Any alternatives for a change?

What about Charles Schwab? (It even looks like it accepts US citizens @anon90991199)

Anyone using it?

https://enroll.schwab.com/AoUI/#/getStarted

©2017 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

Using Schwab. It’s alright except that it’s USD and US equities only. Non-USD/non-US trading will be very expensive. So you will still have to use IBKR or something else to get your benjamins in and out for cheap.

Anyone tried moving stuff from IB to Swissquote? I still consider the idea of moving stuff every 50k from IB to Swissquote as a good way to avoid that risk. If SQ is less risky. Or split IB/SQ.

I wonder about that, because it’s bypassing the Swiss Stamp Tax… It’s a bit like avoiding Swiss VAT by buying outside CH, and we all know what happens when you pass Swiss customs officials with a big bag of shopping.

Hmmmm… interesting approach. Doesn’t transfers cost some 40 CHF/USD per position? At what amounts of Stocks would you break-even?

Considering Sq will cost about 40 CHF or USD for 10k transaction compared with IB’s almost-nothing, break-even is at approx 10k per position. (Simplifying a bit here, I know)

Ouch, you have to be sado to inflict that to yourself… I stick to IB, thank you very much.

That is why it’s not meant to avoid the tax, but to diversify/minimize IB’s risk.

Yep, for 10’000 it’s 30 + VAT + Stamp Duty and for 10’001 it’s 55 + VAT + Stamp Duty. I did say I simplified somewhat. ![]()

I understand your motive (avoid some risk at IB), and didn’t want to suggest tax avoidance is your aim, I just wonder if this isn’t a “problem” to transfer positions from IB to Swiss brokers, as Swiss Stamp Duty is a national tax, which brings in a few Billion CHF p.a. I guess if it’s 0.00000001% of Swiss trade volumes, no-one will care.

I know you weren’t accusing me, no worries. I just meant that I didn’t calculate that part at all. I’m more worried about the cost of transferring things.

…so is using every other foreign broker and keeping shares there.

…or buy via Swissquote outright.

While I can imagine transferring large positions for tax reasons or change of broker, I would never plan on doing it on a regular, recurring basis. After all, it’s a one-time cost.

To anyone buying US assets via CornerTrader, SwissQuote, PostFinance:

- what CHF-USD exchange rate do you get?

- how big is the withholding tax? 15 or 30%?

- were you able to reclaim it successfully?

Again? We had this all before… recently, no?

I can only speak for Sq and Pf.

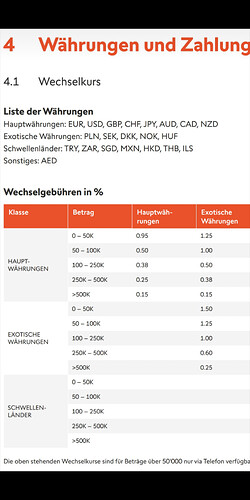

Fx - see attachment (Sq & Pf are the same)

30%

Yes, of course. - 15% wht (is a credit for your Swiss tax, DTA) + 15% rückbehalt USA (gets refunded)

Sorry, I know we talked about it, but all the stuff kind of blends in my head, so I wasn’t sure. Plus, Moneyland says this about SQ, which confuses me:

0.95% is bad. And if you buy ETFs on SIX in CHF, you potentially lose 0.3% annually (15% * 2%), being unable to reclaim withholding tax. I wonder how much is really “leaking” from VWRL relative to VT.

Btw I guess it does not matter that much if 30% or 15% is withheld, right? You’re able to reclaim both.

No worries ![]()

“Keine Gebühren, ausser spreads”… seriously? ![]()

![]()

Wht - If one were to buy VT at Sq, you’ll be able to reclaim all, yes. It’ll be essentially equivalent to owning VT on IB.

One tends to buy VWRL on Sq though, there one loses the 0.3% that the IE fund loses to the US.

0.3% every year, compared to 0.95% once at purchase, and maybe the second time when selling? anyway, after 6 years you’re in the same spot, and you’re supposed to be holding for longer.

That’s confusing, because at IB there is no difference. You make a forex trade and then you use this new currency to trade on the stock exchange. I miss this flexibility at other brokers.

I’ve been following this for a while now. So far I haven’t received any communication from IBKR so I’m unsure if my account would be moved. I started it while living in Switzerland and I’m a Swiss resident and supposedly only EU domiciled accounts (or entity accounts formed in the EU) are affected.

The current cash and securities protection scheme has been quite generous and far above what I have with my European brokers so losing it does not faze me too much.

As the next Mustachian, I’m mostly concerned about trading US ETFs. The FAQ page does say that the trading permissions stay the same after the move - let’s hope it means ETF trading as well.

Finally, I will definitely keep my IBKR account because I’m also investing in US shares and I occasionally trade US options. I don’t see a better alternative for those.

I’ve found an interesting article from a Swiss resident perspective. I’ll follow this topic…