Again? We had this all before… recently, no?

I can only speak for Sq and Pf.

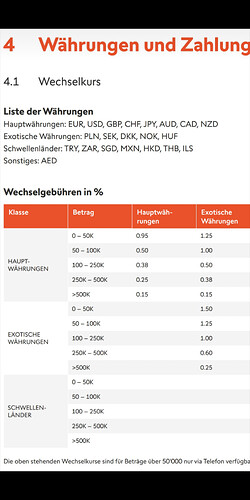

Fx - see attachment (Sq & Pf are the same)

30%

Yes, of course. - 15% wht (is a credit for your Swiss tax, DTA) + 15% rückbehalt USA (gets refunded)

2 Likes