Coming late to the discussion but i remember when switzerland unpegged the franc from the euro. I could not log in in PF for 24 hours because of the volume. I don’t remember if SQ reported issues. After the incident i left PF for interactive brokers.

3 posts were merged into an existing topic: Security at Interactive Brokers

Thanks for sharing!

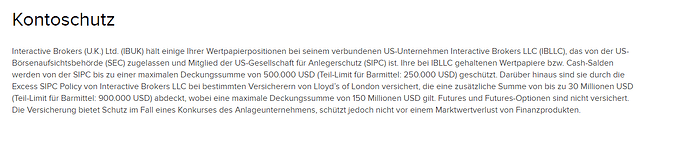

How do you handle your securities above $500,000?

As far as I know, everything above $500,000 isn’t protected by SIPC anymore.

In this case I do not understand, what “IBLLC” means?

IBLLC is just the abbreviation of Interactive Brokers LLC.

This means we are additonally protected by the “Excess SIPC Policy von Interactive Brokers LLC bei bestimmten Versicherten von Lloyd’s of London?”

This is the point, I do not understand.

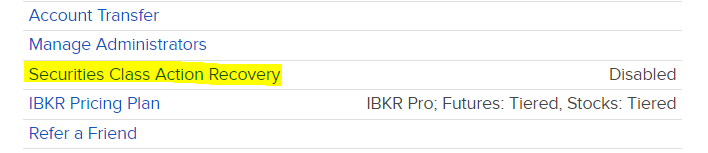

At the US entity, you have following additional option in the settings:

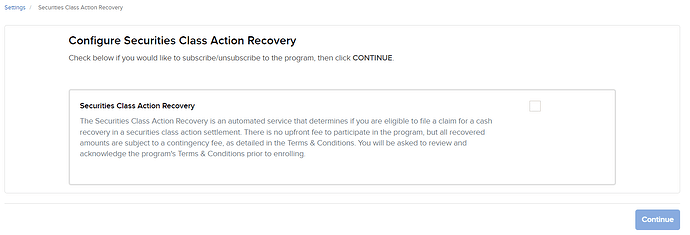

When you click on it, following message pops up:

Tbh, I have to check that in more detail this weekend, since I do not know the pros, cons, costs, effects, etc.

“Unfortunately”, I will change my employer and will work again for a bank, soon. Since I am obliged to close my IBRK account I did not further investigate the above mentioned topic, I am sorry ![]()

Update: it seems, it is not possible anymore to open an IBRK US account. When setting up IBRK for my gf the UK account was set up automatically. Therefore, there are some restrictions in trading, as e.g. IBIT.

I am assuming, since crypo can now be traded through the UK entity, there is no need anymore to offer an US account.

3 posts were merged into an existing topic: Swiss brokers [2023]