currency_pair has the priority and EUR is on top.

The charge is always made in your base currency. Seriously, I have the feeling most of the people don‘t even bother reading all the information that is available on IB. I agree, TWS trade, is a bit more technical to use, since they implemented the App it is a bit easier. But thank god,I am happy they don‘t spend more money on the User Interface because it would be paid by the users, i.e. with the fees.

To provide also some information. If you are going to have marging, always have them in CHF! IB hast the lowest interest for CHF, i.e. 1.5%! And please you can check the interest rate for margin for all currencies online - the information is easily available. If you use TWS trader you can even connect every trade with an automated forex exchange so you don‘t even have to bother about having the right amount of cash other than your base currency.

but it’s still $10 right? And not a variable amount of CHF each month. I mean, for clarity, it’s easier to have it in USD.

It’s 10 USD, and the amount is charged in CHF based on the actual conversion rate.

Thanks @nabalzbhf - learning something new every day here! ![]()

Yes same thing here. I opened a margin account without intending to. I can’t remember how I saw it but I remember calling them and I had to delete it and restart the application process.

I remember some posts were showing the process on how to deal with a margin account with their software and I thought it was too complicated ![]()

Anyhow, don’t sweat it, and many thanks for sharing

Would you mind sharing where (in which report) exactly did you find this out?

I accidentally also opened my account as Margin and I was trying to be careful, but I am also a newbie. Hopefully I didn’t burn myself the same way. Maybe I will also try to downgrade.

@svecon For sure:

In the client portal:

Menu => Reports => Statements => Activity => Arrow (run)

New window, where you can choose period, date, format, language:

Period: Month to date (or whatever period you want to check)

Format: I choose PDF

In PDF: Search for ‘interest’

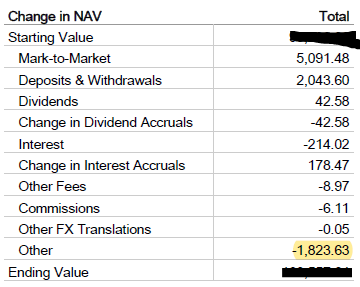

I found the ‘Change in NAV’ most helpful - there I could see how much interest I had been paying (as well as all fees)

Btw, just looking at that report - I’m realizing that I’m once again not understanding it. I’ve got a category ‘other’ at the bottom of this table, which stats ‘-1’823’. No clue what this other is - couldn’t recreate that amount through any calculations

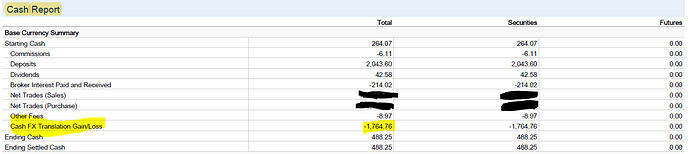

Further down in the documents there’s a ‘Cash Report’ which lists -1764 in ‘Cash FX Translation Gain/Loss’. Also not sure what that is.

“Cash FX Translation Gain/Loss” are not result of having a margin account. The way I understand it is that row just accounts for the virtual difference of the FX between now and the time you exchanged CHF->USD. Assuming your base is CHF.

My “Cash FX Translation Gain/Loss” also shows -500, but I believe that’s because CHF got stronger after I exchanged CHF->USD.

Can someone confirm my understanding please?

Thanks @svecon

I agree re margin account - by now I downgraded to cash account.

My base is USD - so I don’t fully understand why there would be a virtual difference. However, the final amount more or less matches what I would have expected to be there after all the sales and purchases of currencies.

The ‘other’ (-1823.63) in the ‘Change in NAV’ report is also still a mistery to me - @Bojack any clue what that is, or could be?

Well, let’s try to reproduce how it could happen:

- You send 100’000 CHF to IB. At this moment the exchange rate is 1.00, so the NAV is 100’000 USD.

- Some days pass, the price of 1 CHF is now 1.03 USD. Your NAV is 103’000 USD. Not sure where IB would put the +3’000 USD rise in NAV, though.

- You exchange all CHF to USD, so now you have 103’000 USD.

So, even though your base currency is USD and currently you only hold USD and USD-quoted ETFs, you probably first had a different currency and didn’t convert it on the spot. Moreover, IB keeps virtual positions for all your fx trades and tracks the M2M performance for each of these positions.

Thanks a lot for your help @Bojack - that make sense now!

Would your assumption also be that the ‘other’ (-1’823) in ‘Change in NAV’ (table above) is a combination of this Cash FX Translation Gain/Loss or is that something that I should be worried about?

I fail to ‘reconstruct’ that amount, i.e. find a combo of numbers that would add up to -1823

IB takes a 88m $ hit from the recent oil user trades: https://on.ft.com/3byijG0

Hope they won’t go bankrupt…

It said the losses would not have a material effect on its financial condition.